(Bloomberg) -- Asian shares edged lower after ratcheting up four months of gains, as China’s efforts to support its ailing economy showed no signs of taking hold.

A gauge of the region’s stocks fell, marking the first day of trading in a typically volatile month for markets. In Hong Kong, the benchmark index declined almost 2% with shares of New World Development Co. falling as much as 14% after the indebted property developer said it expected to post its first annual loss in two decades.

US index futures also slipped, suggesting the S&P 500 is in for a reversal after closing higher on Friday, as data supported expectations of pending Federal Reserve rate cuts. The dollar was steady as cash Treasuries were closed globally Monday for the US Labor Day holiday. Australian government bond yields rose.

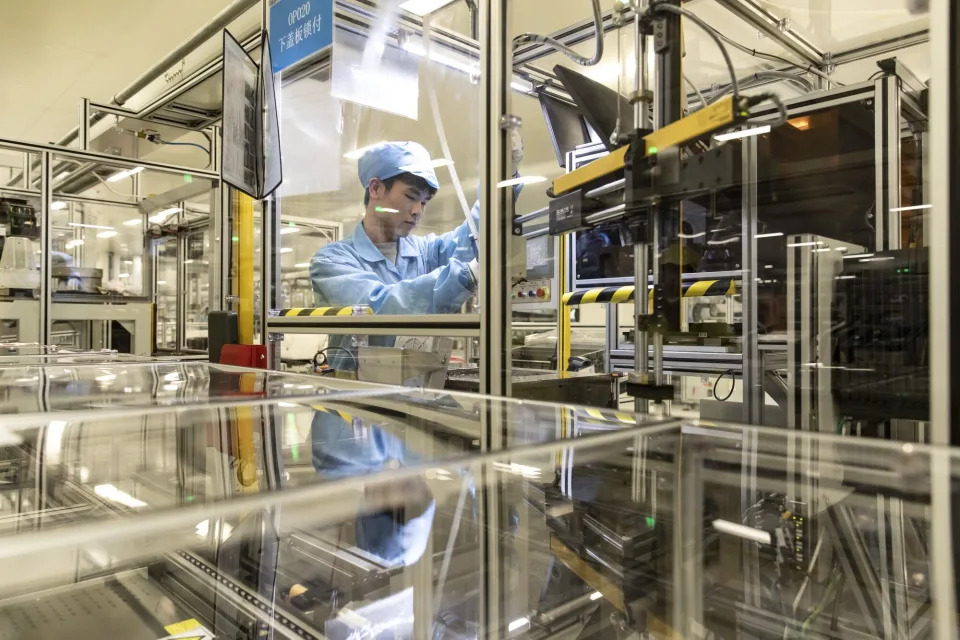

Global funds are positioning for major central banks including Federal Reserve to reduce interest rates in September, while at the same time multiple rounds of stimulus have failed to revive growth in China, where a prolonged property market slump is curbing domestic demand in the world’s second-largest economy. While the Caixin China manufacturing data registered an unexpected increase on Monday, the move failed to reverse sentiment after an official gauge of Chinese factory activity contracted for a fourth straight month in August.

“I would be more worried about the China side of the equation, to be quite frank,” Carlos Casanova, a senior Asia economist at Union Bancaire Privee told Bloomberg TV. While the fourth quarter is likely to be positive for Chinese risk assets thanks to efforts to shore up domestic demand, “there’s not enough policy space to do big bazooka support measures like in 2009,” he added.

The latest home sales figures showed a worsening residential slump, after China Vanke Co. — one of the nation’s biggest developers — underlined the industry’s woes late Friday by reporting a half-year loss for the first time in more than two decades.

Authorities also said on Friday they had stepped into the government-debt market to curb a relentless bond rally, though the move raises new questions about efforts to stimulate the world’s second-largest economy.

“I think there’s a huge problem — by now everybody recognizes that,” Hao Ong, chief economist at Grow Investment Group told Bloomberg’s David Ingles and Yvonne Man in an interview. “The government needs to do substantially more.”

Elsewhere in Asia, Japanese businesses boosted investment in the second quarter of the year, reaffirming signs of moderate domestic demand-led activity after growth rebounded in the period. Purchasing managers’ surveys for Taiwan, Thailand and Indonesia all declined, weighing on their currencies.

September Volatility

September is historically a volatile month for global markets. It’s been one of the worst months for stocks in the past four years, while the dollar typically outperforms, according to data compiled by Bloomberg. Wall Street’s fear gauge - the Cboe Volatility Index, or VIX - has risen each September the past three years, the data show.

This month may be no different with the crucial US jobs report later this week serving as a guide to how quick, or slow, the Fed will cut rates, and as the US election campaign gets into full swing. Options traders spent upwards of $9 million to protect against a surge in the VIX this month.

Meanwhile, data on Friday also showed the Fed’s preferred measure of underlying US inflation — the core personal consumption expenditures price index — rose at a mild pace. Traders are pricing the Fed’s easing cycle will begin this month, with a roughly one-in-four chance of a 50 basis point cut, according to data compiled by Bloomberg.

“Tactically, good news should be good news for risky assets” and a better-than-expected jobs report will likely lift stocks and the dollar, said Chris Weston, head of research at Pepperstone Group in Melbourne. “A 25 basis point cut is the move the Fed really wants to make, so further evidence that the US economy is headed for a soft landing, amid non-urgent rate cuts, plays into a nirvana backdrop for risk.”

In commodities markets, oil pushed lower on signs OPEC+ will progress with a plan to lift output from October, while the economic headwinds mount in China. Gold also declined.

Key events this week:

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Winnie Hsu and Joanna Ossinger.