The world’s largest crypto exchange announced Wednesday that it had secured a $2 billion investment from MGX, a state-backed investment firm in the United Arab Emirates. Binance received the investment in stablecoins, and MGX received a minority stake in the crypto exchange, according to a press release.

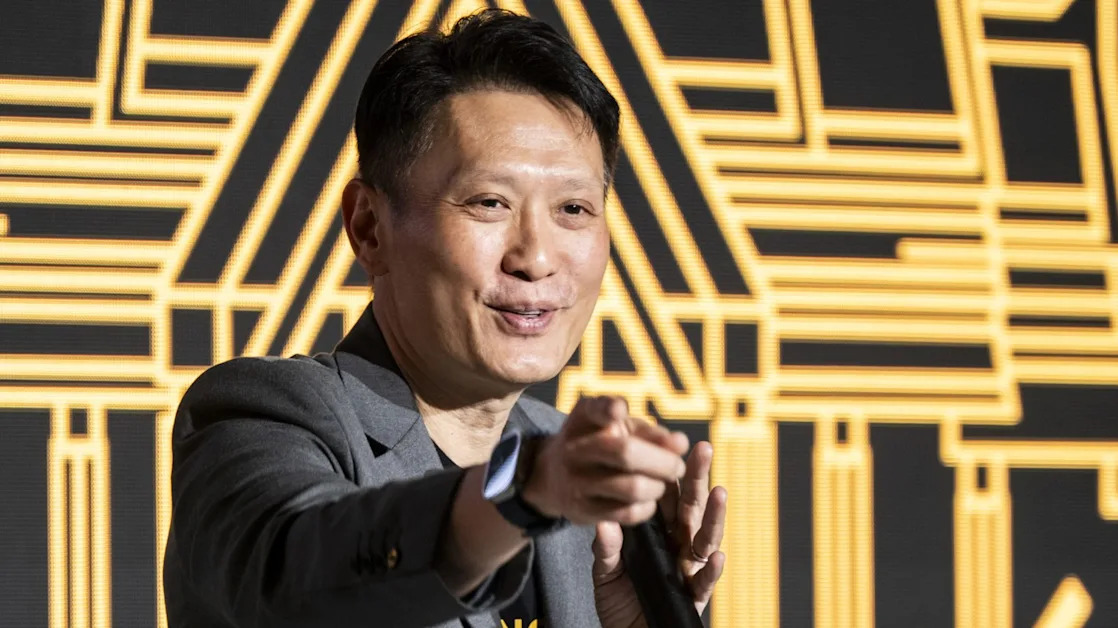

A spokesperson for the crypto exchange declined to disclose at what valuation the investment was made, the size of MGX’s stake, or what stablecoins Binance received as part of the deal. “This investment by MGX is a significant milestone for the crypto industry,” said Richard Teng, the crypto exchange’s CEO, in the press release.

MGX is based out of Abu Dhabi, the capital of the UAE. The chairman of the firm, which specializes in AI and tech investments, is Bitcoin, the world’s largest cryptocurrency, stayed flat.

The UAE’s backing of Binance is one of the largest injections of capital into a crypto company in the industry’s history and cements the crypto exchange’s presence in the Gulf. Binance has about 1,000 employees based in the UAE out of its 5,000 total staff, according to the press release. Its former CEO, Changpeng Zhao , has residence in the country, and its current CEO, Teng , was a former regulator in Abu Dhabi.

Unlike the vast majority of financial firms, Binance has long avoided committing to a company headquarters, but its executives have spoken positively about the UAE’s crypto regulatory regime. The company also hosts crypto conferences in the country, and has offices in Abu Dhabi and Dubai.

MGX’s investment in Binance is also a welcome change in narrative for the once-embattled crypto exchange after a record $4.3 billion settlement it reached with the Department of Justice in November 2023. As part of that agreement, Zhao, the former CEO, agreed to resign, pleaded guilty to not maintaining an effective anti-money-laundering business, and reported to prison for less than four months.

Teng took over after Zhao’s resignation, and the new CEO has worked to revamp the crypto exchange’s image from a crypto outlaw into a boring financial firm that repeatedly emphasizes its cooperation with regulators and law enforcement.

In February, the Securities and Exchange Commission agreed to pause ongoing litigation against Binance because of the SEC’s new approach to crypto regulation.