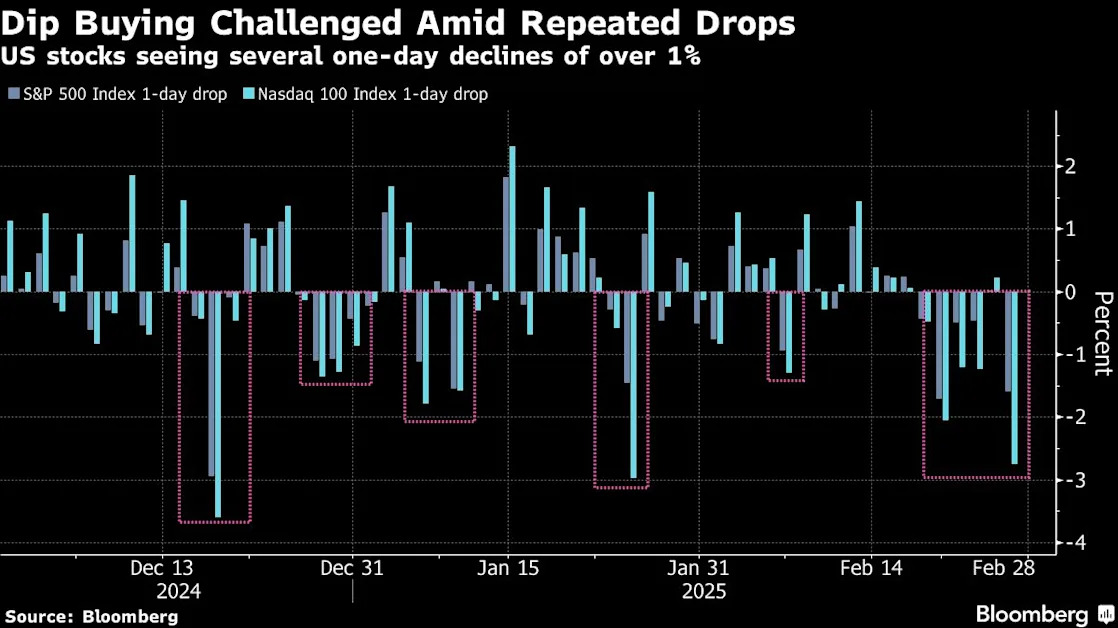

(Bloomberg) -- Dip buyers are missing in action as the narrative for stocks is quickly souring due to the negative news flow on trade.

It’s a “manic headline roulette,” Goldman Sachs Group Inc. traders wrote in a note to clients. “Imagine everyone is looking to play for a bounce, but right now with possible tariffs looming, positioning and technicals, the dynamics don’t line up that well to follow the ‘ole playbook,” they said.

US stocks dropped so much on Thursday that they turned negative on the year after President Donald Trump said 25% tariffs on Canada and Mexico are on track to go into place on March 4, and said he would impose an additional 10% tax on Chinese imports. And unlike several other pullback episodes in the first two months of the year, dip buyers were notably absent.

Trump’s remarks on trade were already causing confusion this week, and there’s still a lack of clarity about what awaits the European Union.

The tariff risk comes at a time equity flows were already turning unfavorable. Systematic investors are either selling or staying on the sidelines amid the drop in stocks and rising volatility, while retail flows are fading and the month-end portfolio re-balancing is complicating the backdrop further.

Investors are bracing for higher volatility and hedging against shock events, and their caution could limit chances of panic selling.

“We haven’t seen any capitulatory flows on our desk that could suggest investors are throwing in the towel,” the Goldman traders said.