(Bloomberg) -- Fresh readings on retail spending and unemployment benefits quelled some of the restiveness about the US economy, parts of which remain restrained by elevated interest rates.

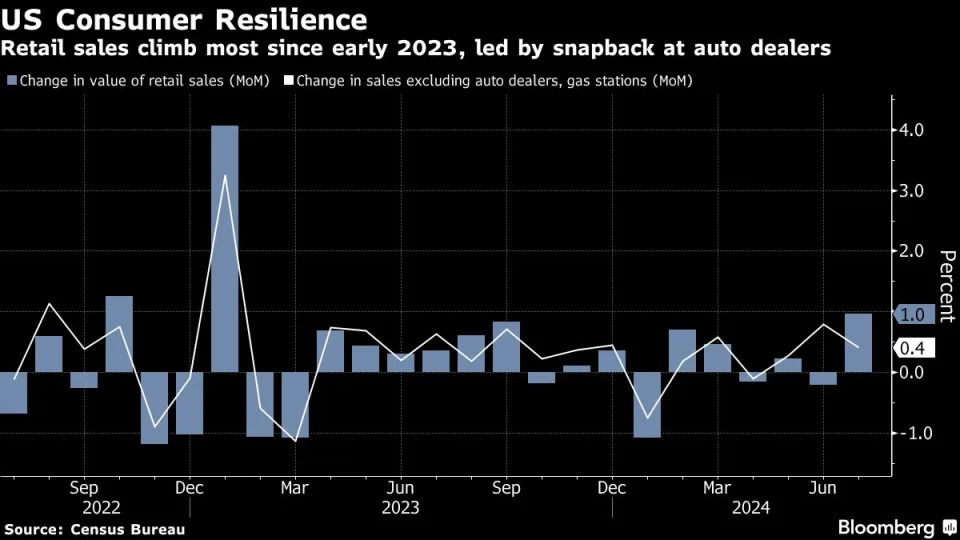

The value of retail sales increased in July by the most since early 2023 in a broad advance that indicates a resilient American consumer. Separate government figures on Thursday showed the fewest applications for unemployment benefits last week since early July.

That was welcome news in the wake of a disappointing monthly jobs report that suggested the labor market may be drawing closer to a bigger downturn and risking upending the expansion. Combined with the stronger-than-expected sales figures, the economy appears to simply be moderating.

Subscribe to the Bloomberg Surveillance podcast on Apple, Spotify and anywhere you listen.

Firmer sales guidance by Walmart Inc., a barometer of growth, also indicated that shoppers are becoming more selective but are still spending.

“Consumers have become more discerning with their spending as they continue to face higher prices and borrowing costs, but the latest retail sales data shows a continued willingness to spend,” Lydia Boussour, EY senior economist, said in a note. “We expect increased spending prudence in coming quarters though we do not foresee a consumer retrenchment.”

The S&P 500 and Treasury yields advanced after the reports. Investors are betting Federal Reserve policymakers will begin lowering interest rates next month as inflationary pressures gradually abate. Other economic data Thursday showed the high level of borrowing costs is holding back other parts of the economy.

Confidence among US homebuilders slipped in August for a fourth straight month to its lowest point of the year as high loan rates and home prices weigh on companies and buyers alike. The Fed also reported that industrial output declined in July by the most since the start of the year, though the 0.6% decrease included the impact of Hurricane Beryl on Gulf Coast refinery activity.

Manufacturing, which accounts for three-fourths of total industrial production, has struggled as the Fed has kept interest rates at a two-decades high for more than a year now. Factory surveys have been more downbeat. Thursday reports showed manufacturing in New York state shrank for a ninth straight month, while activity in the Philadelphia Fed region contracted for the first time since January.

In the retail sales report, 10 of the report’s 13 categories posted increases. Car sales bounced back strongly after a cyberattack on auto dealerships led to a sizable drop in June. Electronics and appliances also posted solid gains. E-commerce sales rose at a modest clip, potentially reflecting heavy discounting in the period by Amazon.com Inc.’s Prime Day and other promotions from Walmart and Target Corp.

The report showcases a consumer that’s holding up. With pandemic savings now largely gone and wage growth cooling, many Americans are increasingly resorting to credit cards and other loans to support their purchases — raising questions about the sustainability of consumer spending, especially as more people are falling behind on payments.

“The July retail sales data were consistent with our soft-landing economic outlook,” Bank of America economists wrote in a note. “The decline in jobless claims reported today supports our view that a still-solid labor market is propping up consumer spending.”

What Bloomberg Economics Says...

“Consumers continue to spend more slowly than prior years. Going forward, we expect to see continued tepid spending focused on essentials.”

— Estelle Ou and Eliza Winger. To read the full note, click here

--With assistance from Augusta Saraiva, Jarrell Dillard, Michael Sasso, Mark Niquette and Molly Smith.