The S&P 500 could be getting a slightly fresh look soon with the index’s quarterly rebalance on the horizon.

Based on historical patterns, S&P Dow Jones Indices could announce new entrants to the benchmark large-cap U.S. stock index after Friday’s close. The index provider would then also announce the components set to leave the S&P 500 SPX.

Stocks tend to rise when they are announced as forthcoming S&P 500 constituents, particularly because there are trillions of dollars invested in index funds that track the benchmark.

“It means that those index funds have no choice but to buy the stock that is joining the index. so it’s a clear source of demand over a defined period, from whenever the announcement occurs, to whenever to whenever it transpires,” which is usually a short window, according to Interactive Brokers Chief Strategist Steve Sosnick.

Usually the announced new entrants don’t come as a surprise, because they are buzzy names that just met profitability criteria or are among the largest components by market capitalization of the S&P MidCap 400 Index MID or the S&P Small Cap 600 Index SML. These indexes, along with the S&P 500, make up the S&P Composite 1500 Index XX:SP1500.

“Markets are somewhat efficient,” Sosnick said. “They do tend to anticipate.”

There are various criteria that companies have to meet for initial inclusion in the S&P Composite 1500. These include being domiciled in the U.S. and showing positive combined earnings per share over the past four reported quarters, while also being profitable for the most recent reported quarter. To be included in the S&P 500, companies need a market capitalization of $18 billion or more, but the market-cap thresholds are lower for the other indexes.

Various names have been floated as candidates for S&P 500 inclusion this time around, including financial-technology plays Coinbase Global Inc. COIN and Block Inc. SQ, software company Workday Inc. WDAY and used-car retailer Carvana Co. CVNA

The decisions are made by an index committee, and they are “more art than science,” according to Sosnick. The S&P 500 isn’t simply a list of the largest 500 companies by market cap. Rather, the committee may seek to avoid particularly volatile components or focus on particular attributes at different times.

Sosnick likened the process to college admissions. “You know what you have to have, but having it doesn’t mean you’re doing to get in.” The school might need a new tuba player for the band more than someone with high SAT scores.

In discussing the potential for Block to join the S&P 500, Bernstein’s Harshita Rawat noted that “sector diversification is one of the index committee’s considerations, in that they aim to maintain a sector composition that is generally in line with the economy.”

What “in line with the economy” means isn’t perfectly spelled out, but Rawat highlighted that financials currently make up 13.9% of the S&P 500, compared with 14.6% in the S&P Total Market Index, “suggesting that there is room for a financials addition since they are underrepresented.”

Meanwhile, Oppenheimer’s Owen Lau highlighted Coinbase as a candidate over the summer. It is one of the biggest companies, by market cap, that meets other criteria but isn’t yet in the index.

See more: Coinbase’s stock could join the S&P 500 as bitcoin goes mainstream, analyst says

Candidates for joining the S&P 500

To encompass companies that were possible candidates for inclusion in the S&P 500 but weren’t yet included in the S&P Mid Cap 400 or S&P Small Cap 600 indexes, we began a screen with the components of the Russell 3000 Index RUA, which is designed to cover 98% of stocks publicly listed in the U.S.

It turned out there were 60 U.S. companies with market caps of $18 billion or more that were not yet included in the S&P 500. Among these, 13 were already included in the S&P Mid Cap 400, and none in the S&P 600. So we only applied the profitability tests, described above, to 47 of the companies. Applying the profitability screens for companies with market caps of $18 billion or more, but not yet included in the S&P Mid Cap 400, brought the candidate list down to 42 companies.

Here are the largest 20 companies that might be candidates to be added to the S&P 500:

|

Company |

Ticker |

Market cap. ($mil) |

Total EPS for past four fiscal quarters |

EPS for most recent reported fiscal quarter |

|

AppLovin Corp. Class A |

APP |

$111,612 |

$3.30 |

$1.25 |

|

Apollo Global Management Inc |

APO |

$98,865 |

$9.50 |

$1.29 |

|

Southern Copper Corp. |

SCCO |

$80,005 |

$3.84 |

$1.14 |

|

Coinbase Global Inc. |

COIN |

$67,813 |

$5.85 |

$0.28 |

|

Trade Desk Inc. Class A |

TTD |

$62,731 |

$0.62 |

$0.19 |

|

Workday Inc. Class A |

WDAY |

$57,269 |

$6.03 |

$0.72 |

|

Block Inc. |

SQ |

$55,370 |

$1.78 |

$0.45 |

|

Datadog Inc Class A |

DDOG |

$51,956 |

$0.54 |

$0.14 |

|

Cheniere Energy Inc. |

LNG |

$50,195 |

$15.68 |

$3.93 |

|

Vertiv Holdings Co. |

VRT |

$49,124 |

$1.50 |

$0.46 |

|

Ferguson Enterprises Inc. |

FERG |

$44,733 |

$8.53 |

$2.23 |

|

Veeva Systems Inc Class A |

VEEV |

$38,498 |

$3.75 |

$1.04 |

|

Ares Management Corp. |

ARES |

$35,085 |

$2.23 |

$0.55 |

|

Carvana Co. Class A |

CVNA |

$33,429 |

$0.01 |

$0.64 |

|

Robinhood Markets Inc. |

HOOD |

$30,543 |

$0.59 |

$0.17 |

|

Carnival Corp. |

CCL |

$30,059 |

$1.12 |

$1.26 |

|

First Citizens BancShares Inc. Class A |

FCNCA |

$28,538 |

$174.52 |

$43.41 |

|

GlobalFoundries Inc. |

GFS |

$24,653 |

$1.34 |

$0.32 |

|

LPL Financial Holdings Inc. |

LPLA |

$24,479 |

$13.29 |

$3.39 |

|

Lennox International Inc. |

LII |

$23,708 |

$21.05 |

$6.68 |

Click the tickers for more about each company.

Read: Tomi Kilgore’s guide to the wealth of information available for free on the MarketWatch quote page

It turned out that all 20 companies on the list were larger than any of the 13 companies in the S&P Mid Cap 400. So the profitability test is included on the table.

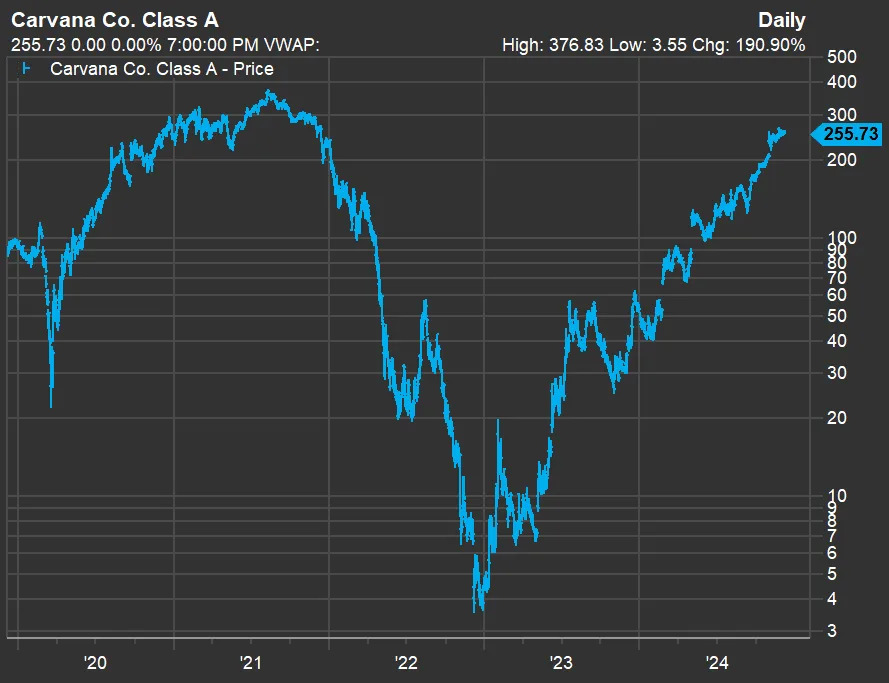

Carvana made the list, with its four-quarter EPS sum just barely in the black. But this has been quite a year for the stock, which was up . The stock was up 383% for 2024 through Thursday. But to understand the drama, you need to look at a five-year chart. The stock has risen 191% over the past five years, but it has been a roller-coaster ride. This is a five-year price chart through Thursday:

Don’t miss: 10 semiconductor stocks that might make you a lot of money in 2025