The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how specialized consumer services stocks fared in Q4, starting with Mister Car Wash (NASDAQ:MCW).

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 0.7% below.

While some specialized consumer services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.3% since the latest earnings results.

Best Q4: Mister Car Wash (NASDAQ:MCW)

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE:MCW) offers car washes across the United States through its conveyorized service.

Mister Car Wash reported revenues of $251.2 million, up 9.1% year on year. This print exceeded analysts’ expectations by 1.2%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ same-store sales estimates but full-year revenue guidance missing analysts’ expectations.

Mister Car Wash pulled off the fastest revenue growth of the whole group. The stock is up 8.8% since reporting and currently trades at $8.27.

Is now the time to buy Mister Car Wash? Access our full analysis of the earnings results here, it’s free .

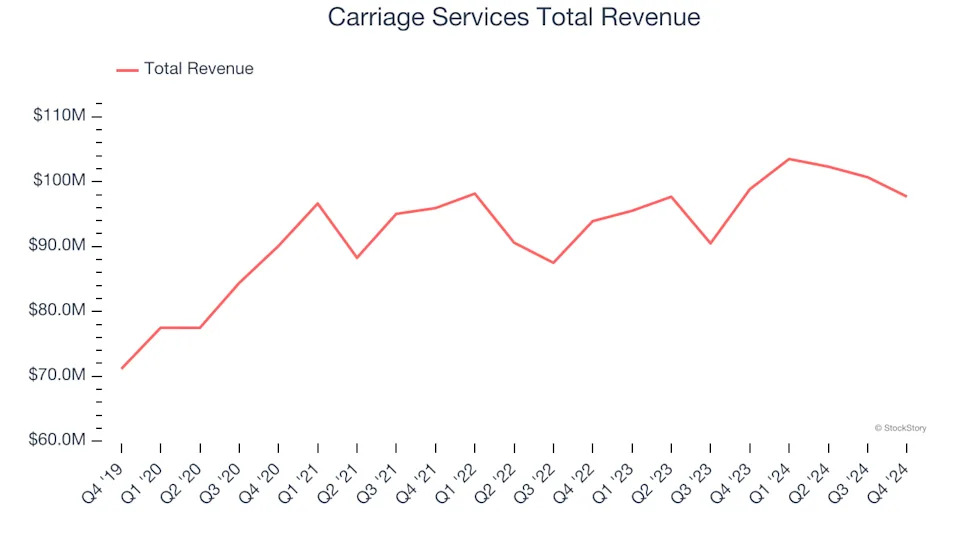

Carriage Services (NYSE:CSV)

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Carriage Services reported revenues of $97.7 million, down 1.1% year on year, outperforming analysts’ expectations by 1%. The business performed better than its peers, but it was unfortunately a mixed quarter with an impressive beat of analysts’ EPS estimates but full-year revenue guidance missing analysts’ expectations significantly.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 2.6% since reporting. It currently trades at $40.11.

Is now the time to buy Carriage Services? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: 1-800-FLOWERS (NASDAQ:FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $775.5 million, down 5.7% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 21.9% since the results and currently trades at $6.88.

Read our full analysis of 1-800-FLOWERS’s results here.

Frontdoor (NASDAQ:FTDR)

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $383 million, up 4.6% year on year. This number surpassed analysts’ expectations by 4.1%. Overall, it was an exceptional quarter as it also produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Frontdoor scored the highest full-year guidance raise among its peers. The stock is down 20.4% since reporting and currently trades at $45.48.

Read our full, actionable report on Frontdoor here, it’s free.

ADT (NYSE:ADT)

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT reported revenues of $1.26 billion, up 7.5% year on year. This print topped analysts’ expectations by 2%. Zooming out, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is up 8.6% since reporting and currently trades at $8.16.

Read our full, actionable report on ADT here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .