(Bloomberg) -- Mexico cut interest rates for a fourth straight meeting Thursday as inflation is slowing back to target and the economy is losing momentum.

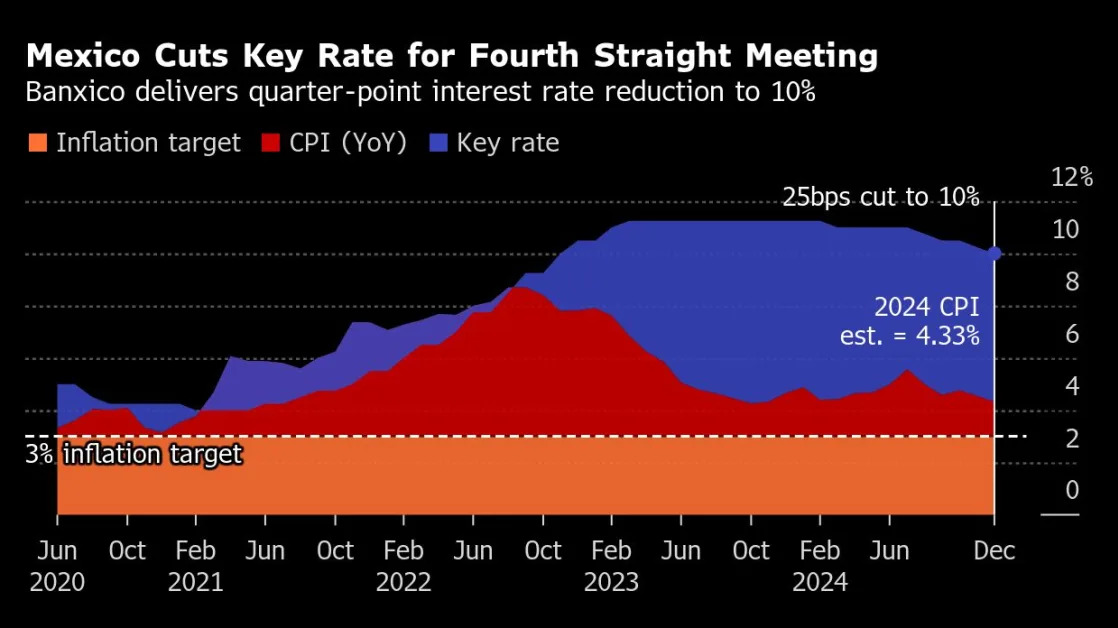

Banxico, as the central bank is known, lowered borrowing costs by a quarter-point to 10% in an unanimous decision. The move was forecast by 21 of 29 economists surveyed by Bloomberg. The remaining eight predicted that the bank would accelerate the pace of easing with a half-point cut.

“The Board expects that the inflationary environment will allow further reference rate reductions,” policymakers wrote in a statement accompanying their decision. “In view of the progress on disinflation, larger downward adjustments could be considered in some meetings, albeit maintaining a restrictive stance.”

Governor Victoria Rodriquez and colleagues last month looked past a number of risks including a slight uptick in inflation and output to unanimously vote to continue easing. Less than a month later, signs of slowing growth abound while both headline inflation and core readings are decelerating, though incoming US President Donald Trump and a more cautious Federal Reserve cloud the outlook.

“Banxico decided for a quarter-point cut to maintain its smooth implementation of the easing cycle, while there are still significant risks ahead, including the new US administration and a shallower easing by the US Fed,” Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc., said by text before the decision.

The bank said the possibility of new tariffs on US imports from Mexico, as Trump has pledged to impose, added uncertainty to its inflation forecast, which was revised upward starting in the second quarter of next year. Banxico now sees inflation converging to the 3% target in the third quarter of 2026 from the fourth quarter of 2025 previously. The balance of risks for inflation remained tilted to upside, the bank added.

“Due to the risks related to the US incoming administration in the first quarter of 2025, it may be difficult for the central bank to become more aggressive in the short term. However, the communication left the door wide open so if coming data allows a faster pace, they will deliver,” said Claudia Ceja, a strategist at BBVA Mexico.

‘Second Read’

The Mexican peso shook off losses and climbed to a session high after Banxico delivered the cut, upending some bets that policymakers could have picked up the pace of easing.

“The initial reaction of the peso is to consider this a hawkish surprise, given that some were expecting a 50bps cut, and also because most expected at least one board member to dissent and vote for a 50bps cut,” said Carlos Capistran, chief Canada and Mexico economist at Bank of America. “But on a second read, the statement is dovish as it anticipates a potential change in pace in future meetings.”

Latin America’s second-largest economy has the second-highest benchmark interest rate among the region’s big economies as Banxico only began unwinding a record tightening campaign earlier this year, months behind peers in Brazil, Chile, Peru and Colombia.

And while resurgent or sticky inflation has some central banks fine tuning monetary policy, or even ratcheting interest rates back up as in Brazil, only Colombia’s BanRep is forecast to cut borrowing costs more aggressively than Banxico in 2025.

Both headline and core inflation slowed in November —- the latter for a 22nd straight month back into the central bank’s target range.

Government data showed that inflation decelerated for the third month in four to an annual rate of 4.55%, down from a 2024 high of 5.57% in July. The bank targets inflation of 3%, plus or minus one percentage point.

Core readings, which excludes volatile items such as food and fuel and is viewed by some Banxico board members as providing a better indication of where inflation is headed, sunk to a 4 1/2-year low of 3.58%.

Economists in the most recent Citi survey published Dec. 18 expect that inflation will end 2024 at 4.33% and in 2025 will slow to 3.9%. The comparable core readings are 3.8% and 3.9%.

The bank in late November revised its 2024 GDP estimate up to 1.8%, but held the 2025 forecast at 1.2%, implying a fourth year of slowing growth. Banxico said Thursday that the economy is expected to register lack of dynamism in the last quarter of this year and during 2025. Also, growth risks remain biased to the downside.

That’s even without taking into account what would happen should the US, Mexico’s No. trading partner, slap tariffs on its southern neighbor once Trump takes office. Business leaders in Mexico’s private-sector have also expressed concern about lower domestic sales next year.

In Banxico’s late November survey of analysts, 79% predicted the business climate would get worse over the following six months. And an estimate from BBVA suggests remittance growth will slow to 3% in 2025, based in part on changes to the US labor market.

The government in its 2025 budget also sought to reign in public spending and bring down the deficit to 3.9% of GDP, suggesting the government would be less of a driver of the economy than in previous years.

--With assistance from Rafael Gayol, Michael O'Boyle and Valentine Hilaire.

(Updates with Banxico, analysts comments throughout)