December’s surge in U.S. Treasury yields hasn’t created a very warm welcome for the incoming Trump administration.

The “red sweep” by Republicans in November’s elections was tethered to voters’ dissatisfaction with the U.S. economy. But a more immediate challenge come Inauguration Day on Jan. 20 might be taming Wall Street’s fears about how much President-elect Donald Trump’s “pro-growth” agenda could add to the large U.S. debt load.

A big part of the Trump team’s focus may be spent convincing the “bond vigilantes” behind the latest Treasury selloff that the fiscal outlook isn’t set to deteriorate sharply under one-party rule in Washington, D.C.

“We still think there is room for Treasury yields to move higher from current levels,” a team led by Zachary Griffiths, head of investment-grade and macroeconomic strategy at CreditSights, wrote in a Friday client note.

The benchmark Treasury yield BX:TMUBMUSD10Y edged up to 4.596% on Friday, after ending 2024 with its biggest yearly jump since the ugly 2022 bond rout . That matters because the yield serves as a base rate for mortgages, car loans, corporate borrowing and more.

Higher Treasury yields can be a headwind for stocks because they erode the present value of future earnings, making it more difficult to justify lofty valuations.

Evercore ISI strategists led by Julian Emanuel recently said rising Treasury yields pose the biggest challenge to the bull market in stocks, warning that a 10-year yield above 4.75% could potentially spark “a longer and deeper equity correction.”

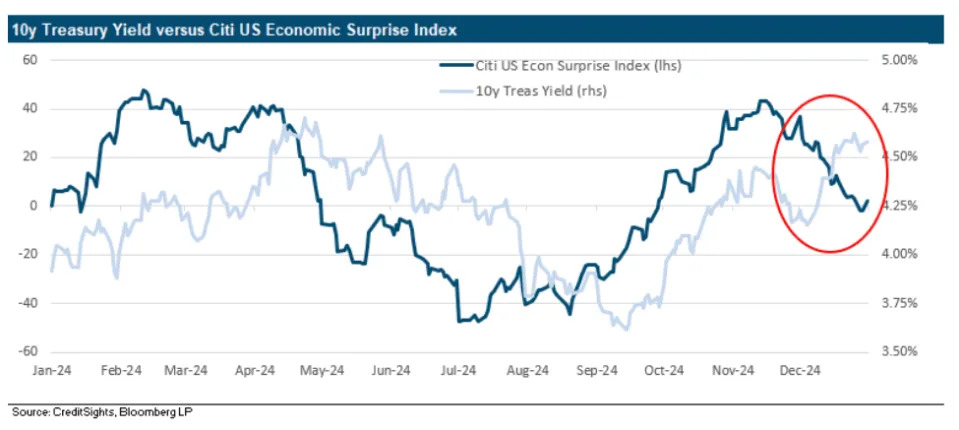

Furthermore, surprises about the economy no longer appear to be driving bond yields.

Instead, the recent “bear steepening” of the Treasury yield curve “indicates to us that the market is concerned about the U.S. fiscal outlook in addition to the potential for higher policy rates for longer,” the team led by Griffiths wrote.

To bolster their argument, the team overlaid the Citigroup Economic Surprise Index, a gauge of expectations about the economy, with the path of the 10-year Treasury yield for the past year. Even though the surprise index declined, yields rose in December.

“I’ve heard some argue that the rise in bond yields is a function of recession risk being repriced,” Neil Dutta, head of economics at Renaissance Macro Research, wrote in a Wednesday client note. “I am not so sure.”

Instead, he views the move higher as likely a function “of deficit concerns related to fiscal policies” next year, which risk increasing “the issuance of debt relative to demand,” as well as of the “ongoing decline in the Fed’s balance sheet” requiring investors to “hold more long-duration securities,” and of the overseas rise in bond yields in places like Japan and the U.K.

Back in the U.S., political wrangling in Washington was in focus on Friday, with Louisiana Republican Mike Johnson winning re-election as House speaker in a close vote. Discord within the Republican party could threaten Trump’s agenda to lower taxes, increase tariffs and limit immigration.

Read: Mike Johnson elected House speaker, easing concerns over delays to market-friendly bills

Plus: All these market indicators point to stocks struggling during Trump’s presidency

Stocks closed out a blockbuster year in 2024, but stumbled in the past week. The blue-chip Dow Jones Industrial Average DJIA gained 0.8% Friday to log its first daily gain in five sessions, while the S&P 500 SPX added 1.3% and the Nasdaq Composite COMP climbed 1.8%, according to FactSet.