Due to a technical error, the emailed version of this newsletter did not get published at the intended time. We apologize for any inconvenience.

A weak end to 2024 for stocks has bled into 2025. The S&P 500 has fallen for the last five sessions, shedding 2.8%.

Markets have entered the “danger zone.”

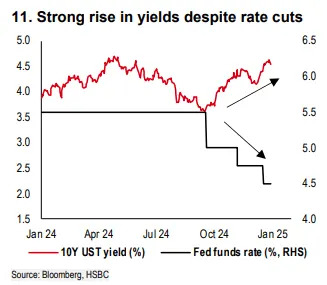

That’s according to a team at HSBC Global Research, led by chief multi-asset strategist Max Kettner. Channeling their inner Kenny Loggins , the HSBC analysts warn that the recent rise in 10-year Treasury yields — at 4.56% they are just shy of seven-month highs — have blown risk assets into precarious territory.

The Federal Reserve’s hawkish pivot in December, amid some better economic data, stubborn inflation readings of late, and, post-election, fears of higher U.S. Treasury issuance, have contributed to the unusual sight of the 10-year yield diverging dramatically from the fed funds rate, HSBC notes.

Investors will recall that risk assets had been doing well since the summer growth scare, even shrugging off some of the potential economic negatives of the incoming administration, according to HSBC. But stocks then started to struggle when yields rose swiftly.

Higher bond yields tend to pressure stocks because they can depress the economy by making borrowing costs more expensive, while also offering a more attractive alternative to equities

“So to us the largest risk for the coming months continues to be higher yields, not politics,” says HSBC. “What this means is that the crucial near-term catalysts are not the inauguration on Jan. 20, but the December U.S. inflation report and, perhaps most importantly, the quarterly refunding announcement,” which come on Feb. 3 and Feb. 5, respectively.

Consequently the next few weeks are likely to stay volatile with fears of higher bond supply and/or stubborn inflation leading to a further selling of longer-duration bonds, which will then prompt more risk asset weakness.

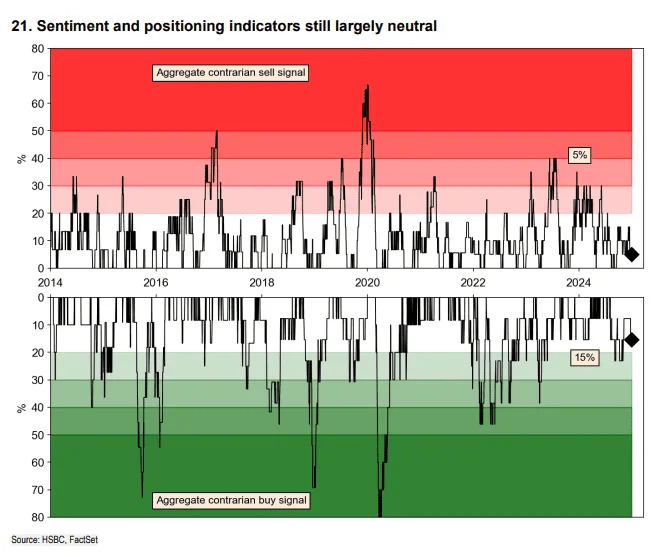

“So we don’t close our underweight in USTs here, nor would we buy the dip in equities or credit just yet. What’s missing for the latter is at the very least a weak buy signal from our sentiment and positioning signals,” says HSBC.

The good news for investors is that the HSBC team think “the next few weeks will likely create such a buying opportunity, in our view – for both U.S. duration and risk assets alike.”

That’s partly because fears about a substantial shift to more supply of long-term Treasury contained in the quarterly refunding announcement may be overblown, and inflation expectations are already high now.

Furthermore, “extraordinarily high readings of supercore inflation in Q1 last year may also not be repeated to the same extent this quarter. This would also support our economists’ view of three rate cuts this year,” says HSBC.

And in stocks, HSBC argues that the sharp deterioration in market breadth tends to actually be a contrarian indicator, and that “solely judging by this metric, we might already be closer to the end of the mini-correction.”

So, how should investors position for what HSBC believes should overall be a ‘Goldilocks’ backdrop for the market?

A more dovish-than-expected Fed is likely to weaken the dollar, pressure yields to the downside and even help assets like emerging-market debt. In equities, some bond proxies such as homebuilders have sold off too aggressively recently, HSBC reckons.

They add: “U.S. banks have not been able to benefit from the rise in yields, but rather corrected lower with the rest of the market – we believe this looks exaggerated given more deregulation, hopes for higher M&A activity and higher yields should all support the sector.”

They’d also be positive on U.S. tech in case of a further dip, while any stabilization in U.S. Treasury yields and the dollar should also be a positive factor for emerging market equities given the strong foreign investor outflows recently.

Markets

U.S. stock indices SPX DJIA COMP are higher at the opening bell as benchmark Treasury yields BX:TMUBMUSD10Y dipped.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5868.55 |

-2.84% |

-3.58% |

-0.22% |

24.74% |

|

Nasdaq Composite |

19,280.79 |

-3.75% |

-2.30% |

-0.16% |

32.13% |

|

10-year Treasury |

4.553 |

-7.70 |

38.30 |

-2.30 |

50.73 |

|

Gold |

2669.3 |

1.36% |

-0.19% |

1.14% |

30.24% |

|

Oil |

72.9 |

3.89% |

6.07% |

1.43% |

-0.16% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

U.S. economic data due on Friday included the ISM manufacturing for December , which topped economist expectations.

U.S. Steel X shares fell after reports President Joe Biden is expected to announce that he is blocking its purchase by Nippon Steel.

Alcohol consumption is the third leading cause of cancer in the U.S. according to a report released by U.S. Surgeon General Dr. Vivek Murthy.

South Korea’s KOSPI Composite index KR:180721 rose 1.8%, shrugging off a failed attempt to arrest the country’s president .

Best of the web

Elon Musk and the right’s war on Wikipedia.

How an FBI sting stopped a Russian smuggler but not his Hong Kong supply route.

What stocks’ worst stumble since 1952 in the final days of 2024 may mean for 2025.

The chart

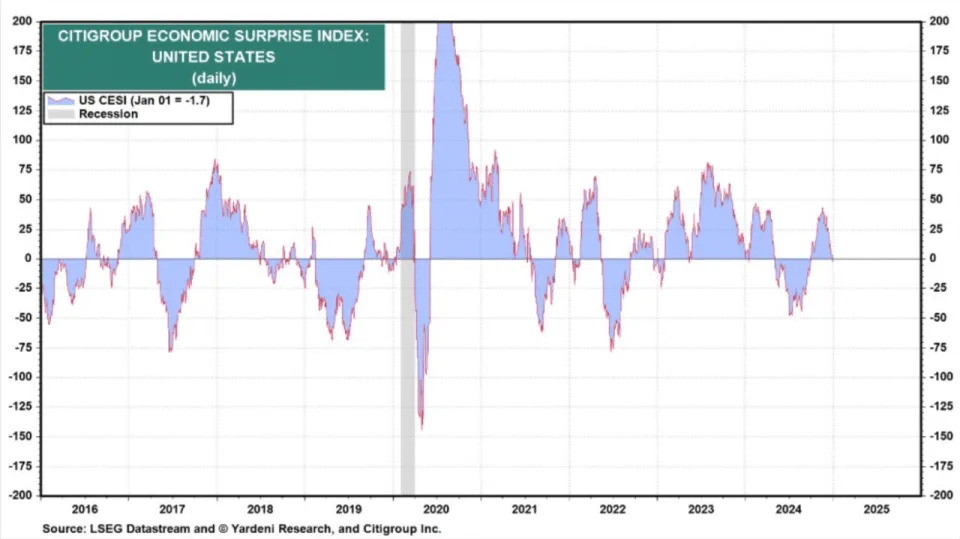

As noted above, the market is currently placing a low probability on the Federal Reserve cutting interest rates again in the first quarter of the year. Perhaps traders should be looking at this chart from Yardeni Research, which shows the Citigroup Economic Surprise index for the U.S. has just turned negative for the first time since October.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

HOLO |

MicroCloud Hologram |

|

RGTI |

Rigetti Computing |

|

PLTR |

Palantir |

|

AAPL |

Apple |

|

MSTR |

MicroStrategy |

|

NIO |

NIO |

|

TSM |

Taiwan Semiconductor Manufacturing |

Random reads

Is this weird dome the future of watching sports?

Huge 166,000,000-year-old dinosaur footprints discovered in Oxfordshire.

Cambridge scientists study if dogs and owners thinking is synchronized.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.