(Bloomberg) -- Chinese curbs on exports of three niche metals to the US have already rattled the market. Now, a bigger clampdown looks set to have far-reaching ramifications for supply chains feeding American defense and chip-making industries.

Beijing this month slapped a ban on US-bound exports of gallium, germanium and antimony in a tit-for-tat move in a technology trade war. The metals are important because they have crucial uses in many Western industries from military tech to semiconductors to satellites.

The ban may seem symbolic at first, given restrictions imposed more than a year ago had wiped out direct exports of Chinese gallium and germanium to the US. That pushed up prices and made it harder for traders to source buffer stocks. Yet panic levels are rising, because this time Beijing could crimp supplies further with rules prohibiting foreign companies and countries from helping US manufacturers to evade the controls.

For instance, the measures could prevent international firms from reprocessing Chinese gallium, germanium and antimony in third countries, and then selling those products into the US.

End buyers of those metals — such as the chip, aerospace and defence sectors — may have little choice but to try to use less, recycle more or strike deals with the few Western companies who can potentially start new production. There are also worries that other critical materials could be targeted if tensions escalate.

Chinese metal that has been reprocessed elsewhere and re-routed to the US has offered a lifeline for American manufacturers, particularly in the gallium market. But those flows will probably dwindle as suppliers fear reprisals from Beijing, according to people with knowledge of the trade, who asked not to be identified due to the commercially sensitive nature of the matter.

The tiny size of those markets and limited companies participating in them mean such sales would be easy to track, and being blacklisted by China would have huge repercussions for firms involved, the people said.

It will be relatively easier for China to stop gallium shipments via third countries, given it’s a niche market, said Uchi Wakaaki, director of overseas business at Wing Co., Japan’s largest importer of the metal. Wing’s imports from China have halved this year due to the knock-on impact of trade curbs, he said.

The impact on supply chains will vary, but traders, analysts and suppliers broadly expect Beijing’s ban to materially tighten global markets and boost metal prices in the coming months.

Prices are already high. Germanium — which is over 300 times more expensive than copper — and antimony have hit records, while gallium is at a 13-year high, data from Fastmarkets show.

Chipmaker Intel Corp. said the ban won’t significantly threaten production given its global supply sources. But since last year’s restrictions, several niche manufacturers in the sector have warned of risks for securing components or selling their products if they become more expensive to make.

They include French night-vision technology company Exosens SAS and Lumentum Holdings Inc., which makes lasers for the semiconductor, defense and renewables sectors. AXT Inc., a semiconductor manufacturer that produces gallium products in China to supply US plants, said in some cases the government hasn’t issued export licenses, and shipments have been delayed.

Exosens and Lumentum didn’t respond to requests for comment about the impact of this month’s ban. A spokesperson for AXT also didn’t respond to an email requesting comment, and a message left on the company’s general voicemail wasn’t replied to.

In the longer term, industry insiders say the challenge will be securing new or alternative supplies, and finding refiners who can transform them into extremely pure forms that manufacturers need.

There’s also the question of whether China could target other commodities. It’s the dominant supplier of dozens of critical minerals, but analysts and traders are focusing on ones that have key applications in the defense sector, and which the US doesn’t produce in meaningful volumes. Possible candidates include hafnium, zirconium, tungsten, titanium, and indium, they said.

“Industries that have never had an issue around material availability are all of a sudden waking up to the fact that there might be one,” said Ionut Lazar, principal consultant at researcher CRU Group. “For the smaller manufacturers who are really heavily reliant on that material being available — almost regardless of the price — that’s the concern.”

Drawing on views from producers, traders, manufacturers and consultants, here’s a metal-by-metal breakdown of how China is exposing pinch points in the West’s defense and chip-making supply chains — and the impact:

Gallium

Like fellow minor metals germanium and antimony, gallium is typically extracted as byproduct from mining and refining mainstream commodities like zinc, copper, aluminum and gold.

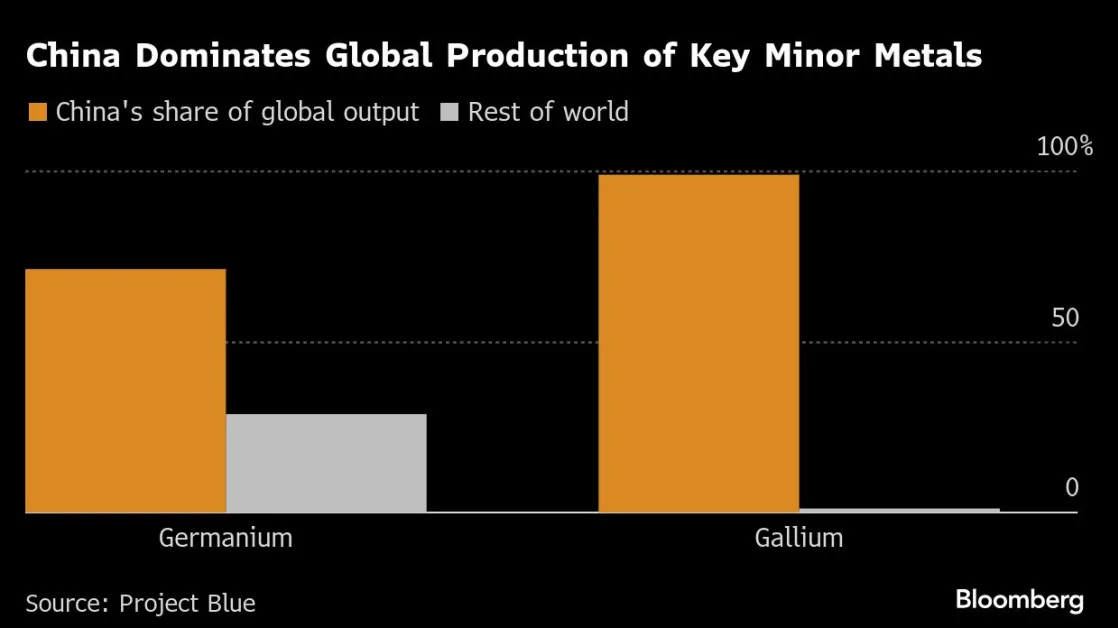

Annual gallium output totals less than 1,000 tons, with China producing virtually all of it. To highlight the minuscule market, China’s aluminum industry — which pumps out gallium as a byproduct — makes more than 40 million tons each year. The nation is so dominant because in addition to being by far the top aluminum producer, its refiners are also required by law to recover gallium.

“If you really wanted to throttle a market, it would make sense to start there,” said Jack Bedder, founder of critical minerals consultancy Project Blue. “We’re still nowhere near the levels of muscle that China could flex in this space if it really wanted to.”

International producers could in theory raise gallium production by investing in ways to extract it as a byproduct. Rio Tinto Group last week said it’s looking into whether that’s worth doing in Canada, and Metlen Energy & Metals SA is exploring something similar in Greece.

Despite gallium’s price, some prospective producers are hesitant to invest and have sought commitments from US and European governments to fund projects. Some refiners also want minimum-price guarantees from manufacturers in return for long-term deals, people familiar with the matter said.

That’s because suppliers are worried that prices could collapse if China lifts export restrictions or metal flows though prohibited channels. That’s a particular concern for gallium since China produced more than the world needed before the ban, meaning it risks building a domestic glut.

Germanium

Germanium is one example of how trade restrictions — including sanctions affecting Russian metals and mining — are shutting international merchants out of the market, reducing their role as suppliers of last resort in times like this.

Alongside a handful of Chinese producers and a few alternative ones overseas, supplies of minor metals have traditionally been controlled by a group of specialist traders primarily operating out of London, New York, Hong Kong and Tokyo.

They’ve historically built inventories when supplies are ample, before waiting — sometimes for years — to sell them when metal becomes scarce.

But since China’s restrictions last year, many have been frozen out of the affected metals, with customs officials only approving shipments to established end users, according to people familiar with the matter. Germanium and gallium exports to traders’ main storage hubs in the Netherlands and Hong Kong have collapsed to zero, trade data show. That means less available metal on hand.

Take Suzannah Lipmann’s family owned firm, famous among London’s tight-knit network of minor metals traders for having virtually every rare mineral in stock. Lipmann Walton & Co. no longer includes germanium on its list, having stepped out of that market for now in response to tightening trade restrictions.

“Normally, the trade would find a way to solve these types of shortages if you leave it be,” said Lipmann, whose family has traded minor metals for three generations. “In a geopolitical crisis, normally the one thing that keeps on flowing is metal.”

With traders ill-equipped to plug the gap, manufacturers have been tapping their own buffer stocks, seeking to lock in additional supplies from a handful of alternative Western refiners and asking governments for help in building more resilient supply chains.

Beijing’s grip on germanium is looser than it is for gallium, but is still a concern for the US as it seeks to become less reliant on Chinese supplies.

After China’s curbs last year, the Biden administration sent diplomats to Belgium and the Democratic Republic of Congo to shore up critical mineral supplies for domestic manufacturers, including defense and aerospace contractors who need extremely pure forms of germanium to keep satellites in orbit and missiles on target.

It’s only the beginning of China’s “attempts to assert its dominance on critical minerals,” Jose Fernandez, US under secretary of state for economic growth, energy and the environment, said in Brussels this month. “I’m anticipating this will not be the last time we need to address this issue.”

The US once dominated germanium supply more than China does today. Cold War-era scientists pioneered a process that made it one of the purest materials ever — with impurities reaching just one in every 10 trillion atoms.

Umicore SA, which transforms germanium for use in high-tech products like thermal-imaging systems and radiation detectors, has partnered with Congo to process the metal from mine-waste dumps there in a deal brokered by US authorities. A key question is how quickly it can boost supplies.

“This partnership is part of our overall strategy to diversify our supply sources and to strengthen the supply chain,” said Umicore, which has historically had agreements for large Chinese supplies. “We are confident that our sourcing strategy and our supply portfolio are sufficiently robust to secure continued operations and supplies to our customers.”

Antimony

Like many minor metals, antimony — widely used in munitions — has been oversupplied for much of this century as China’s rapid industrial expansion boosted output. But that has been changing in recent years as the county’s geological reserves shrink.

While illicit exports via Vietnam in the past helped ease supply squeezes, better border monitoring and supply chain auditing by Western manufacturers have seen so-called border leakages drop in recent years, according to CRU. Looking ahead, such flows are “probably going to be more and more difficult,” said Willis Thomas, a principal consultant at CRU.

The few deposits developed in countries like Tajikistan, Myanmar and Turkey aren’t large enough to make up for the shortfall in Chinese supply, and the big worry is when and where any new mines will be found.

The only known US deposit sits in an abandoned gold mining region in Idaho and the US Defense Department has supported developer Perpetua Resources Corp. to help start production. That could reduce America’s antimony shortage, potentially contributing more than 30% of its needs.

The problem is that development could take years and much more is needed to plug the global shortfall. Many end users remain worried about supplies.

“At the time China made this announcement, we started getting an avalanche of calls from the Defense Department,” said Gary Evans, head of United States Antimony Corp, which runs a smelter in Montana that’s operating at about 50% of capacity due to a raw ore shortage. “The hard part is finding supply. We’ve been on the phone the last 120 days with companies trying to find supply.”

--With assistance from Thomas Hall and Martin Ritchie.