While the stock market was an early frontier of the gambling craze that gripped America in 2024, investors have driven a boom in a relatively new kind of investment product that can amplify gains — and losses — in a single name.

Enter leveraged single-stock exchange-traded funds.

Since their introduction in the early 1990s, ETFs have been groundbreaking in offering the characteristics of a mutual fund — owning a basket of diversified stocks — but offering the daily trading liquidity of a single stock.

But even after 30 years, the humble ETF is seeing fresh updates that cater to investors with a strong appetite for risk.

Instead of owning a basket of stocks, single-stock ETFs track the price of one stock, which the fund will try to juice returns on by levering up.

"These are vehicles that mass retail has never had the ability to trade before, until now," Todd Sohn, an ETF specialist at Strategas told Business Insider.

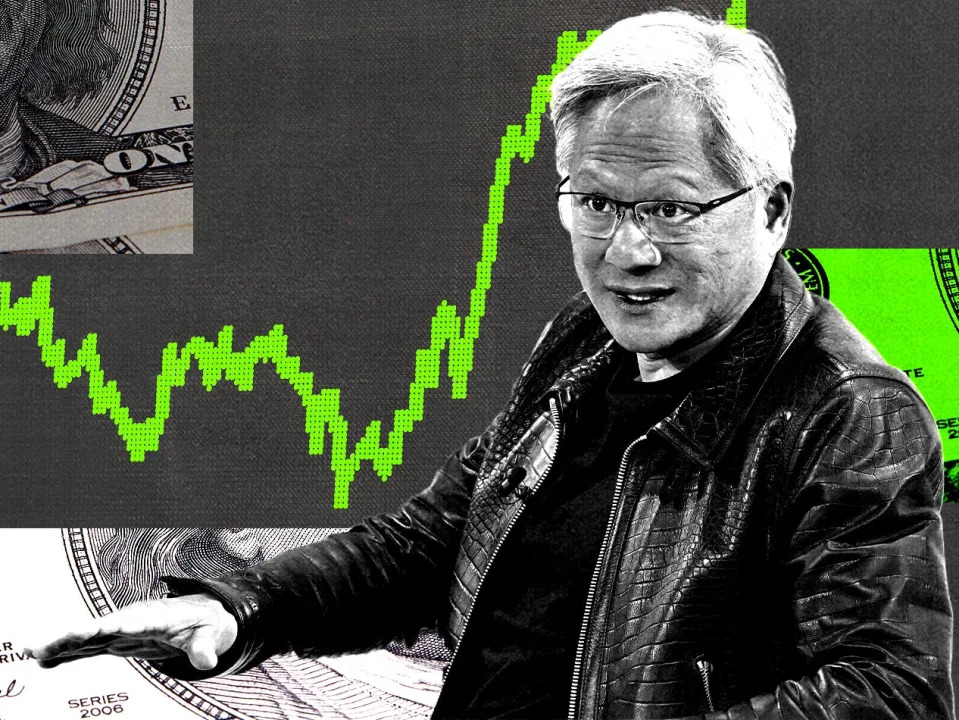

The GraniteShares 2x Long NVDA Daily ETF seeks to deliver double the move of Nvidia's daily price fluctuations.

On Friday, Nvidia stock jumped about 2.5% amid a broader market rebound, while shares of the 2x Nvidia ETF returned nearly 5%. Year-to-date, the 2x Nvidia ETF is up 346%, compared to a 170% gain for the stock.

"Traders are looking to implement high-conviction ideas through them," Sohn said.

Investors are pouring billions of dollars into these funds, making for some highly successful ETF launches in recent months.

That 2x Nvidia ETF has attracted more than $5 billion in assets, while other popular leveraged ETFs tracking stocks like MicroStrategy and Coinbase have each attracted well over $1 billion in assets.

That's a big deal for the ETF space, where the breakeven point for most ETF products is around $50 million in assets, according to white-label ETF provider Alpha Architect.

Year-to-date, more than 60 ETFs have launched catering to single-stocks, attracting a combined $23 billion in assets, according to data provided by Sohn.

While that amounts to relative peanuts in the $10 trillion universe of ETFs, it's still notable, and the funds are seeing a lot of use.

"They do pop up quite often on the most traded ETFs list," Sohn said, adding that ETFs linked to Nvidia, Tesla, Coinbase, and MicroStrategy are the most popular.

But while they can deliver outsize returns, these investment vehicles are inherently risky, much more so than owning the underlying stock.

Sohn said that leveraged ETFs are incredibly volatile, and due to options decay, they're best used as a trading vehicle, "not a set it and forget it vehicle," Sohn said.

Options decay refers to the idea that, even if the underlying stock trades sideways, the leveraged ETFs would likely move lower as options expire with zero value and new contracts are purchased.

And the leveraged downside tied to these ETFs can be painful.

During Nvidia's summer correction, the 2x long Nvidia ETF lost about 63%, prompting concern from Redditors who invested.

"Now I've lost a ton on NVDL (not touching my NVDA) and I am trying to think what makes the most sense," a Redditor said in a post on the Nvidia subreddit earlier this year.

Another example is MicroStrategy stock, which is down about 33% from its late November peak, while the 2x ETF that tracks the stock is down more than 60% over the same period.

The trading craze recalls another popular recent high-risk investment trend— the zero-day option . The contracts are a bet on the single-day move in a stock, with the option expiring the same day a trader buys it. The market took off during the pandemic trading boom, and it got so big that JPMorgan warned last year that its popularity could spark bouts of volatility in the broader market.

But for now, the risks appear to be limited to the individual traders who are buying them and not the broader market.

"While single-stock leveraged ETFs have gained in popularity this year, they remain relatively small in size. For example, NVDL has $5.5 billion in assets and NVIDIA is a $3 trillion stock," Todd Rosenbluth, head of research at TMX VettaFi, told Business Insider.

Going forward, risk-on traders seem less concerned about the risks associated with the single-stock ETFs and more focused on which one will take off next.

"The next questions is… what name catches on next with the trading crowd? Palantir seems to be one candidate (and has 2x ETFs out there). But we'll see what else comes up," Sohn said.

Read the original article on Business Insider