Key Takeaways

It’s been a record-breaking year for artificial intelligence (AI) darling Nvidia’s ( NVDA ) stock, and its momentum could be far from over.

Despite recent declines that brought the shares into correction territory, analysts remain overwhelmingly bullish on the chipmaker’s stock, expecting still more gains as demand for the company’s AI chips continues to outpace supply.

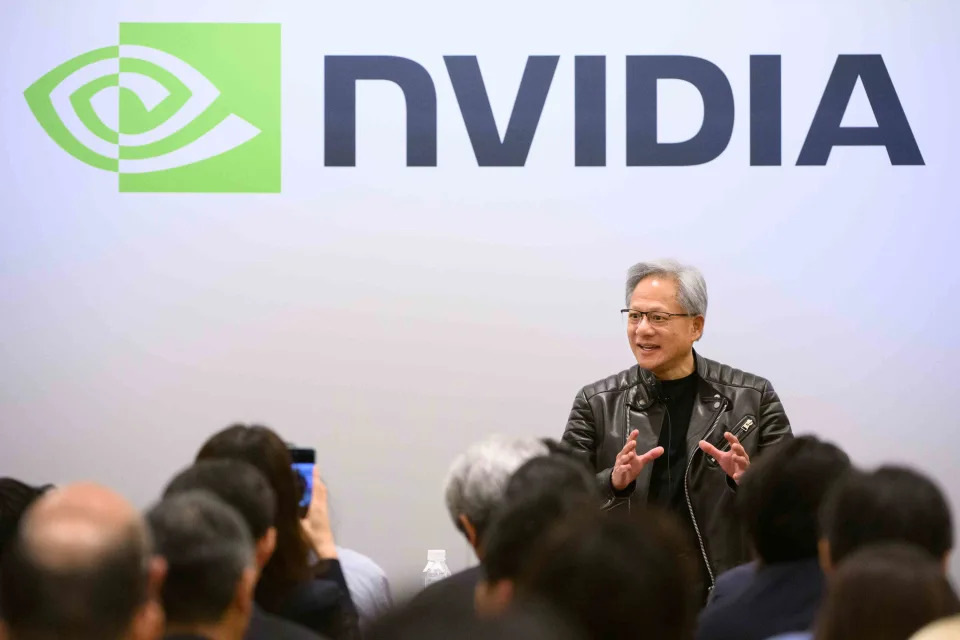

“The age of AI is upon us, and it's large and diverse,” CEO Jensen Huang told investors last month , with Nvidia set to benefit as computing scale grows “exponentially.”

Analysts are overwhelmingly bullish on Nvidia’s upward potential. All but one of the 21 analysts covering the stock tracked by Visible Alpha hold a “buy” or equivalent rating, with the average price target of about $177 implying more than 31% upside from Friday’s closing price of $134.70.

Nvidia’s Sales, Stock Run to Record Highs

Booming demand for AI sent sales of Nvidia’s chips to support developments in AI, as well as the company's stock price, to record highs this year, with shares more than doubling in value in 2024. That has pulled the value of the company into rich territory, with Nvidia one of only three companies currently sporting market capitalizations in excess of $3 trillion.

Last month, the company reported quarterly revenue reached an all-time high of $35.1 billion in the fiscal third quarter, as data-center revenue more than doubled year-over-year to a record $30.8 billion.

In the company’s earnings call, executives said they’ve seen “staggering” demand for the company’s next-generation Blackwell AI system, which CEO Jensen Huang has called "a complete game changer for the industry.”

In a mid-December note to clients, Morgan Stanley analysts called Nvidia a “top pick,” writing that they expect chipmaker to maintain its AI leadership in the near term, citing its research and development budget and strong relationships with major cloud providers.

CEO Jensen Huang’s January Keynote Could Be a Catalyst

Citi told clients the next big event to boost the stock could come next month, with CEO Jensen Huang set to deliver a keynote address at the Consumer Electronics Show (CES) on Jan. 6.

Citi analysts said they expect Huang could announce higher projections for Blackwell sales at the event, and highlight growth opportunities tied to rising enterprise and industrial demand for robotics. Nvidia is also expected to unveil new graphics cards, and could make other product announcements, according to The Verge .

Goldman Sachs analysts also pointed to Nvidia's annual GPU technology conference (GTC) in March. At this year’s GTC , Nvidia unveiled the Blackwell platform, announced expanding partnerships with industry leaders, and more. (Its fiscal fourth-quarter earnings report is expected in February.)

Huang has said previously the company plans to release a

new family of chips each year

, with the chipmaker likely to provide more details about Blackwell's successor, Rubin, in the months to come, with its release expected in 2026.

Read the original article on Investopedia