(Bloomberg) -- The amount of money investors park at a major Federal Reserve facility dropped below $100 billion for the first time since 2021 after policymakers adjusted the parameters this week.

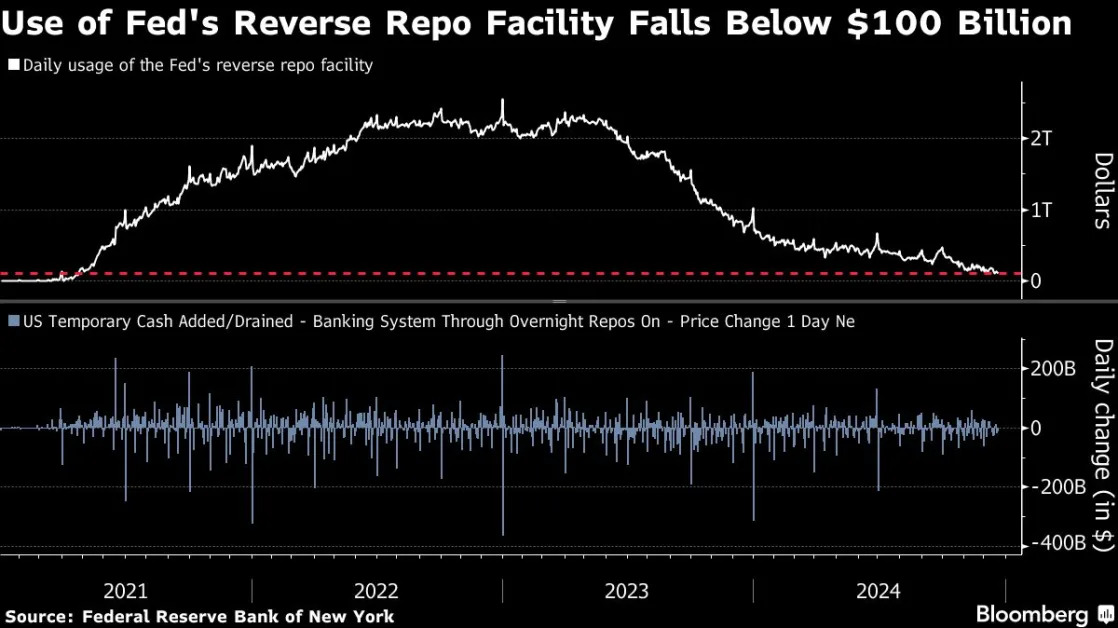

Some 40 participants on Friday put a combined $98.4 billion at the Fed’s overnight reverse repurchase agreement facility, known as the RRP, which is used by banks, government-sponsored enterprises and money-market mutual funds to earn interest. It marks a steep decline from a record $2.55 trillion stashed on Dec. 30, 2022, according to New York Fed data.

The latest decline in usage comes after officials on Wednesday lowered the rate on the RRP relative to the lower bound of the policy target range by 5 basis points as it aims to keep US funding markets running smoothly. Taken together with the Fed’s reduction in the overall target range for the fed funds rate to 4.25% to 4.50%, the new RRP rate is 4.25% — in line with the lower bound for the first time since 2021.

“This is the natural result of the Fed’s decision to realign the RRP rate with the lower bound of the fed funds target range,” said Oxford Economics analyst John Canavan. “It’s not terribly surprising that the decision to lower the relative RRP rate, making it slightly less attractive compared to alternatives, has contributed to the broader trend of declining RRP demand.”

While balances at the facility, a barometer of excess liquidity in the financial system, have dropped by about $2.4 trillion since their December 2022 peak, the pace of declines has slowed in recent months. On Wall Street, the sum of cash parked at the RRP has long been considered a useful gauge to watch as the central bank continues to unwind its balance sheet via a process known as quantitative tightening.

The downshift was foreshadowed in the minutes of the Fed’s November meeting, in which policymakers revealed they saw value in a potential “technical adjustment” so the RRP rate would be equal to the bottom of the target range for the federal funds rate.

Market watchers have said the move is likely to exert downward pressure on money market rates and further impact the amount of funds held at the Fed facility. Since the adjustment on Wednesday, Treasury bills are yielding more than the RRP, which may be spurring the shift away from the central bank. However, that could change next week as T-bill settlements will remove about $70 billion of supply from the market, driving rates lower and money back to the daily operation.

The RRP is now at least several basis points below bills in 1- to 3-month maturities, so there are probably some investors that moved into bills instead, said Deutsche Bank strategist Steven Zeng.

The last time the Fed tweaked the rate on the RRP facility was in June 2021, when a dollar glut in short-term funding markets outstripped supply of investable securities and weighed down front-end rates despite the steadiness of the Fed’s key benchmark. At the time, there was $521 billion in cash squirreled away at the overnight RRP facility.

--With assistance from Carter Johnson.

(Adds analyst comments.)