Exclusive hotel and social club chain Soho House said on Thursday that it had received a nearly $2 billion takeover offer.

The offer, at $9 per share, represents an 83% premium over Soho House's closing price on December 18. Shares soared over 47% on the news.

Before the takeover offer was announced, the London-based company's shares were down nearly 27% this year.

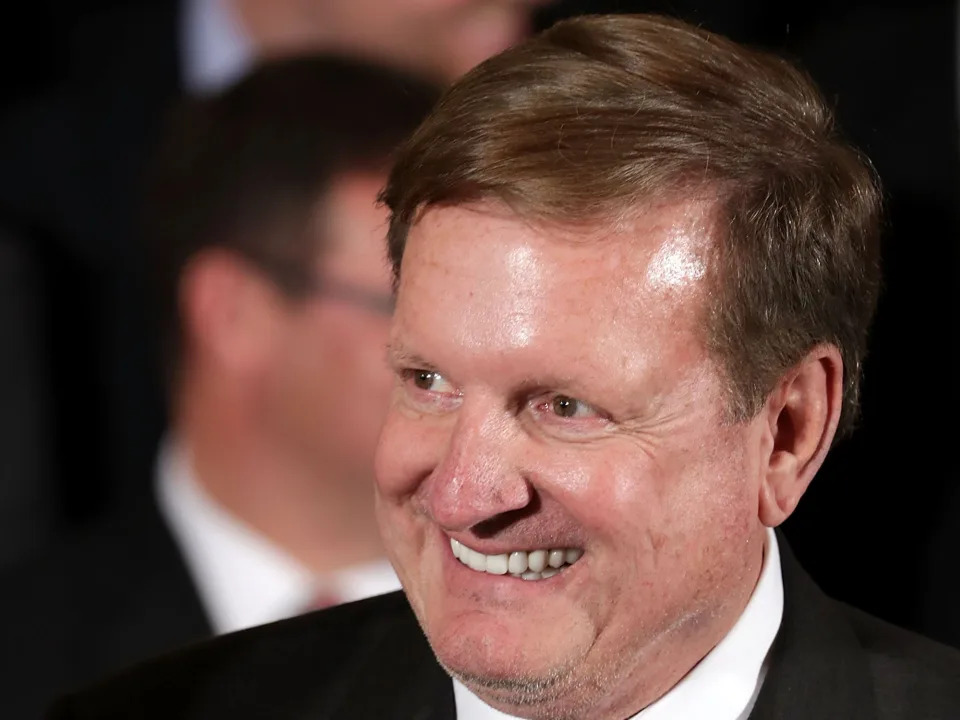

The company said in a statement on Thursday that it had received the takeover offer from a "new third-party consortium" but didn't name the parties involved. The takeover offer, Soho House said, is backed by its billionaire chairman, Ron Burkle .

The deal would require major shareholders like Burkle to roll over their equity stakes in Soho House. Three quarters of Soho House's common stock is owned by the company's board and its affiliates.

An independent special committee is evaluating the offer.

"No assurances can be given that the special committee assessment will result in any change in strategy or if a transaction is undertaken," Soho House CEO Andrew Carnie said of the deal during an earnings call on Thursday.

Representatives for Soho House did not respond to a request for comment from Business Insider.

The company has 45 clubs and more than a quarter-million members around the world. An annual membership to all of Soho House's clubs costs $5,200 for those aged 27 and above.

Soho House was founded in 1995 and went public in 2021 at a $2.8 billion valuation. Now, the company's market capitalization is $1.4 billion.

The exclusive members-only social club, however, has struggled to be profitable.

It brought in $333.4 million in the quarter ending September 29, a 13.6% increase from last year. But the company reported a net income of $200,000 — or $0.00 per share. That's still an improvement from the third quarter of last year, when the company lost $0.25 per share.

On Thursday, Soho House also said its revenue guidance for the year is $1.2 billion, the low end of its prior guidance, and it moved adjusted EBITDA to $140 million, below prior guidance. The company ended the quarter with $686 million in debt.

In the second and third quarters, the company cut corporate staff — with one major exception. On Thursday, chief financial officer Thomas Allen said Soho House increased its accounting team by 50% after finding errors in previous financial statements.

Soho House continues to expand, with a new exclusive members' club called Mews House in London that opened earlier this year. The company is eyeing another in New York, the CEO said on Thursday's call.

Read the original article on Business Insider