(Bloomberg) -- In a Vanity Fair video last month, Lisa, a member of mega K-pop band Blackpink, shared her obsession with toys from Chinese company Pop Mart International Group Ltd.

“I go crazy. It’s like I spent all my money,” she laughed, unboxing dolls from the toymaker’s PUCKY Roly Poly Kitty series. “I go to Pop Mart everywhere. If I fly to New York, I try to find Pop Mart there. Paris, you know, everywhere. (It’s) kind of like finding treasure.”

Lisa isn’t the only one clamoring for Pop Mart’s toys. This year, the Beijing-based company has turned from an in-the-know favorite among China’s Gen Z to a global phenomenon. In the US and Australia, fans have reportedly queued for hours, sometimes in the middle of the night, for new releases. Stores have popped up in the cities including Paris, Milan and New York. Overseas sales have jumped fivefold.

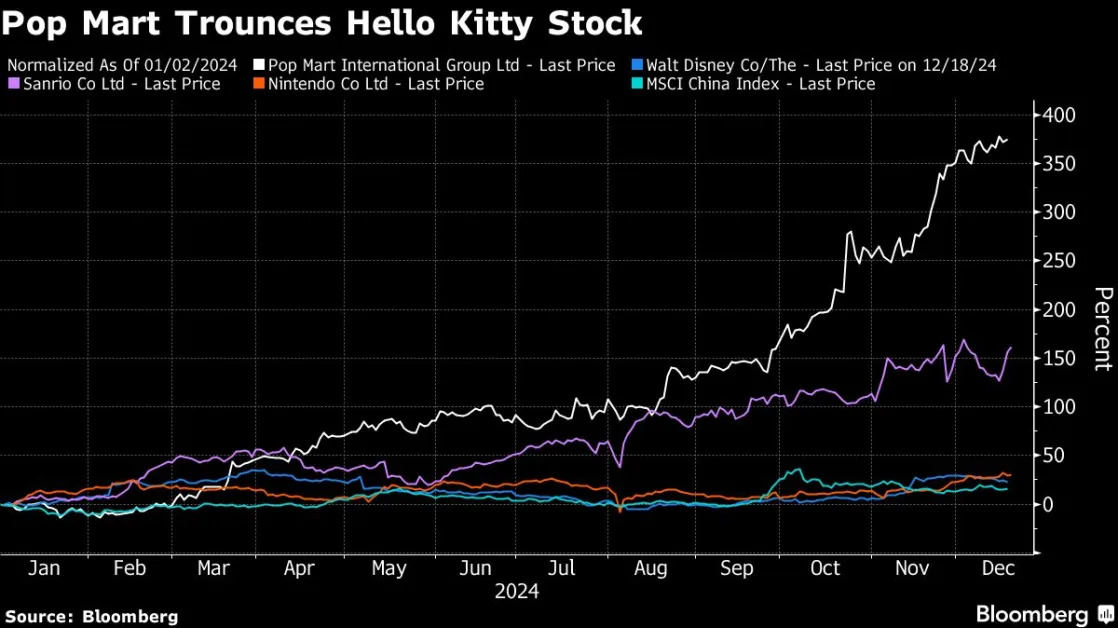

Fervor for its wide-ranging toys has turned Pop Mart into the hottest Chinese growth company, with shares up 368% this year, trouncing most members on the MSCI China Index. It also beat global peers like Walt Disney Co. and Hello Kitty’s parent company Sanrio Co Ltd. The firm reported domestic sales that grew at least 55% in the September quarter from the same period a year earlier, while overseas sales surged more than 400%.

“Pop Mart is likely the first homegrown Chinese consumer brand to achieve significant global success by attracting consumers via intellectual property, design and products, rather than pricing,” Morgan Stanley analysts including Dustin Wei wrote in a note. He called the company a “global brand in the making.”

Pop Mart often sells its dolls inside a blind box, which means the consumer doesn’t know what specific character is inside until they open it. Their novelty lies in its situational, character-driven designs that fans value for their emotional appeal. Take the retailer’s signature character Molly, a short-haired girl with a constant pout. She can appear as Space Molly, an astronaut traveling through the universe, or Baby Molly, depicting her as a three-year old toddler. For overseas markets, the company creates tailor-made designs such as a Mona Lisa-like monster on sale at its Louvre store in Paris.

The toys typically start retailing at 69 yuan ($9.50), while bigger, limited edition ones can sell for a couple thousand yuan. There are also active gray markets on Chinese apps and e-commerce platforms in Southeast Asia, where popular and rare dolls sell at several times their original prices.

Citigroup Inc expects Pop Mart’s global revenue to account for half of total sales next year as the company expands to North America and Europe. As of June 30, the company had 92 physical stores and over 160 vending machines abroad.

Pop Mart didn’t respond to Bloomberg’s requests for comment.

Founded in 2010, the company earns the majority of its revenue from proprietary intellectual property products. It works with artists, established IP providers and an in-house design team to create its dolls. The toymaker also licenses brands from companies like Disney and Universal Studios.

Pop Mart’s intellectual property like Molly isn’t content based and does not have story lines like Walt Disney’s Mickey Mouse or Nintendo Co Ltd.’s Pokémon. Instead, the company relies on introducing new versions to boost popularity.

Long-Term Doubts

In China, the government prohibits blind box sales to children under the age of eight due to worries over addiction. Before authorities imposed such guidelines in 2023, regulatory risk was a key concern among investors. And despite its strong momentum, Pop Mart’s relatively short track record makes it difficult for investors to find long-term conviction in its growth story.

Intellectual property businesses are cyclical in nature, and Pop Mart’s toy characters haven’t been around long, added Shuyan Feng, deputy general manager for investment management at Huatai Asset Management (Hong Kong) Co. “Competition can also get fierce in China, where once there are money making opportunities, everybody floods in,” she said.

This year’s rally has made its shares more expensive. The stock currently trades at 32.4 times forward multiples, above its three-year average. Of the 32 analyst recommendations compiled by Bloomberg, 30 are buys, two are holds and none are sells.

“Pop Mart is still a very young company and more time is needed to tell if they can continue seamless execution and revitalize their IPs,” said Chris Gao, a consumer research analyst at CLSA in Hong Kong. “When it becomes one generation’s memory, that definitely creates more long lasting demand.”

For the time being, however, consumers remain hooked — particularly at home. As of June, the company had 39 million registered member customers in mainland China, with a repeat purchase rate of 43.9%. The mainland accounted for about 70% of total sales in the first half of 2024. On TikTok, the hashtag #popmart has been used in over 667,000 posts and 1.8 million users follow the company’s official account.

Labubu, a small monster with high, pointed ears and serrated teeth, is so popular it’s inspired tattoos, counterfeits and even an Ecstasy pill shaped like the character in Thailand.

“The hunt for your target is a very addictive feeling tied in with instant dopamine,” said Gabriella Joma, a 36-year-old account executive in the US and, like so many others, a regular buyer of the brand’s toys. “I am hoping to visit more Pop Mart stores around the world. So far I have shopped in Italy, France, England, South Korea and Japan.”

--With assistance from Audrey Wan.

(Updates with analyst ratings on 14th paragraph)