(Bloomberg) -- Giorgia Meloni keeps managing a feat that her predecessors as Italian prime minister long struggled with: earning ever greater trust from investors.

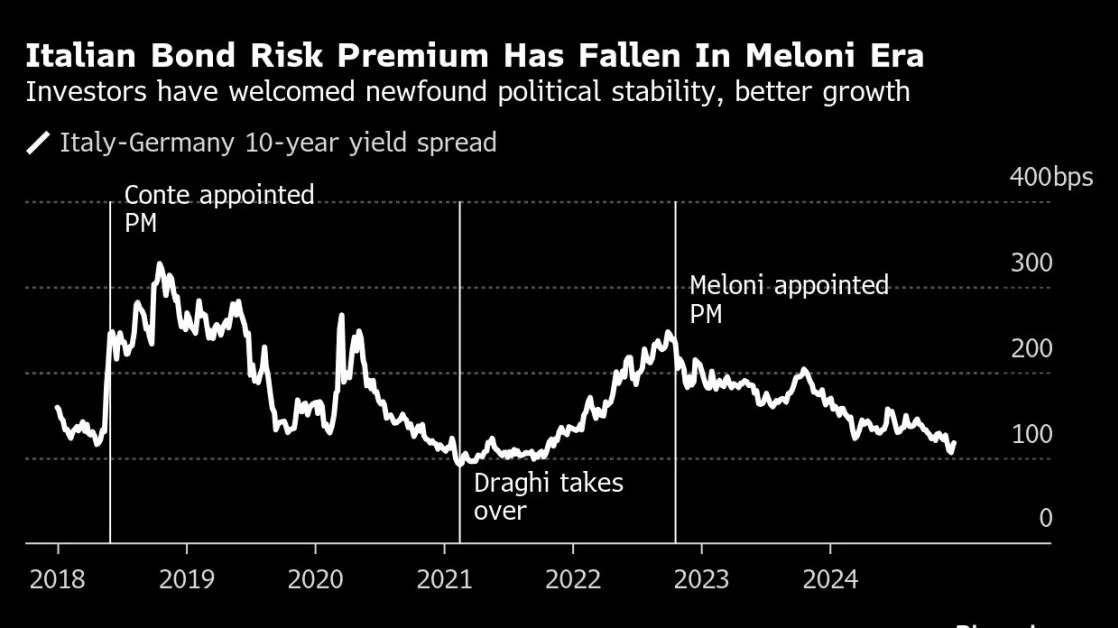

As the premier approaches the end of her second full year in office, the almost unheard of era of political stability that she has ushered in is being applauded by financial markets with yet further narrowing of the spread between the country’s bonds and its German equivalents.

That gauge of regional risk encapsulating the extent of investor doubts in the public finances has long been the torment of Italy’s political class. Meloni herself felt its sway when she served as a junior minister in the crisis-plagued coalition led by premier Silvio Berlusconi until 2011.

With governments in Paris and Berlin barely functioning, and investors reassessing the safety of French debt, the tables have now turned. Leading a nation whose growth is far outperforming Germany, with a stable coalition and a banking industry robust enough to attempt to buy rivals abroad, Meloni stands out in Europe as a beacon of strength.

“I can see Italy tightening a little bit further from here,” said Ella Hoxha, head of fixed income at Newton Investment Management, who owns Italian bonds. “It’s certainly a very good story.”

The spread between its bonds and German 10-year equivalents was around 117 basis points Thursday, having touched a three-year low of 106 basis points earlier in December. That’s down from 258 basis points reached in the immediate aftermath of her election victory in September 2022.

The continued improvement is all the more remarkable given how Italy found itself under renewed scrutiny in the past year, colored by investors’ longstanding experience of the country’s struggle to repair its public finances.

Loosening incorporated into the country’s budget for 2024 prompted a widening of the spread last October. In April, the International Monetary Fund warned that years of debt reduction were about to start reversing, and the European Commission, tasked with reasserting fiscal discipline in the region, harbored similar qualms.

Meloni instead succeeded in both placating her coalition partners’ demands to meet expensive promises to voters, and getting her government to agree on a trajectory for deficits that should put the country on track to meet the European Union’s goal of falling below 3% of output within the next year.

The foundations of her government’s durability were laid under the reign of her predecessor, former European Central Bank President Mario Draghi, who set the country’s finances on course for repair after the pandemic.

Meloni has also been assisted by favorable revisions to its debt profile — still stuck above 130% of gross domestic product — and the tailwind of billions of euros in spending by the bloc’s recovery fund that also began under Draghi. Such data have helped Italy to develop a recent and unusual record of exceeding expectations.

Credit assessors have duly taken note. After Meloni’s initial victory in convincing Moody’s Ratings to remove its threat of a downgrade to junk, in November last year, Fitch Ratings put the country on a positive outlook in recent months.

The run of good news, along with Meloni’s brand of economic nationalism that seeks to protect companies at home from foreign intervention, is emboldening Italian firms to look outside the country. That includes UniCredit SpA’s bid for Commerzbank AG, which triggered angry reactions from the German government.

Meloni herself knows that plenty can go wrong. The country will need to deliver on its fiscal promises or else suffer the consequences that France is currently encountering with a loss of investor confidence. Tough decisions on the public finances lie ahead in the next year to get the deficit below 3% by 2026.

The economy itself may be growing, but even that isn’t stellar. Officials recently acknowledged that expansion this year may be only 0.7%, compared to a prior estimate of 1%.

Most poignant of all, Italy is used to any semblance of stability quickly turning to dust. For all Meloni’s ambition of serving a full term, she can only achieve that at the whim of her coalition partners.

“The spread is very low because it’s a reflection of Italy’s political stability,” said Domenico Lombardi, an economics and public policy professor at Rome’s LUISS University. “Italy is particularly resilient right now, but it may not last in a broader European context that is having trouble.”

--With assistance from Aline Oyamada.