(Bloomberg) -- Bitcoin fell below $100,000 as the Federal Reserve’s cautious outlook for interest-rate cuts hurt speculative investments.

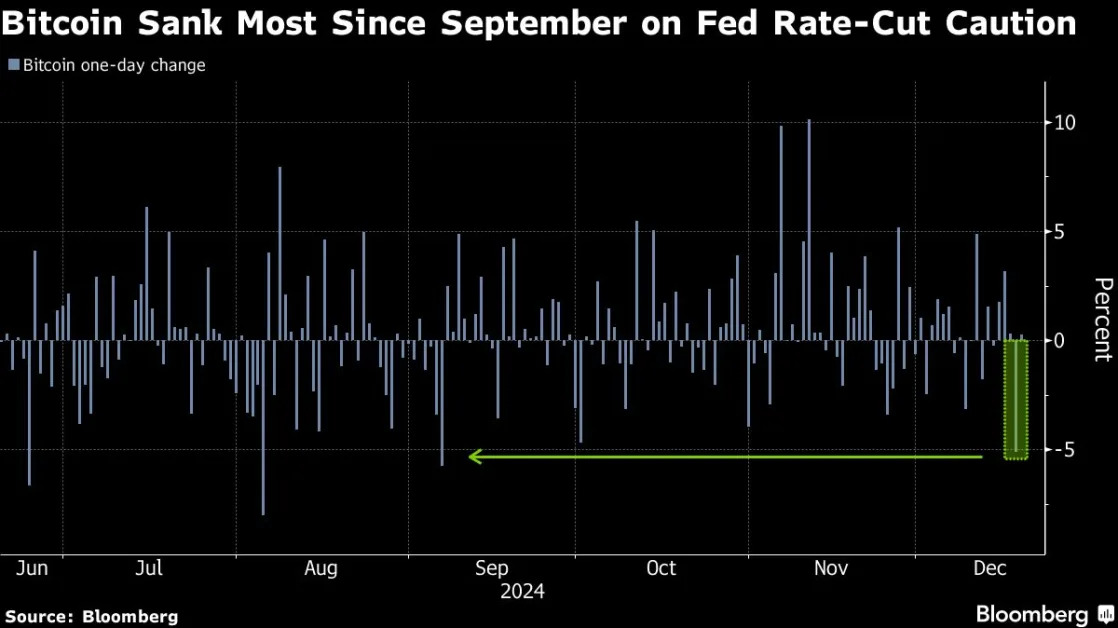

The largest digital asset slipped as low as 4% to $96,789 on Thursday in New York — more than $10,000 shy of the record high set on Tuesday. Other crypto tokens, which tend to be more volatile, have fared worse. Ether is down 5% while meme-crowd favorite Dogecoin is down 12%.

Fed officials lowered borrowing costs for a third straight time, but reined in the number of reductions they expect in 2025. Chair Jerome Powell said more progress is needed on inflation before further loosening monetary policy. Higher rates tend to lessen the allure of risky assets.

The result of the Fed meeting shouldn’t have surprised investors watching “the recent run of warm US inflation and activity data,” IG Australia Pty Market Analyst Tony Sycamore wrote in a note. “However, it has served as the catalyst to wash away some of the speculative excesses that flowed into risk assets, including stocks and Bitcoin, following the US election,” he said.

Global economic indicators like interest rates can correlate to fluctuations in the crypto market, which is why less rate cuts can have an impact, according to Jake Werrett, general counsel at dYdX Trading.

“Bitcoin, specifically, is seen by many investors as a reserve currency, and lower rates means more cash in circulation, higher inflation, and increased incentive to invest in store-of-value assets - such as Bitcoin,” Werrett said.

Bitcoin is up over 45% since the US vote on Nov. 5, buoyed by President-elect Donald Trump’s vow to unfetter crypto from regulatory shackles. The Republican has also backed the idea of creating a national stockpile of the token.

“All signs point to a good floor and outlook for Bitcoin” even if some traders were disappointed about the Fed meeting and took profits, said Paul Veradittakit, a managing partner at Pantera Capital.

Trump’s embrace of crypto has overshadowed warnings about stretched momentum and the lack of any traditional valuation tethers. President Joe Biden’s outgoing administration imposed a clampdown on the industry in the wake of a market rout in 2022 that exposed risky practices and fraud.

Sean McNulty, director of trading at liquidity provider Arbelos Markets, reported a post-Fed pick up in demand for options to hedge against Bitcoin declines. A retreat into the low $90,000s is possible for a very short period, according to Zann Kwan, chief investment officer at the Revo Digital Family Office.

--With assistance from Olga Kharif.

(Updates with Bitcoin price and additional commentary.)