(Bloomberg) -- Bulls stormed into the stock market at the start of trading Thursday, snapping up shares suddenly on sale less than 24 hours after the Federal Reserve’s hawkish pivot sparked a historic rout.

But as Thursday’s session wears on and equity indexes trim or lose their initial gains altogether, the question is becoming whether this is just a dip — and if investors should be buying in at all.

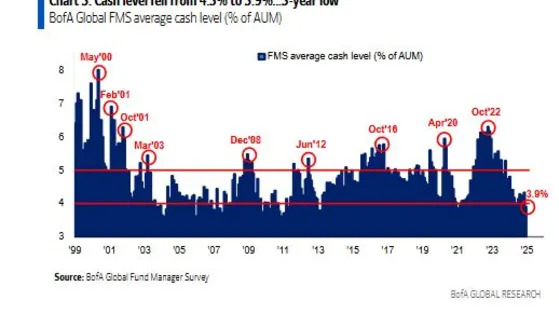

The stock market is in a perilous place following a two-year bull run that’s virtually unrivaled in recent history. Signs of euphoria are everywhere: Positioning is stretched and demand for loss protection is muted. Fund managers have reduced cash holdings to a record low and invested heavily in US stocks. And the S&P 500 was 10% above its 200-day moving average.

“I would be careful,” said Eric Beiley, executive managing director of wealth management at Steward Partners. “Volatility is elevated and another selloff may be in store.”

All of these things are considered signals that a downturn is likely. And Fed Chair Jerome Powell’s discussion of what he’s seeing along with the central bank’s intention to go slower than expected with its anticipated interest rate cuts may be the most troubling aspect for equities investors. “It’s not unlike driving on a foggy night,” was the way Powell described the outlook for rates at his press conference on Wednesday, as he urged caution in taking away restrictive policies.

“Be careful what you wish for,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors. “Most were expecting and supportive of a hawkish cut, and that’s exactly what we got.”

Traders now have a unique challenge betting on where stocks go from here. History is no longer a guide. The previous macro setup — a strong economy with the prospect of Fed easing — has been flipped. Add in the impact of Donald Trump’s plans for tariffs and mass deportations of undocumented workers, alongside tax cuts and a regulatory overhaul, and the economic outlook is even more muddled.

“After focusing primarily on the positives following the November election results, investors have received a reality check that policy uncertainty could make for a bumpy road over the short term,” Phillips said.

The turbulence that sent the Cboe Volatility Index, or VIX, to its highest since August arrives at a typically sanguine time for the stock market. Usually the second half of December benefits from money managers snatching up bargains as retail investors leave for the holidays.

The trend is different this year has been different. So far, the S&P 500 is down 2.4% in December and on pace for its worst quarter in over a year. The question for bulls who’ve done so well as the S&P 500 has put up more than 20% returns for two consecutive years is whether to pocket those profits until the new administration’s plans — and their impact on monetary policy — become clearer.

“I’ve been building short-term cash positions with money-market funds and Treasuries as a hedge in case the Fed won’t cut rates as much as previously expected — and that’s been a good move,” Steward Partners’ Beiley said.

Global fund managers, however, have been doing the opposite, shrinking their cash holdings and pouring money into US stocks. Along the way, they’ve triggered a key metric to a threshold that Bank of America Corp. says has historically been a sell signal for equities.

For investors, wondering what comes next, that warning is probably worth a second look.

“You’re entering the end of the year where a lot of people had gains,” said Carol Schleif, chief market strategist, BMO Private Wealth. “Taking some gains off the table probably wasn’t a bad thing either.”

--With assistance from Carmen Reinicke.