(Bloomberg) -- The worst Treasuries selloff since 2013 on a Federal Reserve meeting date is likely to prove short-lived, according to a survey of Bloomberg Terminal subscribers.

Benchmark 10-year Treasuries will yield 4.4% at the time of the central bank’s March gathering, from about 4.51% now, according to the median of 81 responses in a Markets Live Pulse survey. The poll was conducted Wednesday after policymakers lowered borrowing costs by a quarter-point, but trimmed the number of cuts they anticipate in 2025.

The bond market slumped after the Fed announcement, with 10-year yields jumping about 12 basis points. It was the biggest increase on a Fed meeting date since June 2013, when a signal that central-bank asset purchases would soon slow sparked a rout.

Fueling Wednesday’s fixed-income losses, Fed officials projected the equivalent of two quarter-point reductions in total in 2025, compared with four seen in their September quarterly update.

Survey-takers signaled the potential that the Fed may end up becoming more hawkish: 36% of respondents said the central bank is underestimating its long-run neutral rate, the rate that neither promotes nor inhibits economic activity. That’s even after officials raised their projection for the rate to 3%, from about 2.9% in September. A quarter said the Fed’s estimate of neutral is too high, and 39% said it was accurate.

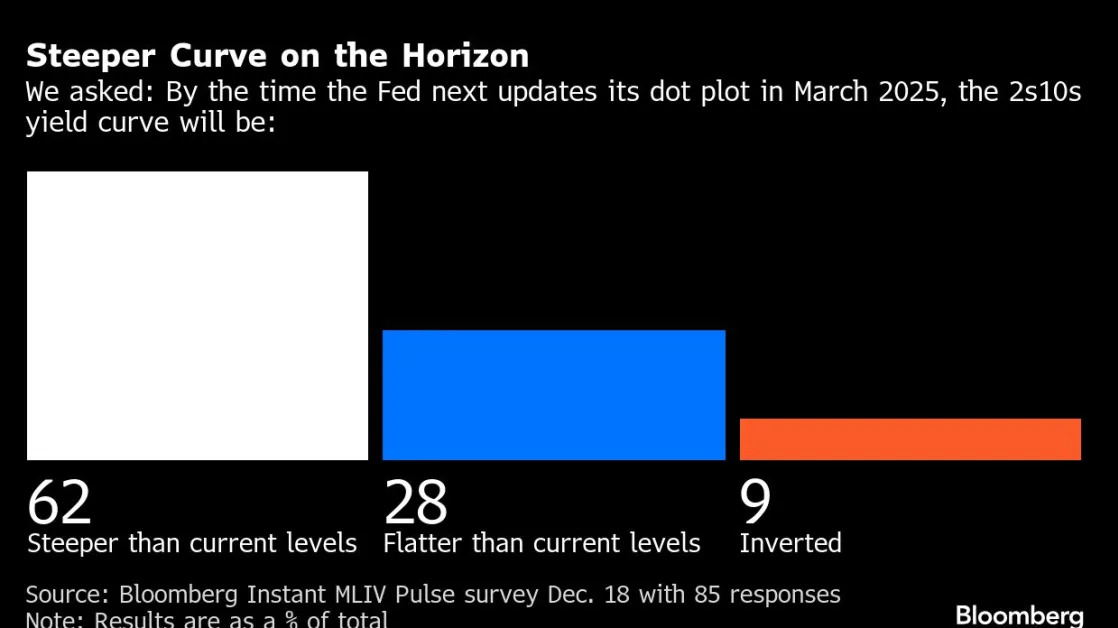

The Treasuries yield curve will likely be steeper in March, according to 62% of respondents to the survey.

The MLIV Pulse survey was conducted among Bloomberg terminal clients immediately after the Fed decision by Bloomberg’s Markets Live team, which also runs the MLIV blog. Sign up for future surveys here.

--With assistance from Tatiana Darie.