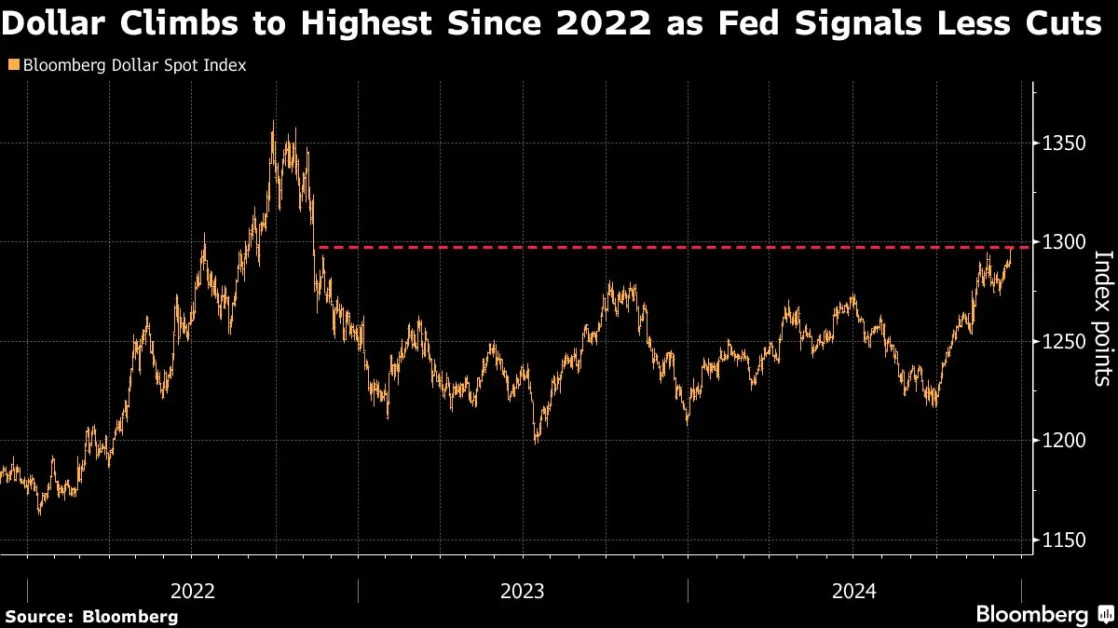

(Bloomberg) -- The dollar rallied to the strongest level in over two years after the Federal Reserve signaled a slow down in the pace of monetary easing next year.

The Bloomberg Dollar Spot Index rose 0.9% Wednesday, its highest since 2022. The surge sent other major currencies lower. The euro, pound and Swiss franc fell 1% against the US dollar during the day, while the offshore Chinese yuan fell to the lowest level since 2023.

The dollar gauge advanced more than 7% so far this year, gaining against all of its peers in the developed world and on path to have the best year since 2015.

As economic “data has come in strongly, Fed expectations have become more hawkish, supporting the dollar,” said Skylar Montgomery Koning, a foreign-exchange strategist at Barclays, following the Fed meeting.

The central bank lowered interest rates by a quarter point Wednesday and indicated two additional cuts in 2025. Fed Chair Jerome Powell said after the decision that policymakers can now “be more cautious” with deciding on future adjustments to rates.

Recent data has raised concerns that inflation may be stalling above the Fed’s 2% target. The median projection for inflation at the end of next year jumped to 2.5%, from 2.1% seen in September.

“It looks like the Fed is beginning to look forward on potential inflationary impact of new trade policies given the change in the median inflation forecast,” said Helen Given, a foreign-exchange trader at Monex. “This is a recipe for dollar strength through the January meeting, or at least not substantial weakness.”

President-elect Donald Trump’s vows to impose harsh tariffs on many US trading partners have aided the dollar rally in the lead-up to the election. The rally continued as the US economy outperformed many other nations. Meanwhile, many central banks around the globe will have to aggressively reduce borrowing costs to aid anemic economic growth.

“Every detail of the Fed was undeniably hawkish,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi US Inc. “All this means a sharply stronger dollar as it continues to amplify US growth exceptionalism.”

A gauge of emerging-market currencies slipped 0.4% to the lowest level since August on Wednesday. The Brazilian real weakened by about 3% versus the dollar on the day to trade at a record low as investors become increasingly concerned over the nation’s fiscal crisis.

“As those divergences in monetary policy paths unfold, along with some other factors, we believe the dollar will strengthen considerably over the course of 2025,” said Brendan McKenna, an emerging-markets economist and foreign-exchange strategist at Wells Fargo in New York, prior to the Fed-rate decision. Wells Fargo forecasts the greenback gaining some 5% to 6% on average against Group-of-10 peers next year.

Many Wall Street’s strategists are forecasting the world’s reserve currency will peak as early as mid next year before starting to decline later in 2025 as rate cuts in the rest of the world will start reviving economic growth outside of the US.

--With assistance from Carter Johnson and Maria Elena Vizcaino.

(Updates with market moves, adds comments from Fed and Amundi.)