Nvidia shares moved higher in early Wednesday trading, after an extended slump pushed the world's leading AI-chip maker into correction territory, and as a top Wall Street analyst issued a bullish market outlook.

Nvidia ( NVDA ) has underperformed its chipmaking peers and the broader tech market over the past five weeks, falling more than 12.4% since reaching their all-time high of $148.88 on Nov. 7.

Related: Nvidia's chip delays may be costing it customers in key sector

Some analysts have pointed to the gains for rivals, such as Broadcom ( AVGO ) and Marvell Technology ( MRVL ) , as evidence of increasing competition for Nvidia in the broader AI space as the pair take an increasing share of the market for custom-made ASIC chips.

ASIC chips help giant providers of cloud-networking infrastructure and services, like Alphabet ( GOOGL ) and Meta Platforms ( META ) , boost the speed and reliability with which they process information.

Broadcom shares have gained more than 45% over the past month alone and have passed $1 trillion in market value and the group posted stronger-than-expected fourth-quarter earnings last week.

Custom-chip challenge to Nvidia

Broadcom CEO Hock Tan in fact told investors on a conference call late Thursday that the group's potential market for both its networking and ASIC offerings could rise to $90 billion over the next two years.

Marvell stock is up 26.5% over the past month and more than 92% for the year and reported Street-beating earnings in early December including a record $1.1 billion in data center revenue and a robust near-term outlook.

Citigroup analyst Atif Malik, however, expects Nvidia to hold its commanding market share well into the coming years.

Related: Analysts overhaul Broadcom stock price targets after Q4 earnings

Malik, who reiterated his buy rating and $175 price target on Nvidia in a note published Wednesday, sees the market for AI accelerators rising to a staggering $380 billion by 2028, "with AI [graphics-processing units] representing 75% of share and ASIC representing 25%."

Strong results from recent custom ASIC chipmakers Marvell and Broadcom "are stirring up new investor questions on the old 'GPU vs custom ASIC' debate," Malik and his team wrote.

"As highlighted in our recent report, we expect both to coexist with the software reprogrammability to different workloads through CUDA being the biggest advantage for GPUs/Nvidia," they added.

CUDA, an acronym for compute unified device architecture, enables developers to use the powerful AI processors in more general-purpose computing.

Nvidia's supply chain improves

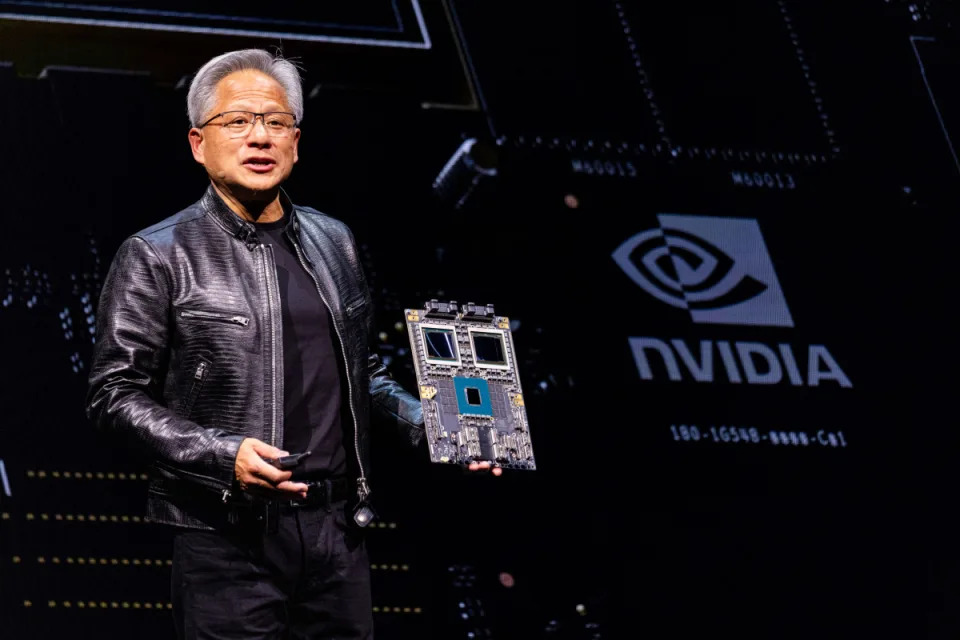

Malik also suggests that some of Nvidia's recent supply-chain issues — including capacity restraints at Taiwan Semiconductor linked to its high-end chip-on-wafer-on-substrate, or CoWoS, a crucial component of AI-chip making — will ease in the coming year.

"Our recent supply chain discussions indicate Nvidia’s CoWoS foundry-capacity allocation is expected to grow to 60% in 2025 from 56% in 2024, pointing to continued GPU momentum in 2025," Malik and his team said.

Related: Nvidia stock hits correction territory, but bulls see value in AI leader

Nvidia will likely continue to gather a commanding share of AI-related revenue over the coming year, compared with its custom-chip rivals, according to figures from a quarterly investor survey published by Cantor Fitzgerald.

The survey showed around a third of respondents see Broadcom's AI revenue rising to $17 billion over its current financial year, which ends in September. A similar percentage sees Marvell generating between $3 billion and $4 billion.

More AI Stocks:

Nvidia, which guides investors on revenue and profit forecasts for only the coming quarter, sees an end-January revenue tally of $37.5 billion, with analysts pegging its data-center total for fiscal 2025 at $113.36 billion.

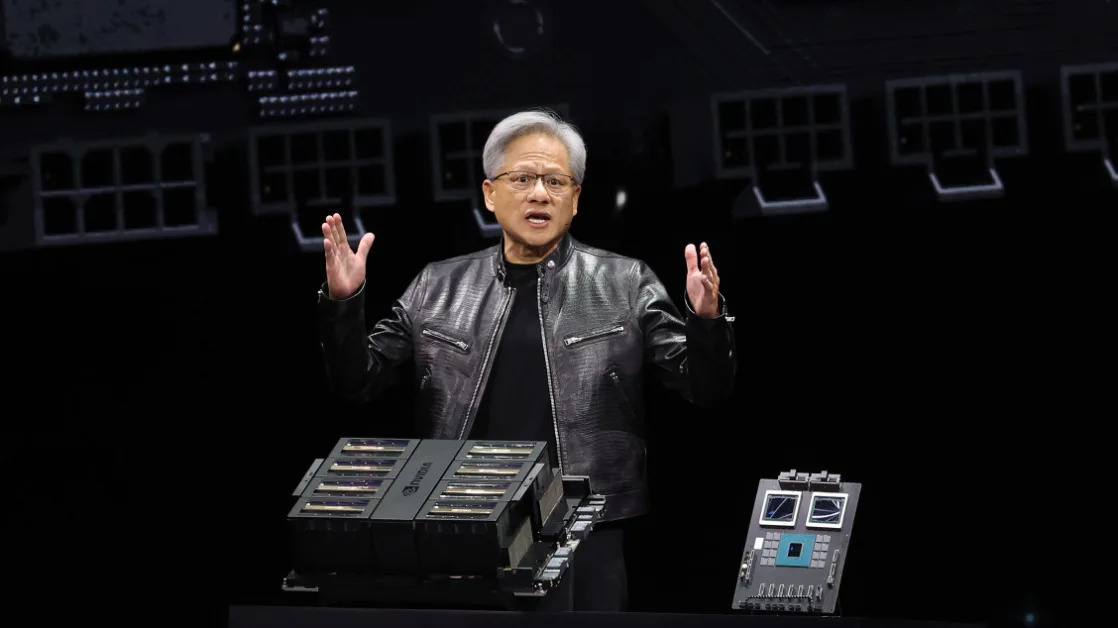

In terms of its Blackwell processors alone, Wall Street analysts expect several billion of revenue in Nvidia's fourth quarter, with totals of $62 billion in 2025 and $97 billion in 2026.

Nvidia shares were last marked 2.7% higher in premarket trading to indicate an opening bell price of $133.95 each.

Related: Veteran fund manager delivers alarming S&P 500 forecast