(Bloomberg) -- A whopping 1130% rally in the shares of a Brazilian waste management company is drawing the attention of the country’s stock exchange operator.

B3 SA, the company behind Brazil’s stock exchange, requested clarification on “atypical fluctuations” in the shares of Ambipar Participacoes e Empreendimentos SA that took place between Dec. 11 and 13, according to a note. On those days, the stock surged about 94%.

B3 decided put the stock under non-continuous trading on Monday and Tuesday to “ensure the continuity of prices” for the security, the stock exchange operator said. On Wednesday, the stock “will be negotiated normally and will eventually go up for auction if there is a price change,” B3 said. Shares declined 13% on the day.

The company in a statement Tuesday night said it’s unaware of any information that could justify the recent share price moves. Ambipar said it also questioned people with potential access to relevant information, adding that those “have no knowledge of any undisclosed relevant act or fact that could justify such fluctuations.”

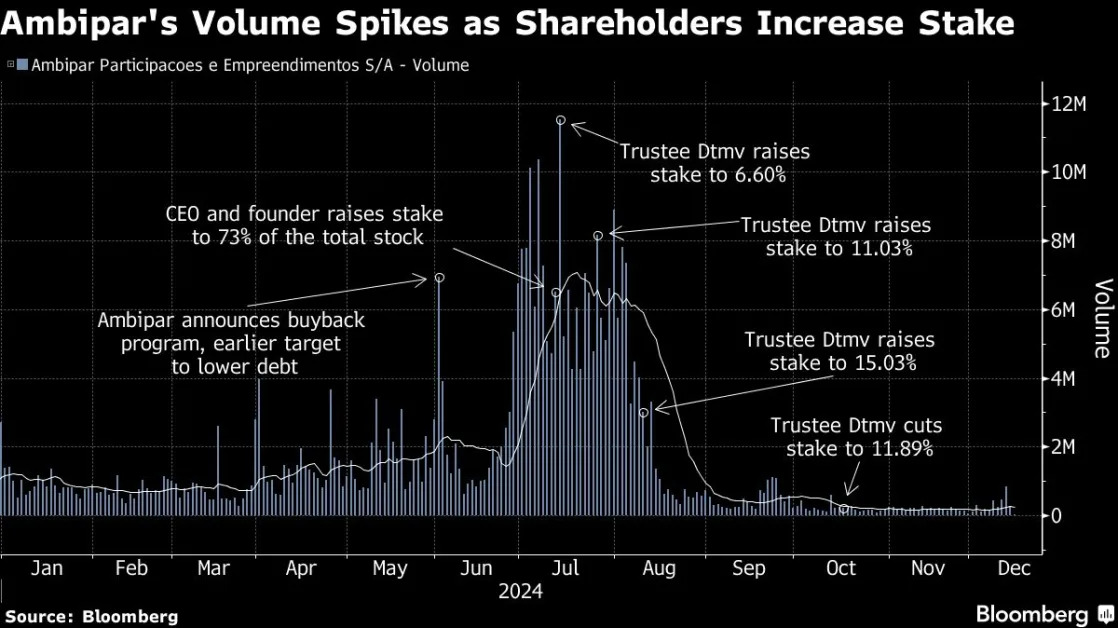

Ambipar has seen its share price soar over 1130% this year. Recent share purchases by founder Tercio Borlenghi Junior as well as Trustee DTVM added to buying pressure and fueled a short squeeze in the stock.

Amid limited trading — an average of 200,000 shares changed hands last week, compared with a peak of 6 million at the end of July — the stock continued to spike, soaring to an all-time high of 268.52 reais ($43.32).

Back in August, Bloomberg News reported that veteran investor Nelson Tanure was buying up Ambipar shares through Trustee DTVM. The company’s market capitalization surged to 44.85 billion reais on Dec. 13, up from 2.6 billion reais at the start of the year.

The stock’s wild surge made Borlenghi Junior even wealthier, with his 73.36% stake worth 24.5 billion reais. The executive founded the firm in 1995.

The rapid increase meant shares exceeded their price targets, forcing analysts to withdraw their ratings for the time being. Bradesco BBI’s Victor Mizusaki was the only one who updated estimates, holding a neutral rating and a price target of 135 reais. Mizusaki wrote in a Nov. 4 note that the stock was reflecting the “successful” implementation of the company’s turnaround plan announced in May.

That month, XP Inc. placed the stock under review, citing the company’s recent operational developments and the outperformance of the stock.

Ambipar, Borlenghi Junior and Bradesco BBI declined to comment.

--With assistance from Daniel Cancel, Cristiane Lucchesi, Raphael Almeida Dos Santos and Jeremy R. Cooke.