(Bloomberg) -- German business expectations sank in December, highlighting the challenges for Europe’s top economy with snap elections likely to bring a change of government.

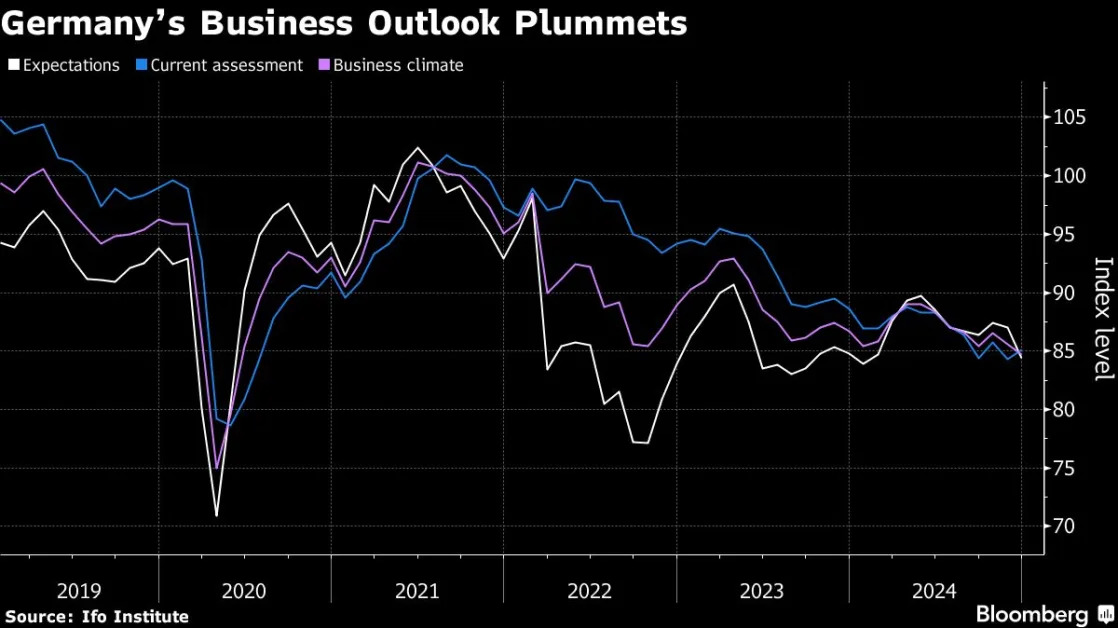

An expectations gauge by the Ifo institute slumped to 84.4 from 87, the Ifo institute said Tuesday. Analysts polled by Bloomberg had predicted a slight uptick and none saw a retreat of that scale. A measure of current conditions rose, bringing the overall index to 84.7 from 85.6 a month ago.

“This weakness in the German economy is becoming chronic,” Ifo President Clemens Fuest said in an interview on Bloomberg TV. “It’s been stagnating for a long time,” so “the next government needs to prioritize economic growth.”

By contrast, there was optimism among investors, with the ZEW institute’s index of expectations jumping to 15.7 from 7.4 — more than any analyst surveyed by Bloomberg anticipated.

“With snap elections ahead in Germany and the resulting expectations of an economic policy encouraging private investment as well as the prospect of further interest-rate cuts, the economic outlook is improving,” ZEW President Achim Wambach said.

That sentiment is certainly reflected in Germany’s benchmark DAX index, which this month broke through 20,000 for the first time.

Europe’s largest economy is poised to shrink for a second straight year in 2024, though the Bundesbank reckons there’ll be a gradual recovery in 2025. Risks to that forecast abound, however — from political turmoil at home and in France to the trade tariffs threatened by US President-elect Donald Trump.

Much of the country’s woes are structural, reducing the chance of a rapid turnaround. Car manufacturers have long struggled with Chinese competition, energy-intensive industries are reeling under high costs and smaller businesses that form the backbone of the economy are drowning in bureaucracy.

Hopes are high that February’s elections will bring some relief. The likely next chancellor, Friedrich Merz, is campaigning on a business-friendly, liberal platform that promises fewer regulations and lower taxes. He’s also flagged openness to increasing public investments, to lay the foundations for future expansion.

With tens of thousands of jobs at risk, change is urgent. Bundesbank President Joachim Nagel warned last week that the labor market, a pillar of strength until now, is “responding noticeably” to protracted economic weakness. Unemployment has climbed steadily for the past two years, reaching 6.1% in November.

There was a slight improvement in business activity in December, according to S&P’s Composite Purchasing Managers’ Index. While remaining at levels that suggest the private sector is continuing to contract, services exceeded analysts estimates.

But, highlighting how difficult longer-term improvements will be, Germany announced Tuesday that it will reduce federal debt sales by 13% next year as the government scales back despite the sputtering economy and pressure to support Ukraine.

--With assistance from Mark Schroers, Kristian Siedenburg and Joel Rinneby.

(Updates with debt sales in final paragraph.)