By Jacob Joseph and Jamie Sly (All times ET unless indicated otherwise)

As the year winds down, the crypto market seems to be catching an early dose of holiday fervor. Bitcoin touched an all-time high just below $108,000 yesterday and is now holding steady around $107,000.

Bitcoin maxis have been in Christmas spirits ever since the U.S. elections in early November, with President-elect Donald Trump's bullish overtures to the industry a sign of the growing institutional alignment with the digital asset market.

The president-elect seems to be teasing "more surprises," fueling speculation of more favorable crypto policies after he pledged to create a strategic BTC reserve. The pledge earlier this month helped fuel bitcoin’s rally.

The incoming administration’s pro-crypto rhetoric has supercharged sentiment, with some analysts drawing comparisons with MicroStrategy’s balance sheet playbook, but on a national scale. While the idea of the U.S. stockpiling bitcoin feels audacious, the markets seem to like the fearlessness.

While plans for a “national bitcoin reserve” remain speculative, Trump’s crypto-friendly stance is already influencing sentiment and markets. Exodus Movement (EXOD), a crypto wallet provider, just secured approval to list on NYSE American, the New York Stock Exchange’s sibling market. While a single listing isn’t seismic, it’s yet another data point suggesting U.S. markets are ready to welcome digital asset companies back into the fold.

The season of giving is seen elsewhere in crypto too, with the highly anticipated introduction of PENGU, the official token of the Pudgy Penguin ecosystem. Luca Netz, Pudgy Penguins' CEO, said the token’s release “opens the door for deeper engagement” while rewarding long-time believers in the ecosystem.

The PENGU airdrop follows the high-profile airdrops of Hyperliquid and Magic Eden in recent weeks, with the former’s price action serving as a note of caution for potential early sellers of the token.

Avalanche released its biggest network upgrade , Avalanche9000, introducing improvements that make it cheaper and easier to launch subnets. “This is the start of hundreds of Avalanche L1s launching,” the team wrote on X. “Avalanche9000 reduces the cost to deploy an L1 by 99.9%, and with hundreds of L1s being developed on testnet, look out for an explosion of launches in the coming months.” The blockchain's AVAX token is trading at $50.2, up 2.49% from last night’s close.

The latest leg up for BTC, however, faces a near-term headwind in the form of the Federal Reserve’s rate decision on Wednesday. Moreover, with this cycle marked by growing institutional participation, the markets might be in for further volatility as the holiday season approaches. TradFi participants often adopt a risk-off stance and close positions ahead of the break. Stay Alert!

What to Watch

Crypto:

Dec. 18, 9:30 a.m.: Software cryptocurrency wallet maker Exodus Movement (EXOD) starts trading on NYSE American, a sibling of NYSE.

Macro

Dec. 17, 8:30 a.m.: Statistics Canada releases November's Consumer Price Index (CPI) report .

Inflation Rate YoY Prev. 2%.

Core Inflation Rate Prev. 1.7%.

Dec. 18, 2:00 a.m.: The U.K.'s Office for National Statistics (ONS) releases November's Consumer Price Inflation bulletin .

Inflation Rate YoY Est. 2.6% vs Prev. 2.3%.

Core Inflation Rate YoY Est. 3.6% vs Prev. 3.3%.

Dec. 18, 5:00 a.m.: Eurostat releases November's euro-area inflation data . Inflation Rate YoY Final Est. 2.3% vs Prev. 2.0%.

Dec. 18, 2:00 p.m.: The Federal Open Market Committee (FOMC) releases its fed funds target rate, currently 4.50%-4.75%. The CME's FedWatch tool indicates that interest-rate traders assign a 97.1% probability of a 25 basis-point cut. Press conference starts at 2:30 p.m. Livestream link .

Dec. 18, 10:00 p.m.: The Bank of Japan (BoJ) announces its interest rate decision . Short-term interest rate Est. 0.25% vs. Prev. 0.25%.

Dec. 19, 7:00 a.m.: The Monetary Policy Committee (MPC) of the Bank of England (BoE) announces its interest-rate decision . Bank Rate Est. 4.75% vs Prev. 4.75%.

Dec. 19, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases third-quarter GDP (final) .

GDP Growth Rate QoQ Est. 2.8% vs Prev. 3.0%.

GDP Price Index QoQ Est. 1.9% vs Prev. 2.5%.

Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November's Personal Income and Outlays report .

Personal Consumption Expenditure (PCE) Price Index YoY Prev. 2.3%.

Core PCE Price Index YoY 2.8%.

Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report . Money Supply M2 Prev. $23.31T.

Token Events

Governance votes & calls

Own The Doge DAO holds a proposal discussion on which NEIRO token can officially use the dog's likeness.

Unlocks

Ethena to unlock 0.44% of its ENA circulating supply, worth $14.7 million at 2 a.m. on Dec. 18.

QuantixAI will unlock 5.6% of its QAI circulating supply, worth $22 million, at 5 p.m. on Dec.18.

Token Launches

Flare is launching a $260,000 retroactive airdrop, distributed bi-weekly to FAssets users on Songbird, Flare's canary network

Conferences:

Day 2 of 2: Blockchain Association’s Policy Summit (Washington D.C.)

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Token Talk

By Shaurya Malwa AI Agents aren't a joke category anymore. Eliza Labs, the creator of the sector leader AI16Z, is joining Stanford University's Future of Digital Currency Initiative to research how artificial intelligence agents can improve Web3. The partnership is set to leverage Eliza Labs' open-source AI agent framework, an anime character named Eliza, to research how AI agents can foster trust, coordinate activities and make choices in the world of decentralized finance. Starting in 2025, the focus will be on crafting new strategies for how these autonomous agents can build and confirm trust in digital-currency ecosystems — providing credence to the niche sector that may initially pass off as yet another meme play. Eliza is an open-source, decentralized AI agent framework developed by ai16z, a project parodying the venture capital firm Andreessen Horowitz (a16z). It allows users to build and deploy autonomous AI agents that can interact across multiple platforms, including Discord, X (formerly Twitter) and Telegram. These agents can handle voice, text and media interactions, providing a versatile communication tool for users.

Derivatives Positioning

The futures annualized rolling basis continues to float around 15%, making the basis trade an incredibly attractive investment. This can be seen with CME futures open interest growing by around 30,000 BTC from the November low.

Currently, $15.4 billion of notional value is set to expire in bitcoin on Dec. 27, with almost 60% of the total set to expire out of the money.

MicroStrategy's 30-day implied volatility has dropped 53% from a Nov. 22 high, indicating the market is expecting less dramatic price swings as we approach the end of the trading year.

Market Movements:

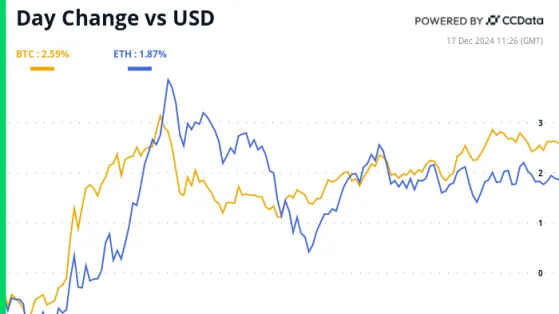

BTC is up 0.93% from 4 p.m. ET Tuesday to $107,069.48 (24hrs: +3.36%)

ETH is down 0.92%% at $4,011.12 (24hrs: +2.81%)

CoinDesk 20 is up 0.87% to 3,950.07 (24hrs: +2.93%)

Ether staking yield is up 12 bps to 3.16%

BTC funding rate is at 0.01% (10.95% annualized) on Binance

DXY is up 0.16% at 107.03

Gold is unchanged at $2,653.70/oz

Silver is unchanged at $30.86/oz

Nikkei 225 closed -0.24% at 39,364.68

Hang Seng closed -0.48% at 19,700.48

FTSE is down 0.75% at 8,199.90

Euro Stoxx 50 is up 0.33% at 4,963.45

DJIA closed -0.25% to 43,717.48

S&P 500 closed +0.38% at 6,074.08

Nasdaq closed +1.24% at 20,173.89

S&P/TSX Composite Index closed -0.5% at 25,147.20

S&P 40 Latin America closed -1.86% at 2,276.92

U.S. 10-year Treasury was unchanged at 4.42%

E-mini S&P 500 are down -0.27% at 6,064.00

E-mini Nasdaq-100 futures are up 1.31% to 22,400.50

E-mini Dow Jones Industrial Average Index futures are down 0.37% at 43,608.00

Bitcoin Stats:

BTC Dominance: 57.88 (24hrs: +0.32%)

Ethereum to bitcoin ratio: 0.037 (24hrs: -0.45%)

Hashrate (seven-day moving average): 784 EH/s

Hashprice (spot): $63.4

Total Fees: $1.3 million/ 12.3 BTC

CME Futures Open Interest: 208,000 BTC

BTC priced in gold: 40.3oz

BTC vs gold market cap: 11.47%

Bitcoin sitting in over-the-counter desk balances: 405,423 BTC

Basket Performance

Technical Analysis

Bitcoin has seen free-flowing price discovery since breaking March's all-time high on Nov. 6, with the price rising to a record above $107,000 from $73,757.

Both the 50-day and 200-day exponential moving averages (EMA) are pointing upwards, indicating bullish momentum during the price discovery phase. The notably large gap between the two EMAs underscores the recent short-term price action as one of significant strength.

Still, the RSI shows momentum gradually slowing since the March breakout, with the measure printing a bearish divergence on the daily chart. The current RSI reading of 70.85, may be considered overbought.

Crypto Equities

MicroStrategy (MSTR): closed on Monday unchanged at $408.50, up 1.65% at $415.25 in pre-market.

Coinbase Global (COIN): closed at $315.31 (+1.52%), up 0.67% at $317.42 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$29.56 (+2.07%)

MARA Holdings (MARA): closed at $24.56 (+8.05%), up 2.04% at $25.06 in pre-market.

Riot Platforms (RIOT): closed at $14.03 (+8.01%), up 2.49% at $14.38 in pre-market.

Core Scientific (CORZ): closed at $16.56 (+6.5%), up 1.87% at $16.87 in pre-market.

CleanSpark (CLSK): closed at $12.48 (+3.83%), up 1.2% at $12.63 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.60 (+8.19%), up 1.96% at $30.18 in pre-market.

Semler Scientific (SMLR): closed at $74.50 (+10.91%), up 3.36% at $77.00 in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net inflow: $636.9 million

Cumulative net inflows: $36.21 billion

Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

Daily net inflow: $51.1 million

Cumulative net inflows: $2.31 billion

Total ETH holdings ~ 3.520 million.

Overnight Flows

Chart of the Day

Since Sept. 19, long-term holders — defined by Glassnode as investors who have held bitcoin for longer than 155 days — have distributed over 880,000 bitcoin.

On average, about, 9,887 BTC have been sold each day since Sept. 19.

While You Were Sleeping

Bitcoin Traders No Longer Chasing Record Price Rally, Options Data Show (CoinDesk): Bitcoin topped $107,000 Monday, but options pricing signals traders’ caution despite this week’s expected 25 basis-point rate cut, showing reduced enthusiasm to chase the uptrend in the short term.

Trudeau Teeters in Canada After Deputy’s Scathing Resignation (Bloomberg): Canadian Finance Minister Chrystia Freeland resigned in protest of Prime Minister Justin Trudeau's fiscal policies, deepening a political crisis as the government struggles with growing internal dissent and tariff threats from U.S. President-elect Donald Trump.

SEC Approves Crypto Wallet Maker Exodus to List on NYSE American After Denying It in May (CoinDesk): Crypto wallet firm Exodus Movement will uplist from OTC Markets to NYSE American on Dec. 18, potentially signaling a regulatory shift following Trump’s pro-crypto election win.

Will the Fed Keep Cutting in 2025? (The Wall Street Journal): Federal Reserve officials remain divided on the pace of 2025 rate cuts, as firm inflation, a resilient labor market, a surging stock market and the incoming administration's proposed policies add to economic uncertainty.

Dollar Set to Extend Trump Rally, Says Wall Street (Financial Times): Wall Street is expecting the dollar to strengthen in 2025, fueled by pro-growth policies and trade tariffs, despite Donald Trump’s stated desire for a weaker currency to support U.S. exports.

IP-Backed Meme Token CAT Bags Binance Spot Listing, Spiking Bullish Sentiment (CoinDesk): Simon’s Cat (CAT) surged 50% on Monday after securing a Binance spot listing, with the support of its intellectual property giving it an edge as non-IP memecoins face increasing legal scrutiny.