Bitcoin (CRYPTO: BTC) , the world's largest cryptocurrency, has been one of the big headlines in 2024. Despite struggling earlier in the year, once falling below $40,000, the token didn't stay down for long, faring much better in the high-interest-rate environment than many expected.

As inflation declined and the prospect of lower interest rates began to materialize, Bitcoin joined tech and growth stocks and rallied, breaking away from the rest of the crypto sector.

Once president-elect Donald Trump won on election night, Bitcoin and the rest of the crypto sector soared. Since Nov. 5, Bitcoin is up almost 50% and has surged past $101,000. Should you buy Bitcoin below $115,000? Let's investigate.

Wider acceptance and regulatory clarity on the horizon

The crypto community cozied up to Trump during the presidential campaign, and that strategy is now paying off. Trump has vowed to make the U.S. the "crypto capital of the world."

He's already nominated several pro-crypto people to head key agencies that oversee matters in the sector. Gary Gensler, chair of the Securities and Exchange Commission (SEC) who has pursued several rules/policies that crypto proponents have disliked, plans to step down from the SEC once Trump takes office.

Key stakeholders like Coinbase 's chief policy officer Faryar Shirzad are optimistic about the incoming U.S. Congress and think crypto legislation can move through the House and Senate "fairly quickly." There are two bills already on crypto advocates' agenda, one seeking to construct an official set of rules for crypto, clarifying many of the gray areas that crypto companies have run into. Another bill Shirza thinks Congress can pass would set up a framework for issuing licenses to stablecoin companies. Stablecoins are digital assets pegged to fiat currencies like the U.S. dollar or commodities.

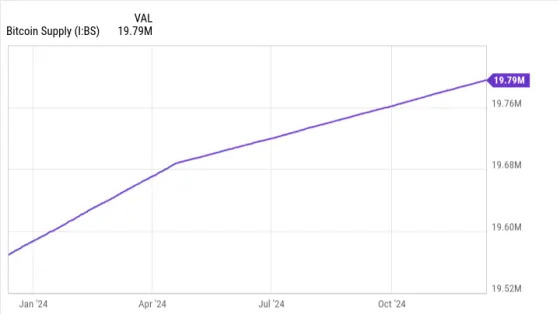

In addition to a favorable regulatory backdrop, Bitcoin has benefited from a growing consensus that the token can hedge inflation. Only 21 million Bitcoins can be mined, and the number of Bitcoins mined per block is cut in half about once every four years, making the world's largest cryptocurrency a scarce asset similar to gold. Most of these 21 million tokens have already been mined.

Bitcoin Supply data by YCharts

Recently, Federal Reserve Chair Jerome Powell likened Bitcoin to digital gold in arguably one of the token's strongest endorsements. BlackRock , the world's largest asset manager, recently issued a report suggesting that investors can allocate up to 2% of a multi-asset portfolio in Bitcoin. However, the report noted that investors should be aware of the broader risks of Bitcoin including volatility and the possibility it may not gain broader adoption as many suspect.

Should you buy Bitcoin under $115,000?

Bitcoin has a lot going for it right now, including a regulatory backdrop under the incoming Trump administration that will likely be the most favorable ever for crypto. Plus, more and more experts and financial institutions view the token as a hedge against inflation and uncertainty, although Bitcoin has also benefited from a risk-on environment. Whether this dynamic can continue remains to be seen.

I think Bitcoin is a good long-term asset to have some exposure to. Its history is relatively short, but the asset has stood the test of competition and survived, and even flourished in different interest rate environments. After such a big run, I recommend using dollar-cost averaging when buying Bitcoin, which involves investing a set amount of money over regular intervals. This will smooth out and generally lower your cost basis over time.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »