Christmas could come early for stocks, as long as the Federal Reserve stays on the market's nice list this week.

The yearly Santa Claus rally generally takes place from the last five trading days of the year and through the first two trading days of the new year. Yet, Bank of America said it sees the year-end rally kicking off this week if the Federal Reserve delivers what investors are expecting.

Given last month's tame inflation data , investors are nearly certain that the Fed will cut interest rates by a final quarter-point on Wednesday. CME FedWatch Tool data calculates a 99.1% chance of this happening.

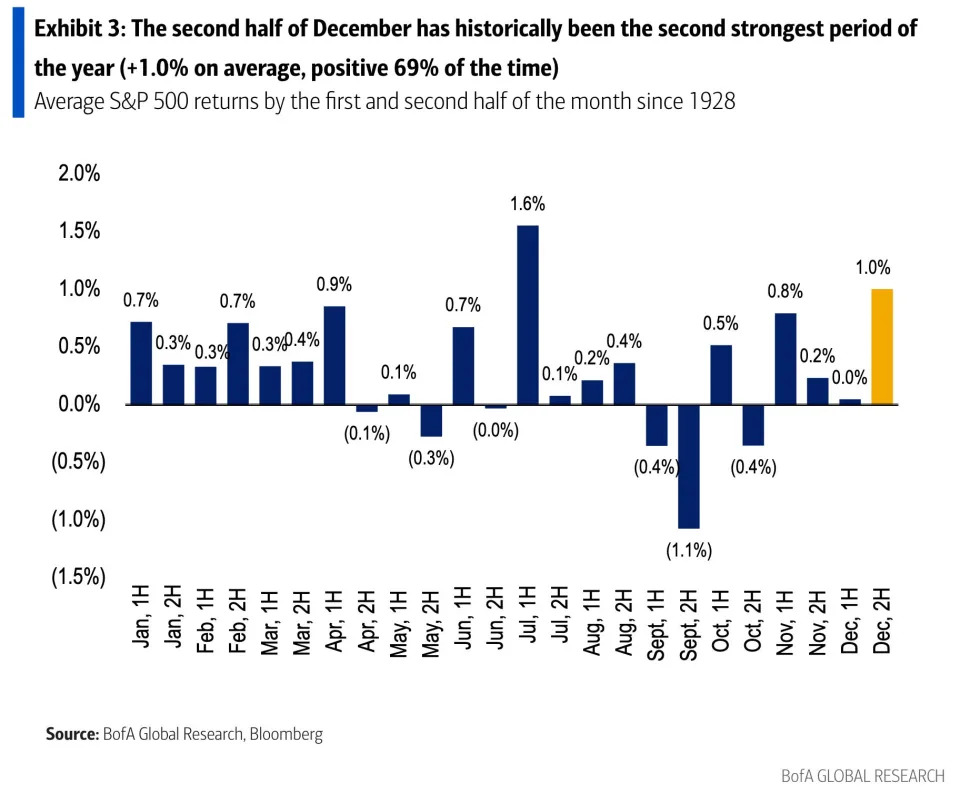

"The 2 nd half of December is typically the 2 nd strongest period of the year for US equities, and the S&P has been up 83% of the time in December of Presidential election years," analysts wrote on Monday. "This week's FOMC (not expected to bring fireworks based on the 76bp SPX implied move) may be the last hurdle before a Santa rally."

Despite the market's high degree of confidence in a rate cut, some economists are questioning why the Fed would do so. Analysts have said that a robust economy and rising inflation should incentivize policy hawkishness through 2025 .

December has been the second-best performing month since 1950, generating an average 1.6% gain for the benchmark index, according to LPL Financial strategist George Smith. The annual Santa Claus rally often marks the strongest seven-day period of the year.

If it occurs this year, that could help indexes deliver another all-time high before the year ends. Stocks and other risk assets like bitcoin have recently blown through a string of record highs, as postelection euphoria continues to grip the market.

Before the Fed's FOMC policy meeting concludes on December 18, investors will watch for November's retail sales on Tuesday.

"We expect the report to show consumption was robust. There are little signs of consumer slowing broadly. We remain bullish on the consumer outlook also given strong real income and wealth growth," BofA analysts said.

Read the original article on Business Insider