(Bloomberg) — Investors anticipating another calm year in 2025 should be on guard for more shocks like the one seen in August as uncertainty around Donald Trump’s tax and tariff policies threaten to roil markets.

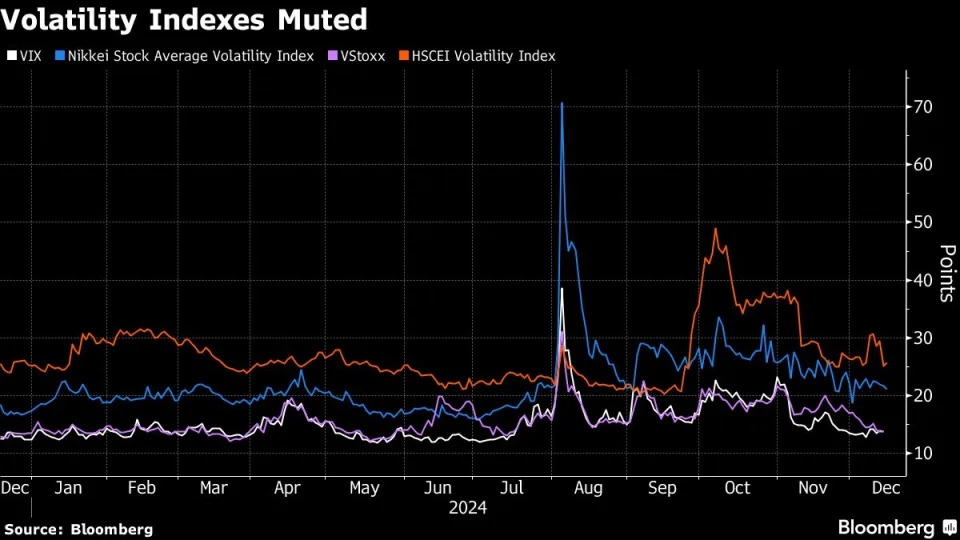

Strategists at Bank of America Corp. ( BAC ), JPMorgan Chase & Co. ( JPM ) and Spain’s Banco Bilbao Vizcaya Argentaria SA ( BOY.BE ) expect the continued flow of option selling to generally keep a lid on volatility, with JPMorgan seeing the Cboe Volatility Index averaging around 16, compared with around 15.5 across 2024. But BBVA points to a slew of factors — including rising uncertainty around US tariff policies, geopolitical tensions, overstretched concentration and valuation, signs of stress in funding markets and a weakening job market — that could spark more swings.

“Continued growth paired with the rising popularity of volatility selling strategies should be supportive of a structurally low volatility environment in both Europe and the US,” BBVA strategist Michalis Onisiforou wrote in a note to clients. However, “several factors point to elevated broader volatility levels and more frequent bouts of it in 2025.”

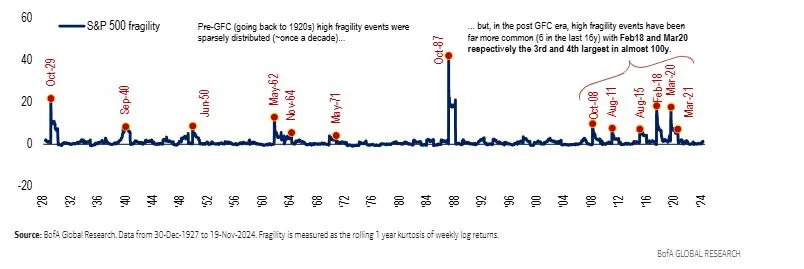

BofA sees the market as characterized by long periods of calm followed by “fat tails,” or large sudden extreme swings. It expects a fivefold increase in the frequency of fragility shocks in the S&P 500 Index compared with the prior 80 years and says another index-wide major shock event may be overdue.

Zero-day to expiry options, quantitative investment strategies hawked by banks and ETFs selling options to juice returns will add supply to the market, keeping dealers long gamma. That tends to dampen moves, as the dealers will need to buy more futures or shares when the market drops and sell into rallies in order to keep balanced positions. On Monday morning, the VIX traded around 14.26 at 8 a.m. in New York.

JPMorgan also noted that although technical factors are suppressing swings, macro indicators suggest volatility should be higher, with data pointing to a fair VIX level of around 19 on average. While there should be a continued flow of volatility selling from investors in the US and Europe, in Asia demand for volatility will be higher, especially in China and Hong Kong amid economic pressure countered by stimulus measures and the uncertainty around US tariffs.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

“The current low volatility regime is likely to be temporary: investors have already priced in all the good news of the upcoming Trump policies but have shrugged off their possible negative side effects,” said Pierre de Saab, partner and head of investments at Dominice & Co. Asset Management. “I expect in 2025 a weaker upside for markets and a greater risk of severe disruption, caused by Trump’s unorthodox methods, than in 2024 or 2017.”

UBS Group AG strategists noted that the policy offset between tariffs and tax cuts could spur more gyrations. “We could go straight into a relatively elevated equity volatility environment in the first half of next year,” said the bank’s head of US equity-derivatives research, Max Grinacoff.

A potential tariff escalation would bring a more dovish Federal Reserve and more certainty around its policy, therefore lowering bond volatility, according to UBS. The firm suggested buying June S&P 500 ( ^GSPC ) straddles, financed by selling straddles on the iShares 20+ year Treasury Bond exchange-traded fund.

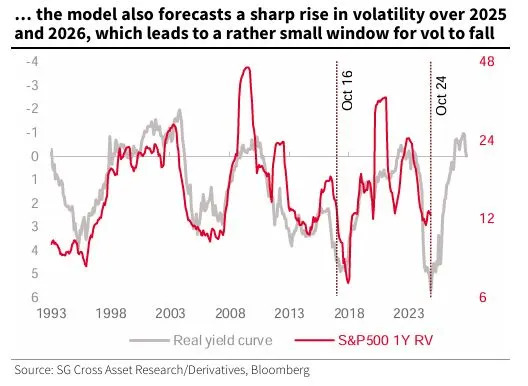

Societe Generale SA ( SGE.SG ) strategists similarly see the window for volatility to go lower getting smaller. “Our models forecast rising volatility through 2025 and 2026,” said Jitesh Kumar, a derivatives strategist at the firm. “We would recommend buying the dips in volatility.”

One way to hedge the risk of a significant selloff with low carry cost would be to buy VIX calls and sell S&P 500 puts, according to BofA and JPMorgan. The volatility index tends to respond quickly to market upsets, with a long position acting as a buffer while a trader can also profit from a grind higher in stocks by collecting premium from the S&P 500 puts.

Both JPMorgan and BofA are pushing custom basket dispersion trades. BofA noted record-high stock fragility — or outsized sudden moves relative to historical swings — as the driver of performance. “The magnitude of fragility shocks in the largest S&P stocks reached 30+ year extremes in 2024 with few signs of dissipating if the AI boom continues,” BofA strategists including Benjamin Bowler wrote.

Cross-asset trades are still popular heading into 2025 after interest surged in 2024. JPMorgan highlights a Euro Stoxx 50 Index down, US 10-year rates up dual binary option “to play a scenario where markets start to price in a more radical execution of campaign promises by the incoming Trump administration around the deportation of illegal immigrants, tariffs and near-shoring.”

“We are cautious about the potential impact of higher rates and new tariffs”, said Antoine Bracq, head of advisory at Lighthouse Canton, a Singapore-based investment firm that oversaw $3.7 billion of assets as of June, with wealth management and family office services. “While risky assets can remain buoyant for longer than expected, we see an opportunity now to capitalize on cheap volatility levels to protect your equities.”

(Updates with VIX level in the fifth paragraph and additional details on Lighthouse Canton in fourteenth paragraph.)