Over the past decade, cryptocurrency has emerged as a new asset class in the investing community. According to research by The Motley Fool , an estimated 75% of people who own crypto view it as an investment. However, the industry isn't perfect, and meme coins and other scams can cost investors their hard-earned money.

That's why Bitcoin (CRYPTO: BTC) , the world's first cryptocurrency, is arguably the best cryptocurrency to invest in today.

However, unlike stocks, which represent equity in companies, Bitcoin's price depends solely on what the next person is willing to buy or sell it at. Therefore, getting the most out of your Bitcoin investment might take a specific approach. Here is the ultimate guide to building wealth with Bitcoin.

Understanding Bitcoin's success

You probably already know that Bitcoin's price has increased exponentially over the past decade. It once took thousands of bitcoins to pay for two pizzas. But recently, Bitcoin's price surpassed $100,000 for the first time. How did it get to this point? More importantly, why could it continue?

Understanding what you own, whether stocks or Bitcoin, is the first step to maximizing your investment returns.

Bitcoin is an anti-inflationary digital asset, similar to gold, but in digital form. While you generally can't buy groceries with gold coins, society covets gold and assigns value to it. Bitcoin is similar, though its digital nature has helped it gain some traction in commerce. Bitcoin's supply grows at a controlled pace and has a total cap of 21 million bitcoins.

In other words, there's only so much Bitcoin . That's important because Bitcoin's price is in U.S. dollars, a fiat currency. The U.S. Federal Reserve has continually created more dollars, increasing the economy's money supply. Prices rise (inflation) if the money supply increases faster than the amount of available goods and services.

As society adopts and covets Bitcoin more, the increased demand against its limited supply drives the price up. Inflation caused by an increasing money supply only adds to that effect. Bitcoin's market cap is approximately $2 trillion today, still just a fraction of gold's (estimated at over $18 trillion). Bitcoin's price could continue rising, if society continues coveting Bitcoin and inflation continues.

With Bitcoin's fundamentals laid out, it's time to focus on some practical tips for investing in Bitcoin

1. Buy Bitcoin slowly and steadily

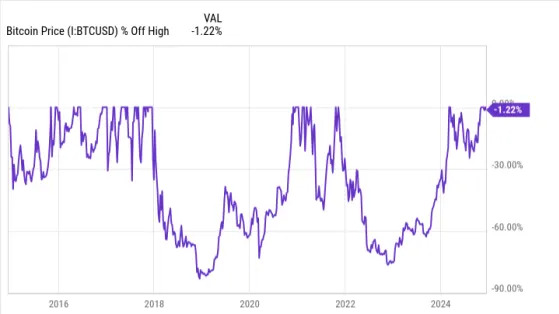

Since Bitcoin's price depends on buyers and sellers, it can be highly volatile, especially when investors are overly greedy or fearful. That means Bitcoin is prone to boom-and-bust price cycles. Below, you can see that dramatic price declines are par for the course:

It can be emotionally challenging to stomach large price swings like this. Consider using a dollar-cost averaging strategy to buy Bitcoin slowly, little by little, so that you gradually accumulate Bitcoin at a price that averages out over time. You probably won't buy at an absolute low point, but it will prevent lousy timing from putting you underwater on your investment.

2. Avoid leverage

Continually rising prices can lull investors into a false sense of invincibility. They can tempt people to borrow money to buy assets or invest in leveraged exchange-traded funds (ETFs). Please remember that leverage is a double-edged sword that feels great when prices rise, but it increases your losses when prices go against you.

Leverage is one of the most common ways individual investors destroy their portfolios, and it's an exceedingly terrible idea when used in conjunction with a volatile asset like Bitcoin.

3. Keep it simple

When investing in Bitcoin, people have some choices. They can buy actual Bitcoin, or invest in a spot Bitcoin ETF like the Grayscale Bitcoin Trust .

There are pros and cons to each.

Investing directly in Bitcoin requires a blockchain wallet or an account with a crypto exchange like Coinbase . However, you can buy or sell shares of a spot Bitcoin ETF in a standard brokerage account, just as you would stocks. The ETFs are more convenient, but charge fees that can affect your investment returns. Of course, you could lose your blockchain wallet if it's stored offline, and you might not technically own the cryptocurrencies you hold on an exchange. So, the way you go depends on your personal preferences.

4. Diversify

Bitcoin's fantastic past returns don't guarantee anything about the future. Investors should treat Bitcoin like any other asset and avoid putting all their eggs in one basket. Remember to diversify your investment portfolio. Besides, if Bitcoin eventually goes as high as some people hope , you won't need much to generate massive returns.

Before you buy stock in Bitcoin, consider this: