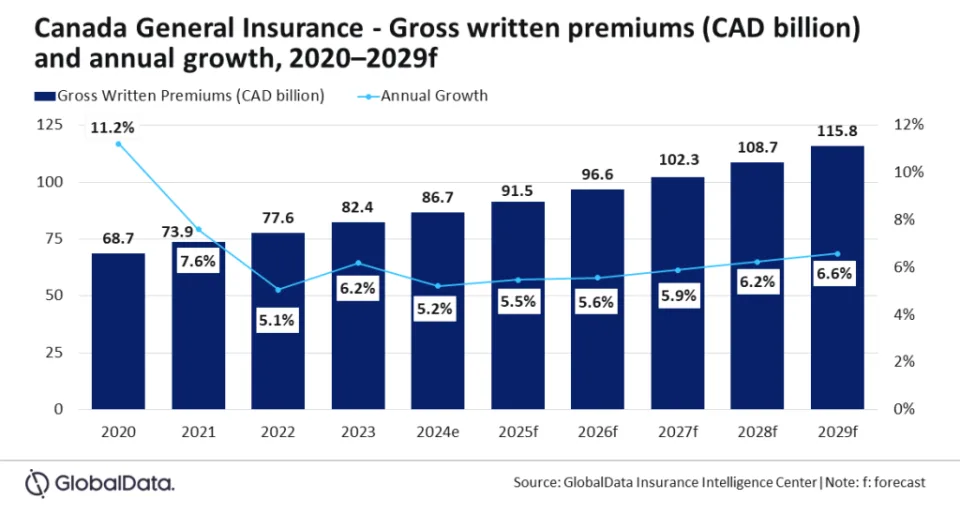

The general insurance sector in Canada is forecast to grow at a CAGR of 6% from CAD86.75bn ($65.12bn) in 2024 to CAD115.82bn ($90.07bn) in 2029, in terms of gross written premiums.

This is according to GlobalData which also predicted that general insurance in Canada will grow by 5.2% in 2024.

In addition, this rise will be driven by an increase in demand for property and motor insurance that are expected to account for nearly three quarters of general insurance premiums in 2024.

Sutirtha Dutta, Insurance Analyst at GlobalData, comments: “The growth in the Canadian general insurance industry is expected to contract slightly in 2024 due to a slowdown in the economy. However, an uptick in the demand for policies covering natural catastrophic (nat-cat) events and growing awareness of high financial implications from cybercrimes will support general insurance growth. The industry growth is expected to rebound from 2025 onwards, supported by a revival in economic growth.”

Property insurance is the leading line of business in the Canadian general insurance industry and is expected to account for a 40.4% share of the general insurance GWP in 2024. It is expected to grow by 5.2% in 2024, driven by home multi-risk and industrial multi-risk policies that account for more than 95% of the GWP share.

Climate change continues to exacerbate nat-cat risks in Canada, which has led to more frequent and severe weather events such as wildfires, flash floods, and storms. According to the Insurance Bureau of Canada (IBC), insured damages from flash floods reached CAD1,192m ($883m) in 2023, while those from wildfires reached CAD696.5m ($940m).

Dutta adds: “The increasing frequency of such events is expected to drive up the premium prices of these policies, contributing to the growth of property insurance, which is expected to grow at a CAGR of 6.9% during 2025-2029.”

"Canada general insurance market to beat $90bn by 2029" was originally created and published by Life Insurance International , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.