(Bloomberg) -- Buyout groups have been sitting on holdings built up as markets slumped after the pandemic. Now they’re helping fuel a bounce in Europe’s capital markets as they look to offload the backlog.

Initial public offerings and selldowns led by private equity funds and similar investors have raised more than $25 billion of gross proceeds so far this year, a roughly 80% jump from the whole of 2023, according to Bloomberg calculations. The number represents about a fifth of all equity capital markets issuance in Europe in 2024.

“For the right asset, sponsor-backed IPOs have worked pretty well,” said Alex Watkins, co-head of international ECM at JPMorgan Chase & Co. “And there are a growing number of companies where the only exit available is an IPO, either because there isn’t a clear strategic buyer or they’re getting too large for another round of sponsor ownership.”

The trend marks the start of a reversal from recent years, when the firms preferred to hold on to the businesses they had backed rather than sell at a bad price. But the spate of deals in 2024 shows they’re taking advantage of falling interest rates and equity markets at all-time highs to offload assets. Advisers say this is just the beginning because buyout groups are still sitting on trillions of unrealized investments.

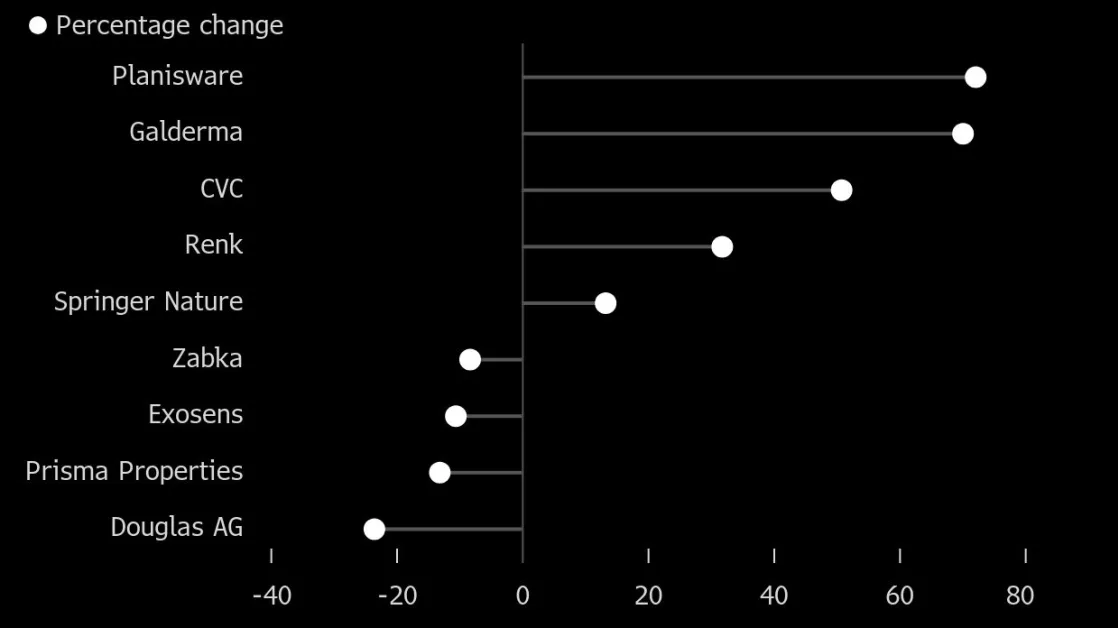

While some have performed poorly, on average the group of IPOs have risen more than 20% in the aftermarket, with French software firm Planisware SA, Swiss skincare giant Galderma Group AG and CVC Capital Partners Plc leading gains, according to data compiled by Bloomberg.

The data counts IPOs of companies backed by buyout groups, including the funds raised by companies. Once companies are public, the data accounts for additional offerings by private equity funds and venture capital firms, as well as sovereign wealth groups and pension funds that are active in private equity deals. Offerings in which the selling holders aren’t known were omitted.

Among the biggest selldowns this year were two block trades by a consortium of investors including Blackstone Inc. and Thomson Reuters out of London Stock Exchange Group Plc with a combined value of $3.8 billion. They were followed by two large selldowns by EQT AB and others out of Galderma worth $2.7 billion in total.

Andreas Bernstorff, head of ECM at BNP Paribas SA, estimates that there is more than $50 billion worth of European stock left in funds’ books that may be available for sale. As pressure builds to return cash to their funders, buyout groups may decide to part with some of their older holdings if they see little upside left in the shares.

“Sponsors are not comfortable owning listed equity, and I think we will see them sell more stakes from earlier IPOs, as long as share prices get to a level where they want to monetize,” Bernstorff said.

German generic drugmaker Stada Arzneimittel AG, Spanish travel technology firm HBX Group and casino operator Cirsa Enterprises are all planning to go public in 2025, Bloomberg has reported. Meanwhile, Apax Partners and Warburg Pincus have been sounding out bankers to arrange a potential listing in Amsterdam of Dutch telecoms group Odido.

“Private equity will potentially exit some of the biggest assets Europe has seen for some time through IPOs,” guaranteeing a flow of selldowns, said Manuel Esteve, head of ECM at UBS Group AG for Europe, the Middle East and Africa.