2024 is on track to be one of the best years in modern history for the stock market, and two of the most popular investments are a big reason why.

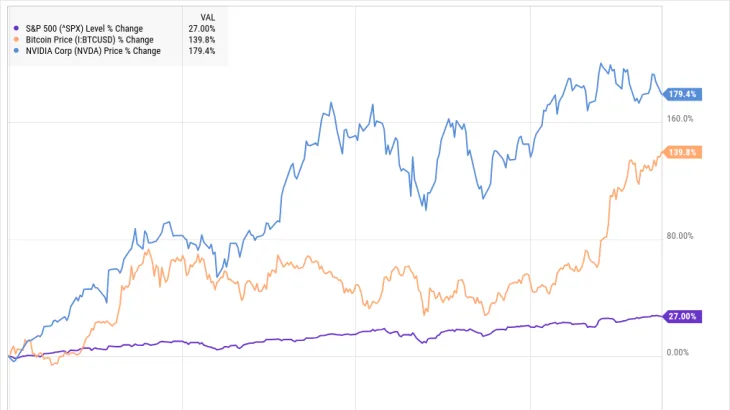

Bitcoin (CRYPTO: BTC) and Nvidia (NASDAQ: NVDA) have soared this year, outperforming nearly every comparable large-cap investment. The chart below shows how each one has performed compared to the S&P 500 (SNPINDEX: ^GSPC) so far in this year's bull market .

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

As you can see, Nvidia is ahead of Bitcoin, though both investments have more than doubled this year. Bitcoin and Nvidia might not be thought of as comparable investments, but in many ways, they are competing for investor dollars.

Both tickers have delivered phenomenal returns over the last decade. Bitcoin rose 29,000% during that time, while Nvidia gained 26,610%, and both investments are among the most talked about on social media platforms. As futuristic growth investments that capture the imagination in similar ways, they naturally compete as investments. But which is the better buy for 2025? Let's take a look at how next year is shaping up for each investment.

Is Bitcoin a buy for 2025?

Bitcoin had two separate waves of growth in 2024. The first came early in the year after the first Bitcoin spot ETFs were approved, and then a second wave came in response to the election as president-elect Trump embraced crypto in an effort to win over young voters. He's also named a crypto-friendly SEC head, Paul Atkins. Venture capitalist David Sacks was tapped as the White House Crypto Czar, the first time such a position has ever been created.

Investors seem to be betting that friendlier regulation will help continue to drive Bitcoin prices higher as the cryptocurrency earns more credibility among the establishment. Additionally, Fed chair Jerome Powell recently said that Bitcoin is "like gold. It's just virtual and digital."

Other ideas that could help boost the value of the cryptocurrency include starting a strategic Bitcoin reserve, and the Trump administration could potentially end capital gains tax on Bitcoin and other cryptocurrencies.

Developments on the regulatory front, including those and others, are likely to influence the value of the crypto next year, and Bitcoin should continue to behave as a high-beta risk asset. If the S&P 500 continues to climb, Bitcoin should continue to gain, but if there's a sharp pullback, Bitcoiners are likely to cash in on their profits, selling the cryptocurrency.

The digital gold may become an effective inflation and volatility hedge someday, but most investors currently lump it together with high-risk assets that tend to amplify the ups and downs of the broader market. Expect volatility from Bitcoin, though the improving regulatory climate and bullish momentum in the stock market bodes well for the cryptocurrency.

Will Nvidia keep soaring in 2025?

Like Bitcoin, Nvidia has soared over the last decade, but for different reasons. The business has gone from a relatively little-known maker of graphics processing units (GPUs) to the company leading the AI charge as it dominates the market for data-center GPUs and the components that make AI applications like ChatGPT work. Nvidia became the most valuable company in the world at one point earlier in the year, though Apple has since reclaimed that title.

Nvidia's prospects are easier to assess than Bitcoin's because it is a real business with profits and a valuation. Currently, the company trades at a price-to-earnings ratio of 55, but Nvidia is still delivering extraordinarily rapid growth for a company of its size as revenue jumped 94% in the third quarter. Additionally, CEO Jensen Huang recently said that demand for the new Blackwell platform is "insane" and is still greatly outpacing supply.

While some analysts have expected competition to eat into Nvidia's dominance, that has yet to happen despite product launches from peers like AMD and Intel , and the company's product ecosystem, which includes the CUDA software library, gives it a significant competitive advantage.

Meanwhile, Nvidia is already at work on an even more advanced platform, Rubin, which it said was six months ahead of schedule.

At this point, the biggest threat to Nvidia doesn't seem to be competition, but the risk of an AI bubble as some are skeptical that the race to build out AI infrastructure will maintain its feverish pace. Over the long run, it's likely to fade, but given the continuing gap between demand and supply, 2025 is likely to be another strong year for Nvidia.

Bitcoin or Nvidia: Which should you buy?

Given the current momentum in the market, sentiment about both of these investments and a favorable backdrop for the two, Bitcoin and Nvidia both look like good bets to be winners next year.

Of the two options, I would rather own Nvidia. As a business rather than a cryptocurrency, its valuation is underpinned by real earnings, and the business's growth justifies the stock's outperformance.

Bitcoin, on the other hand, seems more susceptible to a sharp pullback if the market falters as the price of Bitcoin is almost entirely driven by sentiment, rather than fundamentals.

Given the Trump administration's friendliness to Bitcoin, 2025 looks promising for the leading cryptocurrency, but between the two choices, Nvidia has a stronger foundation and a clearer path to continuing success.

Before you buy stock in Nvidia, consider this: