With the 2024 election behind us, conventional wisdom suggests a second Trump administration may aim to replicate the economic playbook of the first. This approach is expected to feature a blend of pro-business deregulation and elements of protectionism.

Pick the best stocks and maximize your portfolio:

Citigroup head of US equity strategy Scott Chronert is keeping a close eye on the evolving economic landscape and leans toward an optimistic outlook – while acknowledging the inherent risks.

“We maintain a positive view on US equities headed into 2025,” Chronert said. “A base case 6500 S&P 500 target allows for mid-single digit gains on the heels of back-to-back 20%+ years. Ongoing soft landing and Artificial Intelligence tailwinds now interact with Trump policy promises and risks. Continued broadening beyond Mega Cap Growth impacts is critical but an extended valuation starting point will be an ongoing hurdle.”

The stock analysts at Citi are following this line and are noting two stocks poised to climb along with the S&P 500. We’ve opened up the TipRanks database to find out the broader view on both of them. Let’s take a closer look.

Chewy, Inc. ( CHWY )

We’ll start in the online retail sector, with Chewy, a leader in the online pet supply business. Chewy was founded in 2011 and today boasts a market cap of $13.3 billion. The company has built itself into a leader in a niche market, but one that is substantial: approximately two-thirds of US households have pets, according to Forbes , and in 2022, those households spent $136.8 billion on their animals.

That spending is spread across a wide range of products and services, which together make up Chewy’s product offering. The company deals in the usual items, such as pet foods and toys, along with a variety of treats, but also offers customers prescription veterinary medications and pet insurance policies. The company has products available for pets of all types, from the usual cats and dogs to fish, birds, small mammals, and reptiles – and even has products for farm livestock and other non-pet animals.

In addition to its online presence, Chewy is also branching out into the ‘real’ world. The company has opened a network of brick-and-mortar veterinary clinics, with two locations in South Florida, three around Atlanta, Georgia, and two more in Denver, Colorado. These clinics focus on wellness, urgent, and surgical care for cats and dogs, the most popular pets. The company started the clinic chain in December 2023 and has plans to continue expanding it.

The company’s most recent quarterly report, from 3Q24, showed some mixed results. Revenues were strong – up almost 5% year-over-year to $2.88 billion, beating the forecast by $20 million. Earnings, however, missed the estimates; the non-GAAP EPS figure of 20 cents per share was 3 cents less than had been anticipated – although it was up 5 cents per share from the prior-year period. The company did report a modest – half-percent – drop in active customers as of the end of the quarter, but that was balanced by a 4.2% increase in net sales per active customer.

Citi analyst Steven Zaccone covers this stock, and he sees reasons for optimism. In Zaccone’s view, Chewy’s growing market share and its ability to control its own fate are key points, as he writes: “CHWY is reaching a positive inflection in active customer count growth in the 2H24 after 2 years of declines, CHWY is gaining market share relative to the pet retail backdrop which should build as industry growth improves in 2025, and CHWY controls its own EBITDA destiny with idiosyncratic drivers like sponsored ads, increasing volume through automated fulfillment centers, and higher health & wellness sales.”

Looking ahead, the analyst sums up an upbeat outlook: “Stock specific, we believe the risk/reward is favorable based on upside to Street EBITDA estimates for the next 1-2 years and the potential for EV/EBITDA multiple expansion as CHWY’s profit margin rate increases.”

The Citi analyst uses these comments to support his Buy rating , and his $40 price target implies a potential one-year gain of 23%. (To watch Zaccone’s track record, click here )

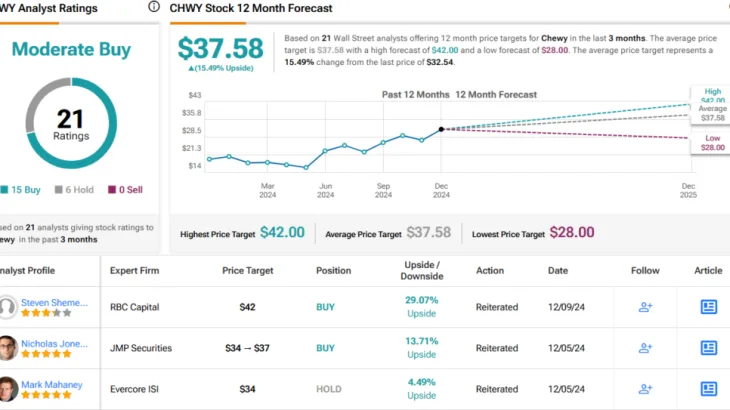

Overall, Chewy’s stock gets a Moderate Buy consensus rating from the Street, based on 21 recent reviews that split 15 to 6 in favor of Buy over Hold. The shares are priced at $32.54, and their $37.58 average price target suggests an upside potential of 15.5% in the next 12 months. (See CHWY stock forecast )

AT&T ( T )

The second stock we’ll look at is one of the stock market’s legends. AT&T is a legacy telecom company in the US market, but more than that, it is also one of the world’s iconic brand names. The company is consistently numbered among the largest wireless providers in the US market, and its market cap, of $168.5 billion, ranks it as the third-largest of the US telecom firms. AT&T’s stock has been outperforming the markets this year, with a 48.5% gain for 2024, and the company is well-known as one of the most consistent dividend stocks on Wall Street.

The company’s recent successes have been built on its ability to increase subscriber numbers, particularly in its 5G and fiber network services. In its 3Q24 report, AT&T made specific note of its growing momentum in 5G and highlighted 226,000 net fiber adds for the quarter. In addition, the company had a net add of 403,000 postpaid phone customers, and its postpaid phone churn, of just 0.78%, was described as ‘industry-leading.’ The company had 28.3 million consumer and business locations passed with fiber and generated $2.8 billion in consumer broadband revenues, for a 6.4% year-over-year gain.

At the top-line, revenues in the quarter reached $30.2 billion, relatively flat year-over-year (a half-percent drop) and $250 million below the forecast. Earnings, with a non-GAAP EPS of 60 cents, came in 3 cents per share better than had been expected. The company’s free cash flow, of $5.1 billion, was considered sound.

On the dividend, AT&T last sent out the common share payment on November 1. That dividend, set at 27.75 cents per share, gives an annualized payment of $1.11 per share and yields 4.72%. AT&T’s dividend history stretches back to the 1980s, and while the company will adjust the payment as needed, it has paid those dividends out reliably through that time – never missing a quarter.

All of this is to say that AT&T is practically the poster child for a venerable blue-chip stock. The company’s overall position impressed 5-star analyst Michael Rollins, who in his coverage for Citi wrote of T, “We view the combination of annual service revenue growth and faster EBITDA/FCF (ex-DTV) growth as a potential catalyst for a better valuation. We view the multi-year fiber update to pass more homes with potentially deeper penetration (partly from convergence) as accretive to our prior outlook and consensus. AT&T remains upbeat on sustaining Mobility growth with 2025 prospects indicated to be at the higher end of its annual financial ranges. Cost cutting, including copper decommissioning, should contribute to margin expansion. Buybacks are also larger than we and consensus expected and with a potentially stronger start in 2H25. We remain a Buyer of T as our top-ranked pick.”

Along with his Buy rating here, Rollins gave AT&T’s stock a $28 price target, indicating his confidence in a one-year upside potential of 19%. (To watch Rollins’ track record, click here )

This stock has earned a Moderate Buy consensus rating with the 13 recent reviews of T including 9 to Buy and 4 to Hold. T is currently selling for $23.48 and its $24.15 average target price implies a modest one-year upside of 3%. (See AT&T’s stock forecast )

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy , a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment .