In 2018, the Supreme Court legalized sports gambling. Six years later, gambling addiction is approaching a national epidemic . Numerous state surveys show an increase in the incidence and prevalence of gambling addiction, and nearly every state has seen increased demand in recent years for treatment services for gambling addiction. The National Council on Problem Gambling estimates that approximately 2.5 million adults in the U.S. are severely addicted to gambling.

Now, unless regulators act, the same factors that got Americans addicted to sports betting may get Americans addicted to stock trading. These factors are technology and availability.

Technology allows firms to use tailored push notifications about stock prices and other behavioral prompts to target individual investors and induce them to trade excessively . These technological advancements would be worrisome enough in their own right, but now the SEC is poised to allow stocks to trade around the clock . The use of advanced technologies that can help financial firms induce frequent trading by retail investors, combined with the ability of retail investors to trade at all hours of the day or night, has the potential to create retail trading addicts.

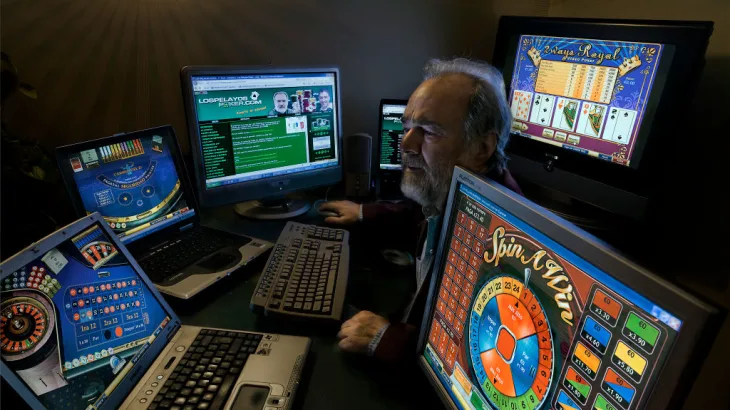

This combination is what has led to the gambling addiction epidemic. As with stocks, sports betting apps use artificial intelligence to entice fans to bet. Features such as tailored push notifications keep bettors betting , and sportsbooks hire data analysts to figure out the optimal strategies for targeting individual gamblers with the right incentives at the optimal times.

The epidemic of gambling is also due to the ability of bettors to place bets around the clock . Human nature dictates that people engage in riskier behaviors at night. They can now do just that wherever they are, all with the touch of a finger on a smartphone.

With sports betting, the ease of betting from a phone at any time of day combined with the techniques sports betting apps use to induce betting has proven to be an irresistible combination . The battle of mobile app versus human willpower has proven to be a total mismatch .

If financial firms pair AI-charged incentives with around-the-clock stock trading, we can expect retail investors will suffer in the same way as sports gambling addicts. This is not least because the target demographics for both sports betting and around-the-clock trading are young men , who are more likely to trade and to engage in financially risky behavior.

Unfortunately, this concern is not theoretical. Both the pandemic and the GameStop/meme stock trading frenzy led some retail investors to get hooked on trading due to the ease with which they could trade and the game-like features of trading apps. And there is evidence that the ability to trade overnight is addictive. The proponents of 24/7 stock trading equate it to cryptocurrency trading, which occurs around the clock. But an underreported element of crypto—aside from its prevalence in frauds , scams , and abuses —is that it can lead to addiction .

Crypto trading addiction has reached the point that there are now addiction centers that specialize in crypto trading. Patients describe using crypto trading apps built to encourage them to invest compulsively and chase a quick profit. One patient noted that crypto was so addictive “because it’s 24 hours a day, seven days a week,” and so they’d be checking their phone at 3 am.

This suggests that crypto should be subject to more guardrails, not less. It also suggests that stock trading should not mirror the around-the-clock nature of crypto trading. At the least, it suggests that we need to limit the ability of broker-dealers and investment advisers to use technological advancements to put their interests ahead of the investors that they are supposed to serve.

In 2023, the Securities and Exchange Commission (SEC) proposed a rule to regulate the way broker-dealers and investment advisers use artificial intelligence. But the rule’s fate is uncertain now that a change in SEC leadership is looming. What is certain is that the SEC needs to act. The ball, so to speak, is in its court. It appears that legalizing sports gambling was a huge mistake . We should not make a similar mistake by giving the greenlight to non-stop stock trading.

Benjamin Schiffrin is Director of Securities Policy for the non-profit watchdog Better Markets. The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune