The city council of Vancouver approved a proposal on Wednesday that seeks to make the major tech hub a Bitcoin-friendly city.

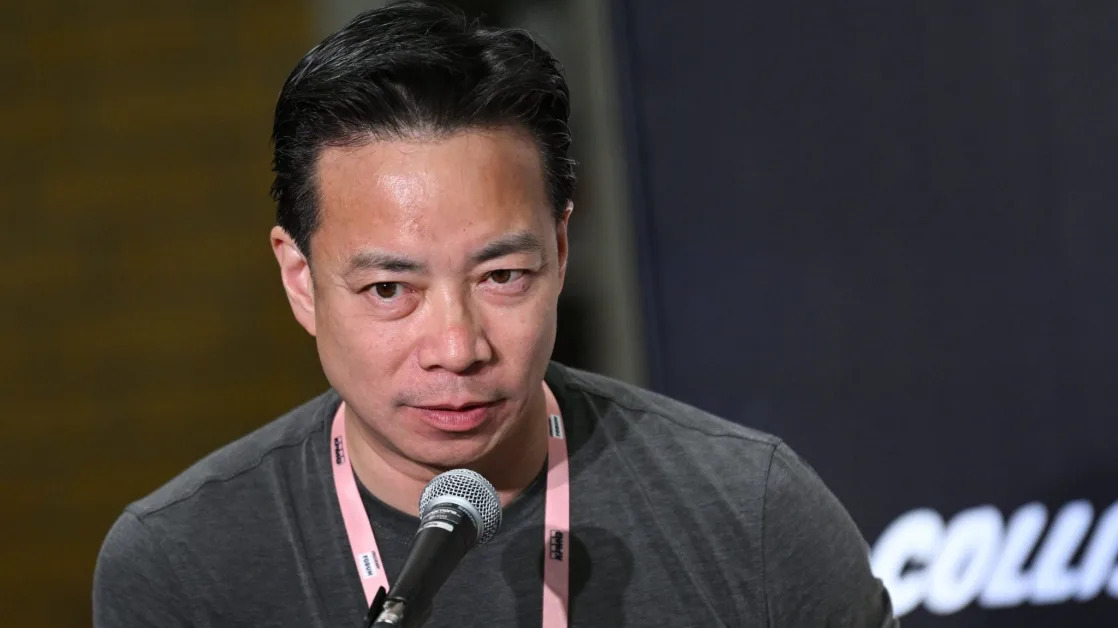

The motion, set forth by Vancouver Mayor Ken Sim, directs city staff to begin looking into converting a portion of the city’s financial reserves into Bitcoin. It also lets officials explore integrating the currency into city government operations, which would include the ability to accept Bitcoin as payment.

Sim, a Coinbase investor who once called Bitcoin “the greatest invention ever in human history,” wrote in the proposal that “it would be irresponsible for the City of Vancouver to not look at the merits of adding Bitcoin to the City’s strategic assets to preserve the City’s financial stability.” Specifically, he cited the currency’s growing institutional interest and benefits as a hedge against inflation.

While Vancouver’s city council might be excited about Bitcoin, the shareholders of Microsoft are decidedly less so. Across the border in nearby Seattle, shareholders at the company’s annual meeting earlier this week voted overwhelmingly against a similar proposal that would have prompted the company to consider investing some of its reserves in Bitcoin.

Michael Saylor, executive chairman of Microstrategy, the largest corporate holder of Bitcoin, made a case for getting the company more involved with the digital currency, but to no avail. Microsoft's board advised shareholders to vote against the proposal, and it was handily defeated.

The latest move from Vancouver comes as a growing number of governments and corporations consider investing their reserves in Bitcoin as the currency becomes increasingly mainstream. Politicians in the U.S., Russia , and Brazil have proposed bills to create Bitcoin reserves. A growing list of companies have done the same, including crypto mining company Mara and Elon Musk’s Tesla . Three biotech firms recently set a goal of purchasing up to $1 million of the currency.

After the price of a single Bitcoin fell below $17,000 in December 2022, the price has risen to more than $100,000 today. Along with other cryptocurrencies, it has enjoyed huge gains following the election of Donald Trump, who has promised to support the crypto industry by cutting regulations and appointing crypto-friendly officials to government positions.