The big economic story for 2024, at least as far as markets was concerned, was the recession that never happened. The U.S. economy, for the third straight year, is going to grow at least 2.5%, probably more like 2.7% when all is said and done.

Citi’s economics team led by Andrew Hollenhorst admits their forecast for an outright contraction of the U.S. economy was entirely wrong. “Our major mistake was to underestimate the extent to which rising net worth of higher income individuals and easy financial conditions for large corporations would continue to drive activity,” they say.

But they did get other calls right — accurately forecasting stubbornly high inflation and 100 basis points of Fed easing (assuming as virtually everyone does that the central bank cuts by a quarter point next week) — leading the team to give itself a B grade for the year.

Now they’re laying out their views for 2025. And the view is not pretty: they expect companies to shift from reducing hiring to outright layoffs. And that in turn will lead to a pullback in consumer spending and business investment. They say even if they’re wrong about the layoffs, spending is still at risk from the slowdown in income growth that accompanies a slowdown in hiring. They do expect the loosening labor market to reduce inflation pressure in the service sector, while softer global conditions will restrain goods prices.

They say that will lead to aggressive action from the Fed — forecasting quarter-point interest-rate cuts at every meeting until July, to bring the fed funds rate between 3% and 3.25%. That’s far lower than the market expectation, which is for the fed funds rate to be about 4% by then.

If long-term rates fell, that would help the hard-hit housing and manufacturing sectors, but not by much, the economists say. “If the labor market evolves as we expect with an upcoming sharper rise in the unemployment rate, weaker consumer health would weigh against any demand boost from lower rates,” they say.

The arrival of a new administration isn’t changing their outlook very much, positively or negatively. They say a slowdown in immigration will result in less supply of new workers, but that will be offset by declining labor demand. A 10% across-the-board tariff would only boost inflation by a few tenths of a percentage point and wouldn’t have a big impact on growth, they say. Cutting corporate tax rates to 15% may be offset by the tariffs, which would mean no new net fiscal stimulus.

They’re not expecting any miracles on the deficit, either. They expect it to be 6.2% of GDP, which is pretty close to this year’s 6.4%, well above the 3.6% average in the 21 years before the pandemic.

The market

U.S. stock futures ES00 NQ00 traded higher, after a six-session losing run for the Dow industrials DJIA.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

|

S&P 500 |

6051.25 |

-0.39% |

1.72% |

26.87% |

28.22% |

|

|

Nasdaq Composite |

19,902.84 |

1.03% |

4.16% |

32.59% |

34.83% |

|

|

10-year Treasury |

4.343 |

14.00 |

-7.80 |

46.21 |

40.41 |

|

|

Gold |

2686.1 |

1.18% |

4.62% |

29.65% |

32.07% |

|

|

Oil |

70.88 |

5.52% |

5.87% |

-0.63% |

-1.25% |

|

|

Data: MarketWatch. Treasury yields change expressed in basis points |

||||||

The buzz

Chipmaker Broadcom AVGO is on the verge of becoming a $1 trillion company after well-received results .

Costco Wholesale COST missed sales estimates for the second straight quarter .

RH stock RH soared on the furniture retailer’s outlook for revenue growth .

The Nasdaq-100 is getting reconstituted , in an announcement that traditionally comes after the close of trading.

Best of the web

Trump advisers are seeking to shrink or eliminate bank regulators, including the FDIC.

UnitedHealth Group CEO: The health care system is flawed. Let’s fix it.

Alleged Chinese spy with links to Prince Andrew banned from U.K.

The chart

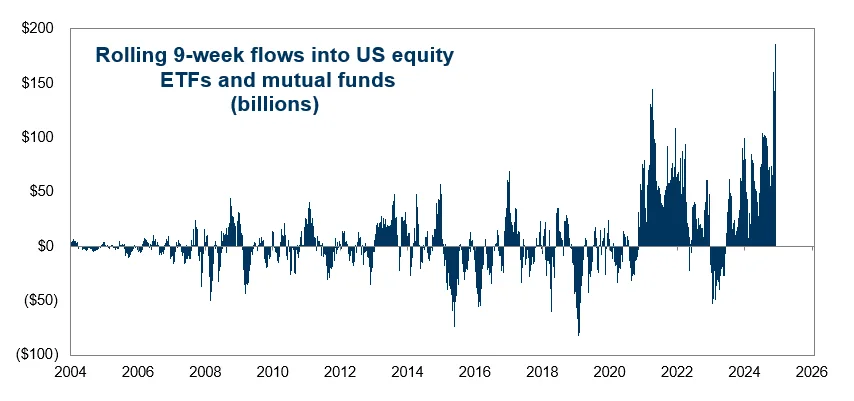

Goldman Sachs tactical strategist Scott Rubner says U.S. equities logged $186 billion of inflows over the last nine weeks , the largest inflow on record. He says it’s the best seasonal time of the year for U.S. equities — but also is looking to fade the stock market in the second half of January as the risk of overshooting remains high.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

AVGO |

Broadcom |

|

PLTR |

Palantir Technologies |

|

MSTR |

MicroStrategy |

|

AAPL |

Apple |

|

AMZN |

Amazon.com |

|

AMD |

Advanced Micro Devices |

|

SMCI |

Super Micro Computer |

Random reads

Why Friday the 13th is considered unlucky.

Also unlucky: this 836-pound cursed emerald.

Conservationists celebrated the discovery of giant catfish — weighing nearly 300 pounds each.

VIDEO : Software stocks have been surging, and AI could fuel a further rally.