(Bloomberg) -- The Federal Reserve is seen likely to lower the rate on one of its tools to help control the main policy benchmark, though some on Wall Street are skeptical about the motivation behind the move.

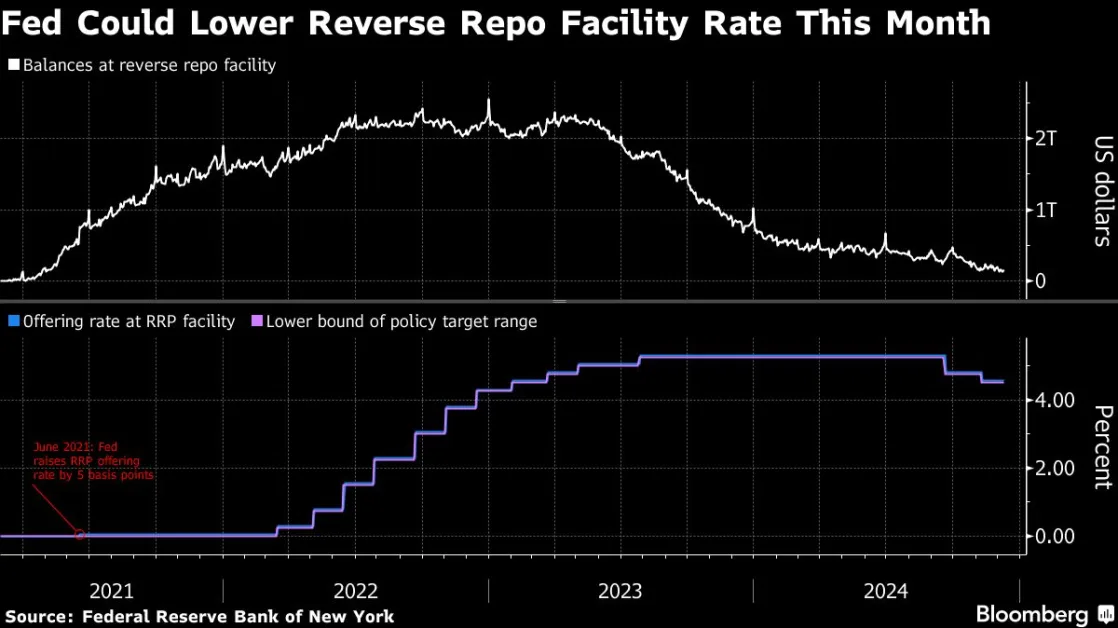

A plurality of strategists expect the Fed to lower the offering rate on its overnight reverse repo facility, or RRP, by 5 basis points, potentially as soon as next week when officials are widely expected to cut their benchmark by a quarter of a percentage point. The current RRP rate is 4.55%, which is five basis points above the bottom of the Fed’s policy target range of 4.5% to 4.75%.

Those expectations follow policymakers noting they see value in considering a “technical adjustment” to the RRP rate so that it’s equal to the bottom of the target range for the federal funds rate, according to minutes of the November meeting. While such a move would probably exert downward pressure on money market rates, it could also further impact funds held at the Fed facility, sparking debate on Wall Street about the benefits of such a move.

Balances at the facility, a barometer of excess liquidity in the financial system, have dropped by about $2.4 trillion since their December 2022 peak, though the pace of declines has slowed in recent months. On Wall Street, the sum of cash parked at the RRP has long been considered a useful gauge to watch as the central bank continues to unwind its balance sheet via a process known as quantitative tightening.

Barclays Plc sees aligning the RRP with the lower band as “purely technical” based on the information provided in the minutes. However, Bank of America, TD Securities and Citigroup are perplexed as to why policymakers need to undertake the adjustment now with roughly $175 billion parked at the RRP. Moreover, usage organically is expected to increase in the first half of 2025 as anticipated reductions in Treasury bill supply tied to the debt ceiling is likely to spur counterparties to park more cash at the RRP.

Officials last tinkered with the tools when it raised the rate on the RRP facility in June 2021 as a dollar glut in short-term funding markets outstripped supply of investable securities and weighed down front-end rates, despite the steadiness of the Fed’s key benchmark. At the time, there was $521 billion in cash squirreled away at the overnight RRP facility.

What the Strategists Say

Wrightson ICAP (Lou Crandall, Dec. 9 report)

Morgan Stanley (Martin Tobias, Dec. 6 report)

Citigroup (Jason Williams, Dec. 6 report)

Bank of America (Mark Cabana, Dec. 5 remarks)

JPMorgan Chase & Co. (Teresa Ho, Srini Ramaswamy, Dec. 2 remarks)

TD Securities (Gennadiy Goldberg, Dec. 2 report)

Deutsche Bank (Steven Zeng, Matthew Raskin, Brian Lu, Dec. 2 report)

Barclays (Joseph Abate, Nov. 27 report)