Key Takeaways

Penn Entertainment ( PENN ) shares surged Friday after JPMorgan upgraded the casino operator's stock, anticipating growth as its investments begin to pay off.

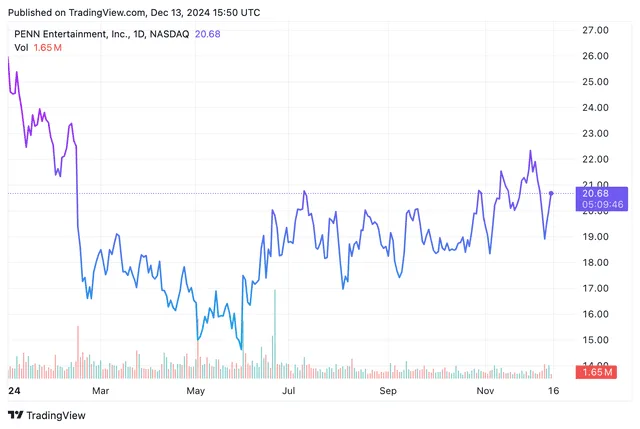

The firm boosted its rating for Penn to "overweight" from "neutral," and lifted its price target to $27 from $19, implying about 30% upside from Friday's intraday price of $20.81.

The analysts told clients they see Penn's investments in retail projects "beginning to bear fruit and ultimately generating attractive double-digit cash-on-cash returns" beginning in the second half of 2025 and into 2026.

They projected improving free cash flow because of land-based capital expenditures “dropping dramatically” in 2026, and Penn’s ability to deploy that free cash flow to “de-lever and reduce its not so burdensome cash interest expense.” They also cited the company's declining interactive gambling losses.

Shares of Penn rose 4% in early trading Friday, though despite Friday's gains, they've lost nearly one-fifth of their value since the start of the year.

Read the original article on Investopedia