During FreightWaves’ State of Freight webinar for December, Craig Fuller, FreightWaves CEO, and SONAR Director of Freight Market Intelligence Zach Strickland, said the future of the freight marketplace looks less uncertain than it has in years.

Last month, Strickland and Fuller said that the Great Freight Recession is over , backed by SONAR data showing tender rejection rates and spot rates that have been rising.

“When you start talking about the directional change … declaring the freight recession is over, if it’s truly data driven from credible sources, people do start to factor that in,” Fuller said. “I had multiple people who were in request-for-proposal season that worked for large brokers and carriers that said, ‘Thank you for saying this.’ They were the same people two years ago that were cussing me out for saying the freight market was collapsing.”

Here are five takeaways from Tuesday’s webinar:

The freight recession is over, but it’s unclear how fast the market will improve

With the Great Freight Recession lasting more than roughly two and a half years, Fuller and Strickland said it will take some time for the market to recover to pre-pandemic levels.

“Last May was the bottom. The market has been improving ever since, and it continues to improve,” Fuller said. “I think the question now remains, how fast does it improve? Does the acceleration continue? Are there risks going into next year? I think generally, most people would say that 2025 is certainly going to be better than 2024. The question is, how much?”

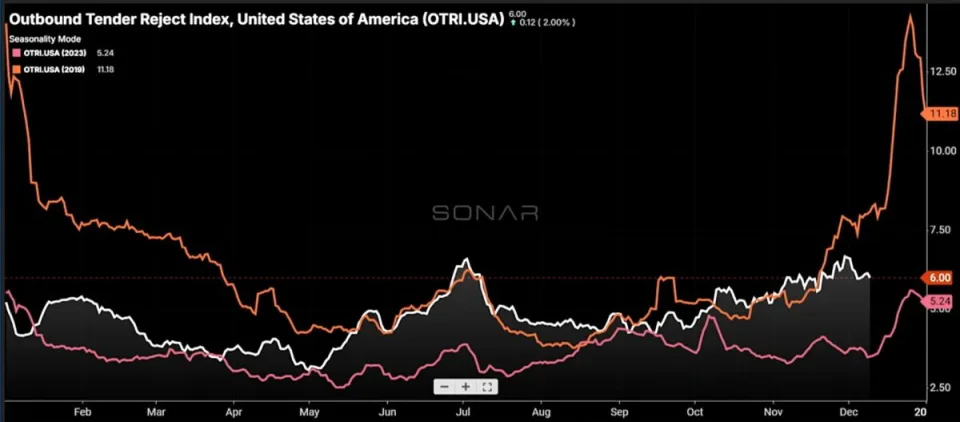

SONAR’s Outbound Tender Rejection Index is trending in the right direction, Strickland said.

“We’ve got the outbound tender rejection index here that is showing us a little bit of a new thing,” Strickland said. “The white line is the current year. The orange line is 2019 … the fuschia line is 2023. We’re showing extreme improvement over this time last.”

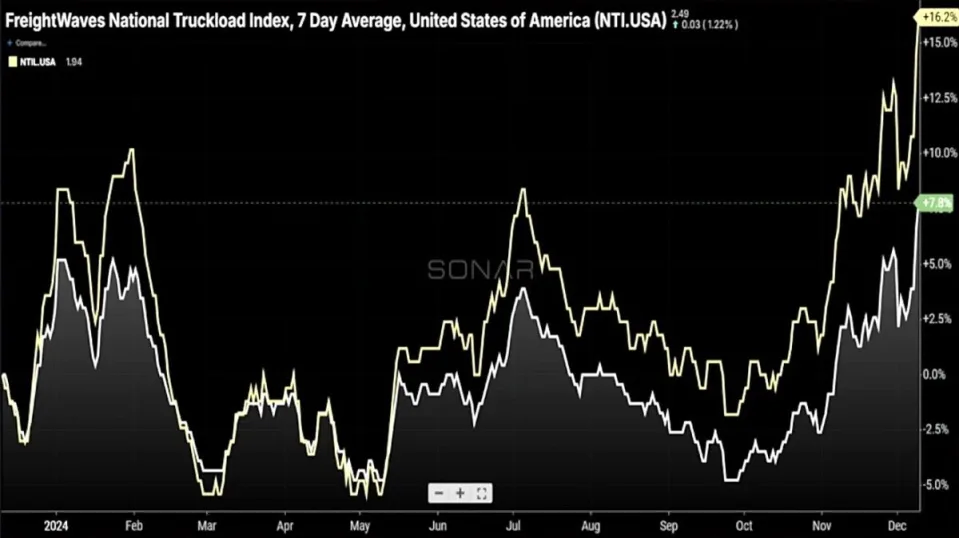

Spot rates are up 16% year-over-year

Data from SONAR’s National Truckload Index (NTI.USA) shows spot rates are at $2.49 a mile, an increase of 16.2% year-over-year compared to the same period in 2023.

Strickland said if you compare NTI.USA with SONAR’s National Truckload Index Linehaul Only (NTIL), which measures the average spot rate for dry van loads moving more than 250 miles excluding the total estimated cost of fuel, spot rates are improving for truckers.

“I think here that the influence of fuel is really the point of this chart. You have the [NTIL.USA] in yellow, that’s excluding the total cost of fuel. If we didn’t have a 20% drop in the average cost of diesel this year, what this chart is saying is that rates would actually be higher,” Strickland said.

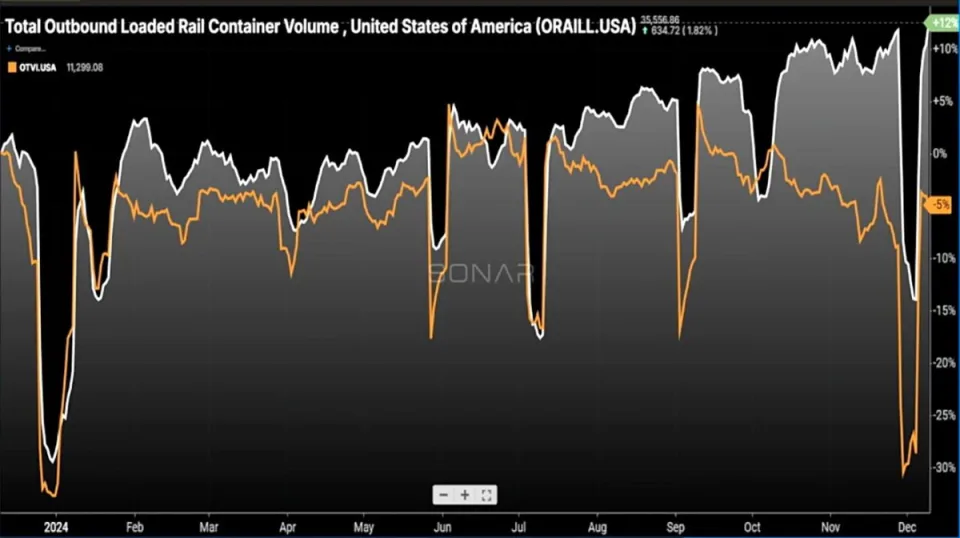

Long haul intermodal rail volumes are on the rise

Strickland noted that long haul rail intermodal volumes for both international and domestic size containers are increasing during a time when intermodal volumes tend to slow down.

“This is not the time of year when intermodal container volumes tend to grow on the rail,” Strickland said.

Shippers who ordered goods, but don’t need the inventory in a hurry are using rail like warehouses on wheels, Fuller said.

“If I need stuff for retail, I’m not going to put it on the rail during October, because rail delays do happen. My freight needs to be in my supply chain and distribution network by early October, certainly no later than mid-November. I don’t have a lot of time to take risks. I want direct control of my transits, and I want trucking services to do that because I can manage it much simpler than I can on the rail. What is driving intermodal is the fact that these products are not needed right now, therefore there’s no need to put them into warehouses. I don’t want to pay taxes on it. I want to be in transit. I think one of the values of using intermodal service is it’s slow, it doesn’t take up warehouse space, and there is a tax benefit to doing that if you don’t need the product right now. Imports are at record highs relative to seasonality, and those imports continue to flow in as shippers are preparing for tariff changes and additional impacts, just uncertainty overall. Donald Trump’s policies, I think, by design, are somewhat uncertain. I think a lot of shippers are preparing for that, and that’s what we’re seeing in the data,” Fuller said.

The U.S. manufacturing sector hasn’t rebounded yet

In November, U.S. manufacturing remained in contraction but at the slowest pace of the past five months, according to a news release from the National Association of Manufacturers .

“The manufacturing sector of the economy has been a little bit sluggish. What is your take on this manufacturing sluggishness? Do you think it will wake up in the next year,” Strickland said.

Major U.S. manufacturers continue to struggle, which has stifled growth, Fuller said.

“If you think about the stuff that is struggling right now in manufacturing, like aerospace, Boeing has significant company issues. If you look at the manufacturing number, how big aerospace is in the United States, one of the core tenets of manufacturing is aerospace manufacturing. Boeing has been such a problem as a business for the last couple of years that that has caused significant issues. It’s a big part of our export market, exporting airplanes. Auto is struggling right now. There’s been reports of Stellantis CEO resigning. There’s been reports Nissan may file for bankruptcy, or at least just having significant liquidity issues over the next year. Auto is struggling, and a lot of it is because the auto manufacturers went and tried to grab as much of the Inflation Reduction Act incentives for electric vehicles as they could, and built production and their supply chains around electric vehicles, anticipating that this was going to be a multi-decade generational shift. The reality is that consumer demand hasn’t caught up. All of that is really plaguing the auto market, people are not buying,” Fuller said.

FreightWaves is launching a playbook for small fleet owners

Fuller said FreightWaves is launching a playbook geared toward small fleet owners on Valentine’s Day. The aim is to help small fleet owners by giving them resources to help them grow their business.

“We’ve partnered with Adam Wingfield, and this is basically taking his masterclass approach, along with our content and select forms of our SONAR data,” Fuller said.

Wingfield is founder and managing director of Innovative Logistics Group . The Charlotte, N.C.-based company is a trucking consulting and carrier services firm that focuses on providing resources and success guidance to small carriers.

“It’s intended for those small-fleet owners that are trying to figure things out. You can’t be a broker and join, you can’t be a shipper and join, and you can’’ be a big broker and join, you have to be a small player. You have to be someone with an MC number. We’re going to create a community for small carriers that is going to give them the resources to really manage their business. I’m very excited about it, because there’s nothing more important than giving someone a playbook who’s running a small carrier. What’s great about what we have at FreightWaves and what Adam has built is we have all of this tribal knowledge and data that we are observing things, we’re seeing things and we know things that, frankly, gives us that knowledge that should be shared to the smallest players in the market,” Fuller said.

The post State of Freight for December: Freight economy due for ‘directional’ change appeared first on FreightWaves .