(Bloomberg) -- Exxon Mobil Corp. will raise capital spending next year as its $60 billion purchase of Pioneer Natural Resources Co. increases its oil-production plans, threatening to worsen next year’s expected crude glut.

Exxon plans to spend between $27 billion and $29 billion of cash in 2025, North America’s largest energy explorer said in a statement Wednesday. Annual outlays will rise to about $30.5 billion in the following five years compared with roughly $24.5 billion before the Pioneer deal.

Exxon’s outlook is in direct contrast to other oil-industry players. OPEC cut its 2024 demand-growth forecast for a fifth straight month on Wednesday, less than a week after the cartel and allies extended plans to withhold crude from the market into next year as prices struggle amid a looming surplus. Meanwhile, Chevron Corp. last week announced the first cut to annual expenditures since 2021 as it prioritizes profits over production.

The budget increase is larger than Wall Street expected and may inspire skepticism among investors, given that some of the investments involve embryonic projects, according to RBC Capital Markets.

“As some of these remain nascent areas today, we think the market may remain skeptical around the earnings potential until we see further evidence of delivery,” RBC analysts including Biraj Borkhataria wrote in a note to clients.

Exxon dropped 0.5% to $112.08 at 9:32 a.m. in New York, making it the day’s worst-performing oil stock in the S&P 500 Index.

Exxon expects to pump the equivalent of 5.4 million barrels a day by 2030, the most in the company’s modern history. Cost savings from the Pioneer deal that closed in May were raised by 50% to more than $3 billion. The oil driller expects to save $7 billion in corporate overhead by 2030, amounting to about half of dividend payouts.

Chief Executive Officer Darren Woods is investing in what he calls “advantaged” projects that can produce oil and natural gas for such low cost that they will be profitable well into the future even if major economies transition away from fossil fuels, denting prices. Nearly all future investments, including those in the US Permian Basin and Guyana, will deliver 10% returns at less than $35 a barrel, about half the current oil price, Exxon said.

“We have a very low cost of supply,” Woods said during a confence call with reporters. “We have, under a very wide range of price scenarios, very robust returns across the portfolio.”

Exxon announced two new developments in Guyana, almost tripling daily production capacity to 1.7 million barrels from current levels. Company-wide, low-carbon investments were raised to $30 billion through 2030, up from $20 billion through 2027.

Woods’ strategy may make sense for shareholders in the long term, but analysts fear Exxon’s increasing oil production may add to a global oversupply forecast for next year. That, in turn, would complicate efforts by the Organization of Petroleum Exporting Countries and its allies to contain the surfeit and buoy crude prices.

“It’s Exxon very directly that’s eating the oil market’s lunch, and particularly the Saudi’s lunch,” Paul Sankey, a veteran oil analyst and founder of Sankey Research LLC, said before the announcement. Weak Chinese consumption and expanding supplies from places like the US and Brazil are leading to a “pretty pressured oil price.”

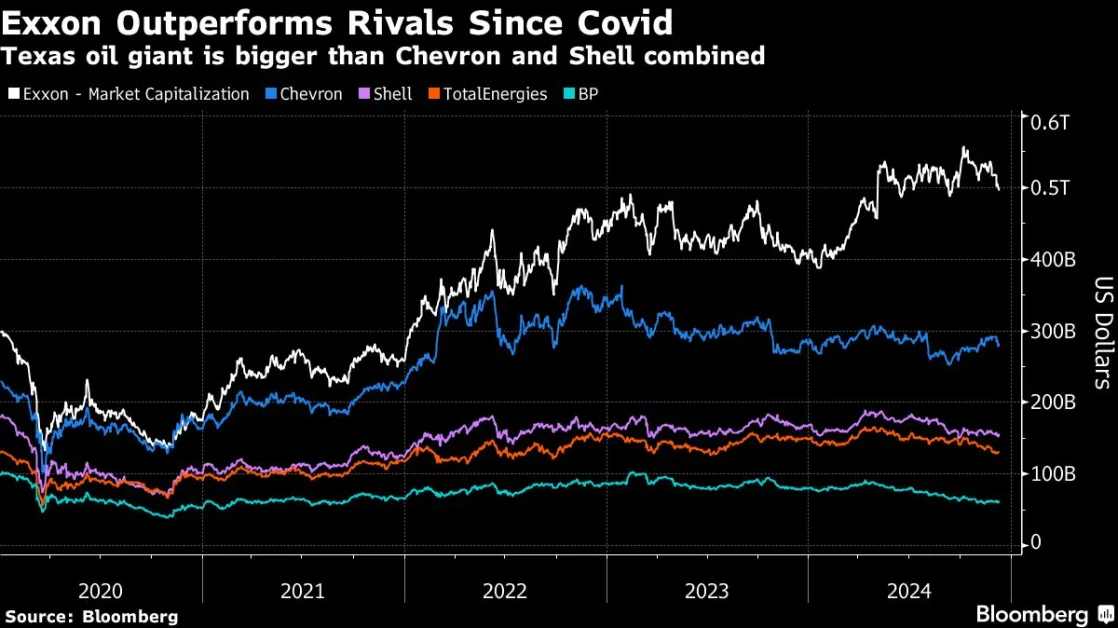

Woods’ refusal to depart from Exxon’s core oil and gas business has served the company well since 2021, when energy demand roared back from pandemic-era lows. The stock’s total return of more than 100% over the past three years is more than double those of the S&P 500 and Chevron.

But analysts are starting to question the wisdom of focusing on oil-production growth at a time when the international crude benchmark is on track for a second straight annual decline, Chinese energy demand remains weak, and OPEC+ is sitting on millions of barrels of untouched output capacity, according to Citigroup Inc.

Here are some key items from Wednesday’s announcement:

(Updates with analysts’ comment in fifth paragraph; CEO’s comment in ninth paragraph.)