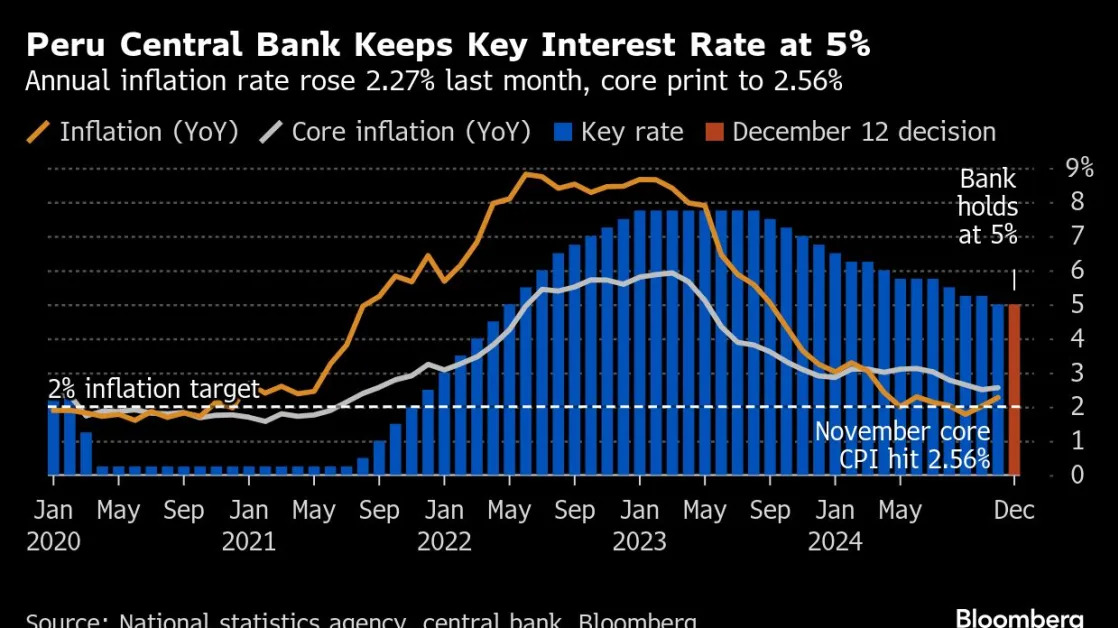

(Bloomberg) -- Peru kept borrowing costs unchanged at its December meeting, after both headline and core inflation accelerated last month.

The central bank kept its key interest rate at 5% on Thursday, as forecast by nine of 12 analysts surveyed by Bloomberg. The other three expected policymakers to lower the benchmark rate by a quarter of a percentage point to 4.75%.

“The board is especially attentive to new information about inflation and its determinants, including core inflation, inflation expectations and economic activity to consider, if necessary, additional modifications in the monetary policy stance,” the bank said in its policy statement.

Peru’s economy has strongly bounced back this year from a recession in 2023, and the central bank expects annual growth of roughly 3% this year and next. While the administration of President Dina Boluarte has pressured the independent central bank to cut rates faster, bank President Julio Velarde has countered that the economy is already growing robustly without the need of monetary policy support.

Peru has the lowest inflation rate and borrowing costs among Latin America’s major economies. Still, Velarde has been particularly focused on core inflation — price increases that exclude energy and food costs — with overall inflation proving more tractable.

Consumer prices rose 2.27% year-on-year in November and core inflation edged up to 2.56% — both readings above the mid-point of the bank’s 1%-to-3% target range. Officials have said they want to get core inflation as close to the midpoint as possible.

Looking ahead, many analysts see scope for the central bank to resume easing in 2025 as global headwinds — the under performance of China’s economy and trade frictions attendant to Donald Trump’s return to office in the US — pose threats to growth.

Economists surveyed by Bloomberg forecast that the central bank will cut borrowing costs by another percentage point next year.

Peru on Dec. 15 posts October economic activity data, with the early consensus forecast for a slowdown to 2.5% year-on-year growth from 3.2% in September.

--With assistance from Rafael Gayol.

(Adds quote from bank’s policy statement in third paragraph)