Investors can expect more gains for the U.S. stock market in 2025, but should brace for more volatility given already lofty valuations for Wall Street.

That’s according to a team of strategists led by Citigroup’s Scott Chronert, which projected a 6,500 base case for the S&P 500 SPX next year, with a bull case of 6,900 and a bear case of 5,100. Their base case put Citi in the median of cautious forecasts across Wall Street ranging from 6,400 to 7,000.

See: The S&P 500 at 4,800? That’s what some Wall Street experts predicted — for 2024.

Across those scenarios, Chronert and his team said a common theme is “modest earnings growth at worst,” and “a still above average index multiple at year end, consistent with a view that we are in an ongoing bull market.”

But while they saw positive economic fundamentals, artificial intelligence and productive gains supporting stocks in the coming year, Chronert and his colleagues expressed concerns about “lofty expectations” heading into 2025.

“We believe post-election euphoria reflects confidence in longer-term growth drivers, but our structurally positive view on S&P 500 fundamentals does have a myriad of issues that need to be navigated,” they said in a note dated Dec. 6.

“Ongoing soft landing and artificial intelligence tailwinds now interact with Trump policy promises, and risks,” they said. “Continued broadening beyond mega mega cap growth impacts is critical but an extended valuation starting point will be an ongoing hurdle.”

The strategists said they see more upside risks — such as further earnings growth in 2025 and follow-through into 2026 — than downside risks for U.S. equities. But it’s the latter that could drive a more volatile year, they said.

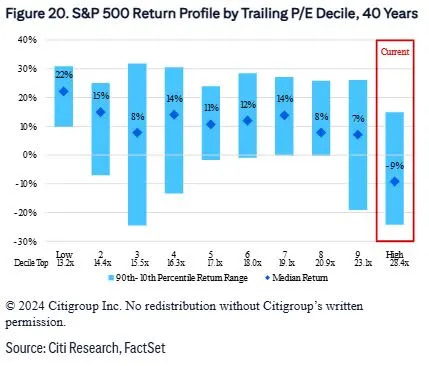

Citi zeroed in on its valuation concerns for 2025. “We are currently in the highest trailing [price-to-earnings ratio] decile. This is the only negative risk-reward valuation decile over the past 40 years. Median return tends to be negative and downside performance is greater than upside wins,” Chronert and his colleagues said.

A trailing price-to-earnings ratio is a valuation multiple that compares current stock prices to those of the last 12 months. It’s considered by some to be more accurate as it uses historical data. Here’s the Citi chart showing the trailing P/E at 28.4 and a negative 9% risk-reward valuation:

“The key is considering high valuation more through a lens of what’s implied in underlying growth, which is elevated, but unattainable at this time. In any event, history says to beware of this starting point,” Citi said.

But they say high valuations can’t be blamed on big tech’s “Magnificent 7,” despite those large weightings, as “it is the other 493 that are trading at their highest forward P/E on a 20-year lookback relative to their own history.” A forward P/E looks at future projected earnings.

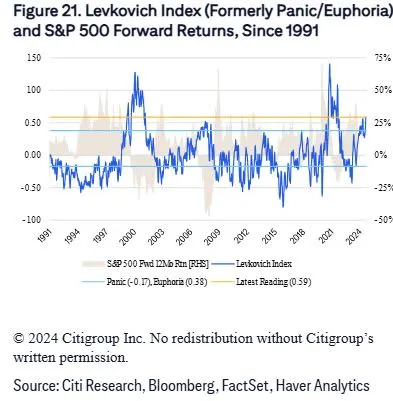

Citi strategists also said current investor complacency will set a “high hurdle” for stocks. Their Levkovich Index — formerly the panic/euphoria index — showed investors are in a “euphoric phase exceeded only by the Tech Bubble and post-pandemic rally.”

And if there is a lesson from bubbles to be learned here, it’s that “buying expensive on the premise that one sell more expensive is a generous premise.”