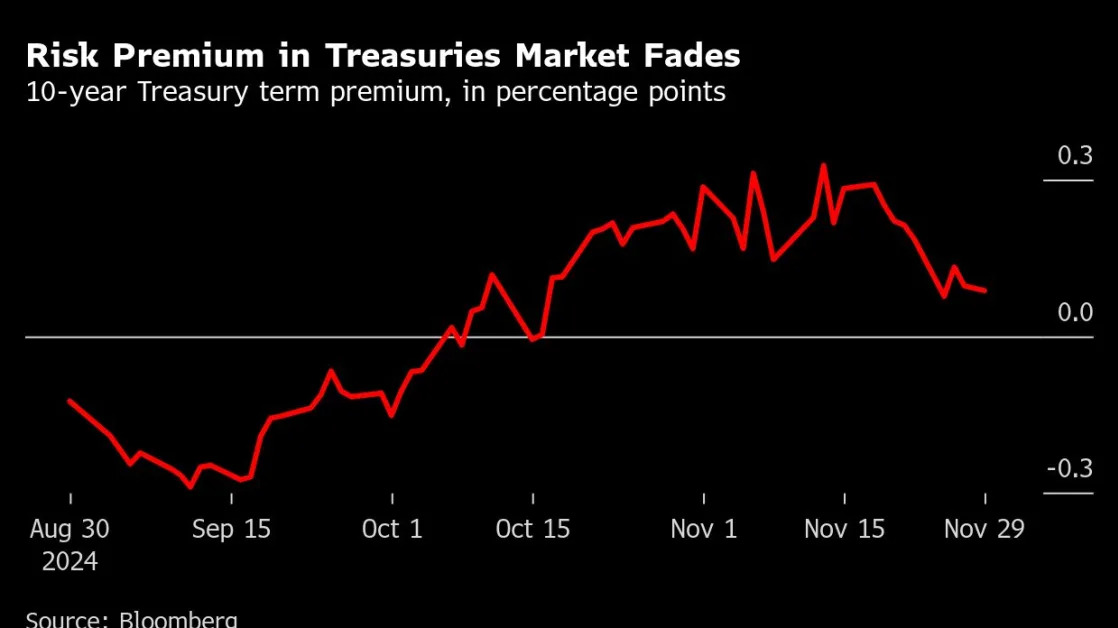

(Bloomberg Markets) -- Donald Trump’s pledges to slash taxes, crack down on immigration and impose steep tariffs have long stirred concern that his policies may widen the budget deficit and fuel inflation, sparking higher interest rates and bond yields. That would be bad news for bond investors, since prices fall when yields rise. But by all measures, the $29 trillion US Treasury market has been relatively peaceful since Trump won the election on Nov. 5. The benchmark yield on 10-year bonds dropped to its preelection level, following an initial selloff. The so-called term premium—a measure of the perceived risk of holding long-term government debt—declined to a one-month low, according to a model by the New York Federal Reserve.

The calmness partly reflects that some worries about a too-hot economy had already been priced in before election night. Bonds had sold off steadily since mid-September, driven by better-than-expected economic data and rising expectations of a Republican sweep. But investors also seem to be assuming that Trump won’t follow through on his campaign promises. “No one really knows what the policies are going to be in the Trump agenda,” says Greg Peters, co-chief investment officer at PGIM Fixed Income. “The belief is that the worst part of the agenda items will be tempered, and the good parts will be amplified. That seems a little kind of hopeful in my mind.”

Markets cheered when Trump picked Scott Bessent as his nominee for secretary of the treasury. The hedge fund manager, who once worked for financier George Soros, is seen on Wall Street as a more conventionally business-friendly figure than others in the MAGA circle. After the announcement, 10-year bonds staged their second biggest daily rally in 2024. The appointment also suggested that Trump cares about how Wall Street reacts to his moves—and might be constrained by it.

Just days later, Trump vowed additional tariffs on Mexico, Canada and China, briefly roiling markets again with his first specific threats to the top US trading partners since his win. But for now, bond investors are feeling enough good will for Trump to keep them quiet, says Baylor Lancaster-Samuel, chief investment officer at Amerant Investments Inc. in Coral Gables, Florida. “The bond vigilantes are still hibernating, and we do not know when they will eventually awake from their slumber,” she says.

“Bond vigilantes” is a term coined in the 1980s to describe investors who dump government debt to enforce fiscal discipline. On the surface, conditions seem ripe for them to make a comeback. Trump’s economic plan, including cutting corporate taxes, would increase the debt by $7.75 trillion above the current projected levels through fiscal year 2035, according to an October estimate by the advocacy group Committee for a Responsible Federal Budget. But the group says its estimates are highly uncertain, with the possible outcome in a range from $1.65 trillion to $15.55 trillion.

Trump says the key to addressing the budget outlook is to shrink government spending, lower taxes to boost economic growth and impose tariffs to increase revenue. Most economists disagree. Tariffs work by raising the prices of foreign-made goods, which could cause an inflationary shock. If they force a shift to US-made products, they’ll raise less revenue.

“The main thing I would suggest has probably not been priced in, because we cannot price it in, is what the fiscal deficit looks like,” Sonal Desai, chief investment officer for fixed income at Franklin Templeton, told Bloomberg Television on Nov. 20. “Right now the market is in a bit of a wait-and-see mode: to see if everything that the incoming administration wished to do, it could do. It would be a massive fiscal blowout. We do not think that is likely to happen. But until we know, we cannot take a position.”

The market seems to be assuming, for now, an extended version of the status quo. Perhaps that’s because the current situation is good enough—with inflation slowing and the Fed steadily cutting rates—that investors feel there’s some room for error. In their 2025 outlook, Goldman Sachs Group Inc. economists expected the Fed to continue to bring down borrowing costs. Deutsche Bank AG economists, on they other hand, are more bearish. They expect the Fed to pause the easing cycle next year after making a quarter-point cut in December. Deutsche Bank predicts that “modest” tax cuts and a deregulation push will lift growth, while “a significant increase in tariffs” will keep inflation elevated. That would lead 10-year bond yields to rise to 4.7% in 2025, from about 4.2% currently, pushing prices down.

Of course, Trump hasn’t taken office yet. Bond trading desks are going to watch closely for any sign of change. “There’s a lot of moving parts in terms of policy,” says PGIM’s Peters.

Xie reports on markets for Bloomberg News in New York.