(Bloomberg) -- A rally across cryptocurrencies has made winners out of a handful of firms in the sector that followed MicroStrategy Inc.’s playbook of selling convertible bonds, thanks to President-elect Donald Trump choosing a crypto-friendly financier to head the top US financial regulator.

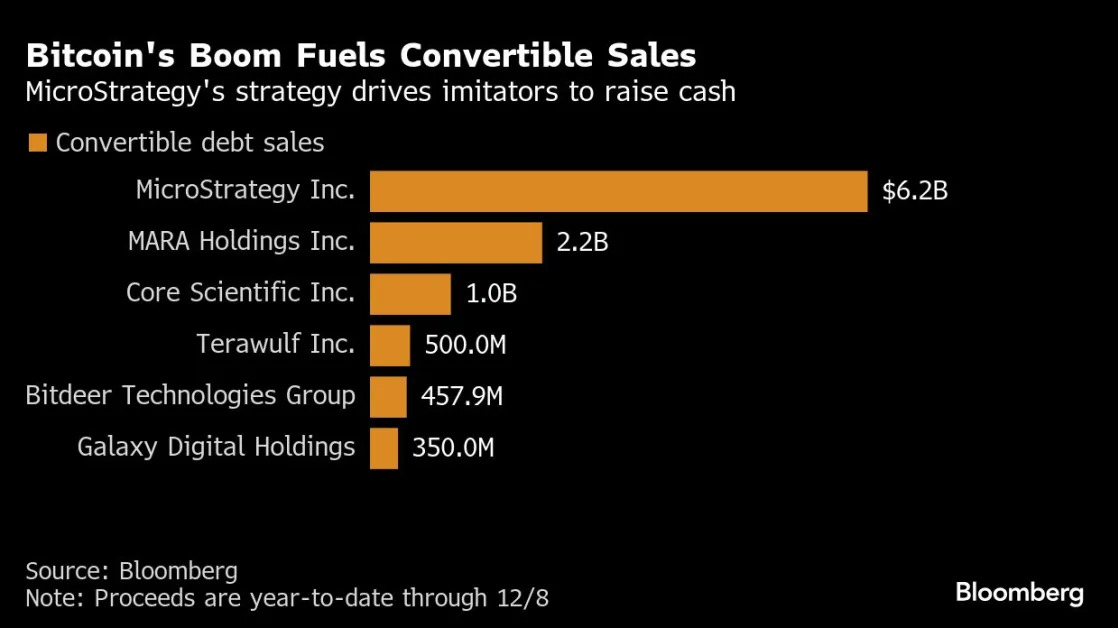

Investors have been piling into companies with ties to the industry, opening the floodgates for fundraising. MicroStrategy’s $6.2 billion worth of convertibles issued this year is just the start, as part of its latest plan to raise $21 billion through fixed income issuance. Other firms also rode the wave, with MARA Holdings Inc. selling more than $2 billion worth — also to buy Bitcoin — and Core Scientific Inc. raising over $1 billion in the year to date.

“One big theme this year has been converts issued by crypto-focused companies, which tells you how much capital the asset class has,” said Raj Imteaz, the head of convertible and equity derivatives advisory at ICR Capital LLC. There will be more deals from crypto companies, in part because of the arms race that is playing out, he said.

The appetite for convertible issues linked to crypto has been stoked by retail traders powering Bitcoin beyond $100,000 following the unveiling on Dec. 4 of Paul Atkins as Trump’s pick to replace Gary Gensler as head of the US Securities and Exchange Commission.

Further deals are likely. Riot Platforms Inc. announced on Monday morning plans to sell $500 million of convertible notes to add to its pile of Bitcoin.

MicroStrategy shares have climbed 73% since the election alone, while MARA, Riot Platforms and Core Scientific’s shares are up 63%, 33% and 30% respectively over that stretch. The gains track a jump of over 40% for Bitcoin, which is churning near $100,000 each.

The token’s surge gives it a roughly $2 trillion market value, with MicroStrategy’s haul worth more than $41 billion on paper after disclosing purchases Monday. The company’s strategy to issue equity and debt and use the proceeds to buy Bitcoin has powered its stock higher while also pumping up the token. It has snapped up about $15.6 billion worth of Bitcoin since Oct. 31, according to SEC filings.

The terms of the crypto-tied convertible deals stand out as investors use them to play a volatile industry, with four of the deals by crypto firms announced since the start of November priced with zero coupon, data compiled by Bloomberg show.

These transactions can also enable hedge funds to deploy convertible arbitrage tactics where buyers buy the bonds and sell the shares short, essentially betting on the underlying stock’s volatility. The more the stock swings, the more profitable the trade becomes — and the share performance for MicroStrategy and the other companies issuing convertibles has been nothing if not turbulent.

The strong appetite for these issues, and the firms lining up to offer them, indicates that there’s little consideration of the risk that Bitcoin will fall.

“If you are one of larger players in the space and your competitor has a large war chest funded at very low coupons and you haven’t tapped the market, you’re at a competitive disadvantage,” Imteaz said in an interview. “You almost have to issue converts to stay competitive within crypto. How can you not?”

--With assistance from Yiqin Shen.