(Bloomberg) -- Cryptocurrencies saw few gains on Tuesday, while price swings surged on Asian exchanges after South Korean President Yoon Suk Yeol declared martial law as the country faces a political deadlock in parliament.

A majority of the largest digital assets were in the red, with market bellwether Bitcoin fluctuating between small gains and losses. Bitcoin has seen a record-setting rally since President-elect Donald Trump won the US election, though the token has struggled to reach the $100,000 milestone many have expected. Altcoins such as XRP, which have also seen large gains in recent weeks, retreated.

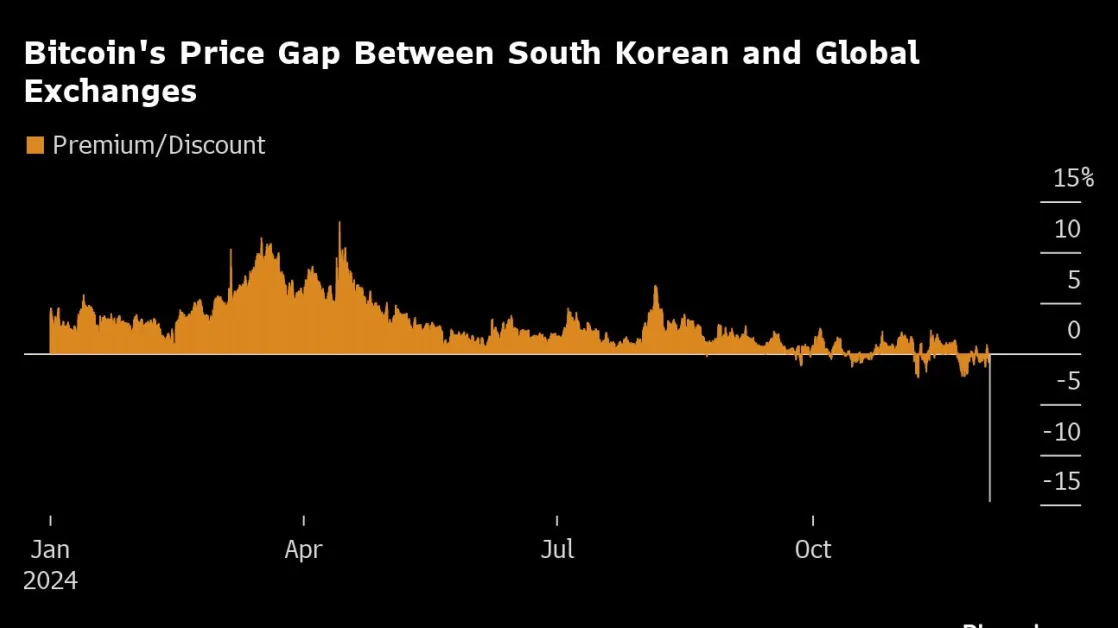

Price declines were much more exaggerated on Korean exchanges, where traders are known to capitalize on the so-called Kimchi premium — a long-running crypto arbitrage strategy named after the popular Korean side-dish. The price of Bitcoin against US dollar-pegged stablecoin Tether fell as low as $71,814.99 at one point on Tuesday, at the same time as a Bloomberg composite of Bitcoin prices across global exchanges showed around $93,600.

Yoon said later that he will lift the decree. He stunned the nation, lawmakers and investors earlier by declaring martial law in a high-stakes move he claimed would prevent the opposition from trying to paralyze his administration amid a political rift.

Altcoins across the board also traded lower earlier in Korea more than on other exchanges. Dogecoin was priced at roughly 34 cents at one point on Upbit, compared to a Bloomberg composite price of 40 cents. Ripple’s XRP, a token that’s surged significantly in recent days, was priced at $2.44 on Upbit, compared with $2.46 on Bloomberg.

South Korea has outsized interest in XRP compared to the US, FRNT Financial wrote in a note to clients. “For instance, XRP/USD has seen a combined trading volume of US ~2.76B over the last 24 hours on Kraken and Coinbase,” analysts at the digital asset platform wrote in a note Tuesday. UpBit, which is available in South Korea, saw $5.5 billion worth of XRP/USD volume in the same time period, according to FRNT Financial.

Altcoins like XRP tend to be less liquid and more volatile than Bitcoin, which is largely used as a store value currency. While this volatility has lead to record gains not seen since the 2021 crypto bubble, it also means that the tokens can see higher losses than Bitcoin during an uncertain market.

XRP was down about 5% as of 2:53 p.m. in New York, with Ether and Dogecoin also seeing losses. Bitcoin was little changed at around $95,334.

--With assistance from Sidhartha Shukla.