(Bloomberg) -- Crypto trading volume climbed to an all-time high in November, with more than $10 trillion of digital assets changing hands for the first time on centralized spot and derivatives exchanges.

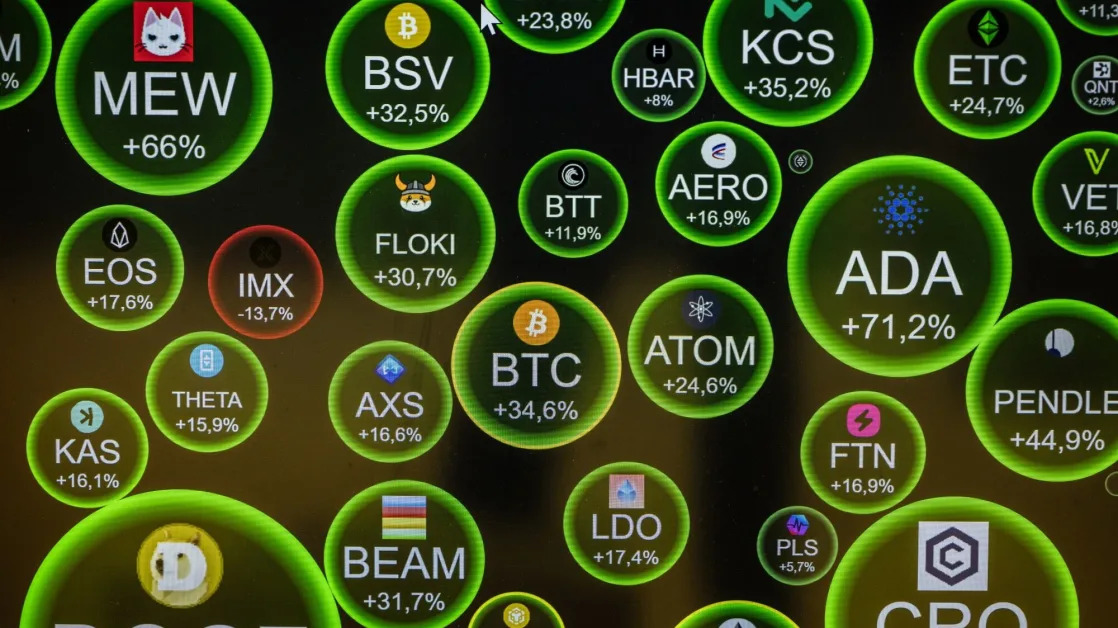

The combined volume doubled last month, according to data compiled by CCData. Crypto markets surged amid optimism for a friendlier regulatory environment for the industry under the newly elected Trump administration, with market bellwether Bitcoin jumping 38% and setting a record high of almost $100,000.

“This sentiment is evident in the increased appetite for assets like Ripple, which has historically faced heightened regulatory scrutiny,” said Jacob Joseph, senior research analyst at CCData. “Optimism is also evident on the institutional side, with CME volumes seeing a significant uptick and substantial inflows into spot Bitcoin ETFs over the past month.”

Monthly spot trading volume on centralized exchanges increased 128%, to $3.43 trillion, the second-highest number ever since May 2021. Derivatives volume climbed 89% to $6.99 trillion, surpassing the previous all-time high from March, according to CCData. The data doesn’t include volume from so-called decentralized finance platforms.

Many South Korean spot crypto exchanges like Upbit saw a surge in activity as traders plunged into altcoins. The aggregate trading volume on the CME exchange rose 83% to $245 billion, an all-time high for the institutional exchange offering crypto futures.