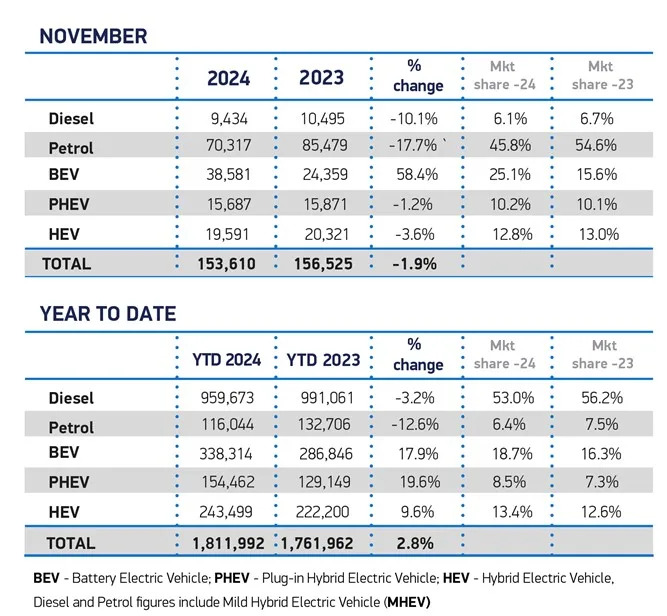

Deliveries of new cars in the UK fell by 1.9% in the UK during November with 153,610 units sold, according to the Society of Motor Manufacturers and Traders (SMMT).

It is the second consecutive monthly decline, and the third decline in four months, as the market contracts amid the race to meet tough EV market share targets under the UK Government’s ZEV Mandate.

Demand from private buyers, among whom uptake has waned for two years, dropped by 3.3% to 58,496 units. Fleet purchases, which represent the bulk (59.9%) of the market, fell by 1.1% to 91,993 units, while low-volume business demand rose by 5.2% to 3,121 units.

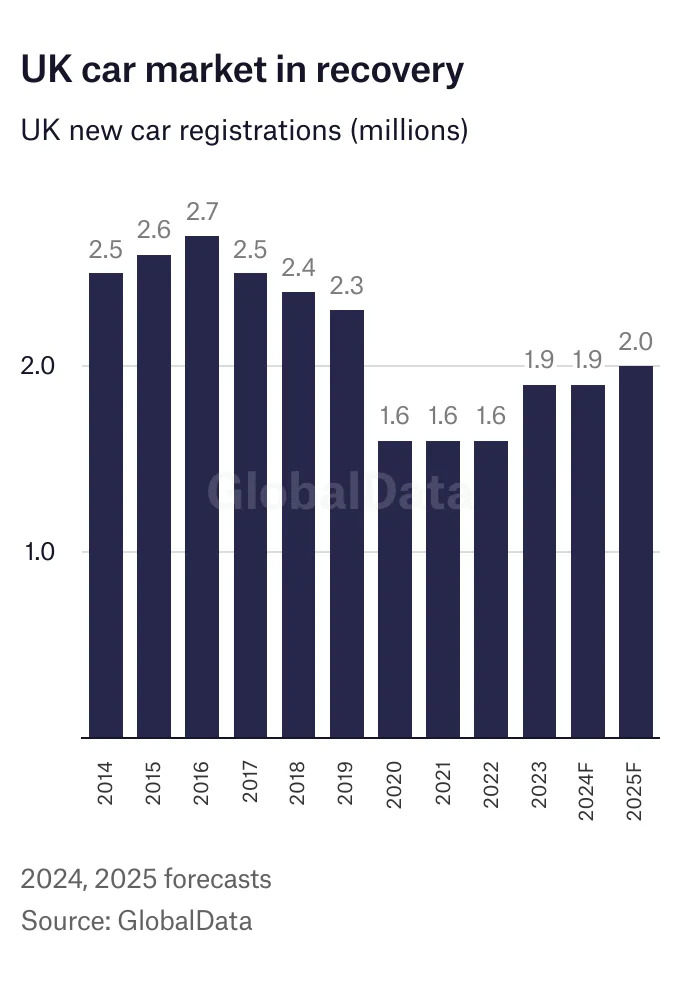

According to GlobalData forecasts, the UK car market will be virtually flat this year, with little growth expected in 2025.

November saw double-digit falls in registrations of petrol (17.7%) and diesel (10.1%) cars, with petrol remaining the most popular powertrain. Hybrid and plug-in hybrid uptake also declined, by 3.6% and 1.2% respectively.

Battery electric vehicle (BEV) registrations, meanwhile, rose for an eleventh successive month, up 58.4% to 38,581 units, representing 25.1% of the overall market but driven by heavy manufacturer discounting.

With the best market share since December 2022, November is just the second month this year in which BEV uptake has reached ZEV Mandate levels (22% target share for the year – but year-to-date share is at 18.7%), albeit against the backdrop of a declining overall market.

The SMMT noted that market demand for EVs remains weak and below the levels expected when the ZEV Mandate regulation was drawn up by the previous government. The industry now expects the UK’s BEV market share to be 18.7% in 2024, although a strong December performance could raise that to 19% – still, however, short of the 22% mandated target for the year.

This year’s growth nevertheless cements Britain as Europe’s second biggest new BEV market by volume and ‘closing the gap on leader Germany’. However, the SMMT also warns that the scale of discounting, worth some £4 billion across 2024, is ‘unsustainable and poses a risk to future consumer choice and UK economic growth’.

Once again, the SMMT called for government support to stimulate EV sales. It said that BEV car registrations will need to grow by an additional 53% in 2025 if next year’s 28% ZEV Mandate target is to be met – an ambitious looking level on current BEV demand trends.

Mike Hawes, SMMT Chief Executive, said: “Manufacturers are investing at unprecedented levels to bring new zero emission models to market and spending billions on compelling offers. Such incentives are unsustainable – industry cannot deliver the UK’s world-leading ambitions alone.

“It is right, therefore, that government urgently reviews the market regulation and the support necessary to drive it, given EV registrations need to rise by over a half next year. Ambitious regulation, a bold plan for incentives and accelerated infrastructure rollout are essential for success, else UK jobs, investment and decarbonisation will be at further risk.”

UK ZEV Mandate concerns

Carmakers in the UK are increasingly concerned that they will incur huge fines on missed EV targets under the UK Government’s Zero Emission Vehicle (ZEV) mandate.

While BEV car sales in the UK have grown to reach over 338,000 in the first eleven months, that represents 18.7% of the market – an increase on 2023, but still significantly short of the 22% target for this year (and of the 28% which must be achieved in 2025) under the UK Government’s ZEV mandate.

Manufacturers that fail to meet the compliance levels or do not sell enough ZEVs face penalties of GBP15,000 (USD20,000) for every non-ZEV unit sold over their mandated allowance. They can buy banked credits with firms who are comfortably over the BEV share target - eg Tesla and BYD - but complain that this means they are effectively subsidising competitors, on top of the already heavy discounting needed to raise BEV sales and get closer to the ZEV Mandate target.

"UK new car market slips back in November" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.