(Bloomberg) -- The yen carry trade — an investment strategy that blew up in spectacular fashion this year — is regaining popularity.

Japanese retail investors as well as leveraged funds and asset managers outside the country are estimated to have boosted bearish wagers on the yen to $13.5 billion in November from $9.74 billion in October, according to Bloomberg’s analysis of data from the Financial Futures Association of Japan, Tokyo Financial Exchange Inc. and the US Commodity Futures Trading Commission.

Those bets are expected to ramp up next year, driven by wide gaps in interest rates, higher government borrowing in the US and low volatility in currency markets. These conditions make it more attractive to borrow in Japan and then deploy the funds in higher yielding markets around the world.

“The very large absolute rate differential against the yen means that it will always be seen as a funding currency,” said Alvin Tan, head of Asia FX strategy at Royal Bank of Canada in Singapore. “The main reason why it would not be used as a funding currency for a carry trade is because of volatility.”

Strategists from Mizuho Securities Co. and Saxo Markets say the carry trade could return to levels seen earlier this year before investors suddenly bailed out of the trade following the Bank of Japan’s July rate hike. One caveat is that Donald Trump’s return to power could throw currency markets into turmoil.

Wide-spread adoption of the investment strategy has the potential to influence markets across the world. The carry trade unwind over the summer erased about $6.4 trillion from global stock markets in just three weeks, and the Nikkei 225 suffered its biggest rout since 1987. A sudden surge in the yen last week underscored the ongoing risks for those investors who’ve bought back into the trade.

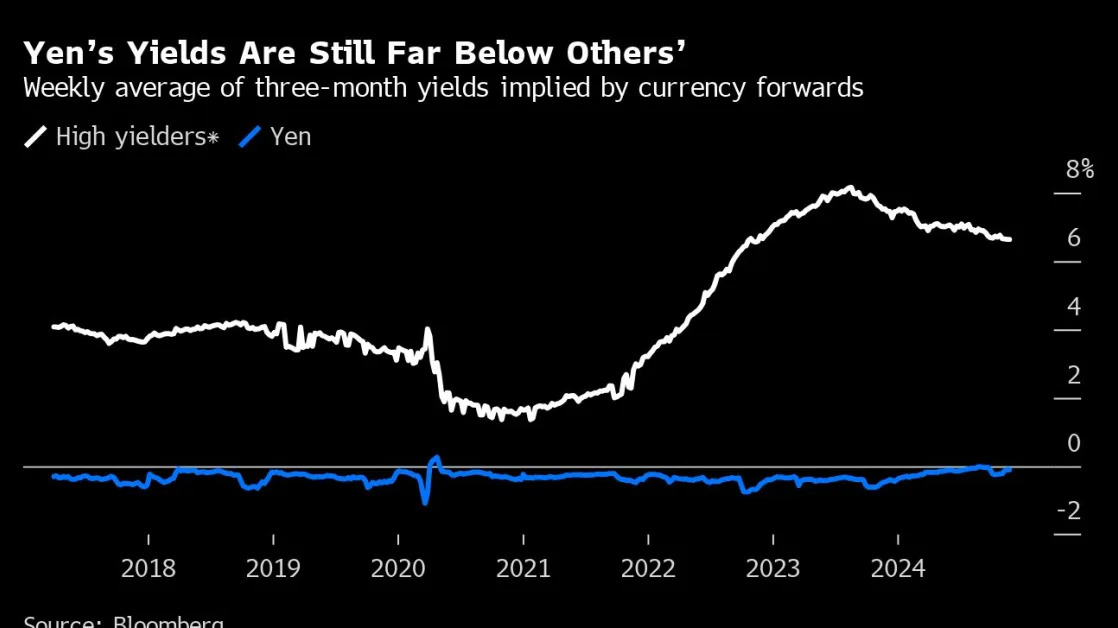

Interest rates are driving the trade. Ten high-yielding Group-of-10 and emerging-market currencies have an average yield of more than 6%. In contrast, with the Bank of Japan’s benchmark interest rate at just 0.25%, the yen’s yield is almost non-existent.

Although the BOJ is gradually raising rates, its yield gap between major economies such as the US still remains wide. The Federal Reserve lowered its benchmark interest rate by a quarter-percentage point in November, to a range of 4.5%-4.75%. Even if Japan hikes its interest rate to around 1%, the logic of the carry trade would still remain sound, according to Felix Ryan, a foreign-exchange analyst at Australia & New Zealand Banking Group Ltd. in Sydney.

The strategy has been very profitable. Yen-funded carry trades that target 10 of major and emerging-market currencies have returned 45% since the end of 2021, compared with a 32% return from the S&P 500 Index that takes account reinvested dividends. That drew in more and more investors with yen short positions reaching $21.6 billion at the end of July, right before the furious unwind.

“The BOJ’s rate hikes are unlikely to be enough to close the yield gap between Japan and the US,” said Charu Chanana, chief investment strategist at Saxo Markets. “With the US debt and fiscal situation clearly among the top areas of focus in the upcoming Trump administration, there will likely be room for yen carry trades to remain attractive.”

The dollar and US yields soared in recent months on speculation that Trump’s tariffs and tax cuts will boost the economy and inflation, and potentially slow down the pace of rate cuts by the Fed. Such market concerns have been alleviated somewhat after Trump nominated Scott Bessent, who has been vocal about controlling the deficit, for Treasury Secretary. However, Trump will ultimately determine US fiscal policy, according to Shoki Omori, chief Japan desk strategist at Mizuho Securities in Tokyo.

“In the end, it’s all about Trump,” said Omori, who says the carry trade could come roaring back as soon as January. “People are forgetting the risk of Trump’s power over Bessent. If Bessent wants to stay in the position, I don’t think he will be so rigid on the budget.”

The threat of a trade war under Trump also has the potential to weigh on global assets, especially after the President-elect vowed additional tariffs on China, Canada and Mexico last week. Although the Mexican peso has long been a go-to currency for yen-funded carry trades due to the country’s double-digit rates, Trump’s rhetoric threatens to cause enough volatility to make the trade unattractive.

That’s important because yen-funded carry trades benefit from subdued volatility in the currency market. A JPMorgan Chase & Co. gauge of foreign-exchange volatility has fallen from a post-pandemic high even amid rising uncertainty from a new Trump administration in the US and an escalation in the war in Ukraine.

Still, some say that a narrowing rate gap will keep the momentum low for carry trades next year, especially after Governor Kazuo Ueda left the door open for a rate hike in December. Japanese officials have also cautioned on the yen, with the Finance Minister saying last month that there have been sharp one-way moves in the currency since late September.

The yen has been one of the worst performers this year among its Group-of-10 peers, as structural issues such as large capital outflows continue to put pressure on the currency. Although the yen had appreciated to the 140 level just a few months ago amid the carry trade unwind, it’s already back around 150.

“The Ministry of Finance has already re-engaged with speculators through verbal intervention and the fears of a December BOJ rate hike are being kept alive by Governor Ueda’s rhetoric,” said Jane Foley, head of FX strategy at Rabobank. Although the carry trade has been gaining further support, “this should ensure that the carry trade lacks the confidence and momentum that was evident in the spring.”

Investors may get further clarity on the carry trade going into the BOJ and Fed meetings in December. A more dovish tone from Ueda or a hawkish one from Fed Chair Jerome Powell, as well as any hints from key data points, may pull carry traders back in.

“The BOJ hike speed is going to be slow and if Powell’s not going to cut rates quickly either, the rate differential is going to be attractive for carry trades,” said Omori. Japan’s Ministry of Finance hasn’t been that aggressive and if they are “going to be quiet, investors are going to feel there’s no reason not to do these kinds of trades.”

--With assistance from Umesh Desai.