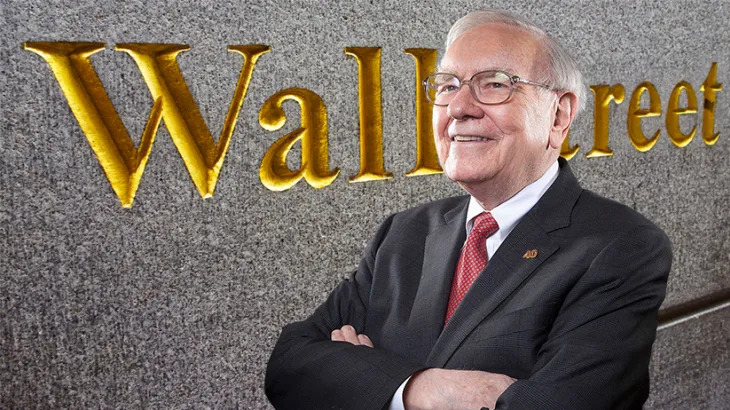

Investors are constantly on the lookout for an edge and one of the best ways to do that is by following in the footsteps of Wall Street’s most lauded investors. And it’s safe to say hardly any are deemed more legendary than Warren Buffett.

Don't Miss our Black Friday Offers:

Dubbed the “Oracle of Omaha,” and boasting an unmatched multi-decade career, Buffett is known for his exceptional investing acumen and disciplined value-based approach. As the chairman and CEO of Berkshire Hathaway, he has built one of the world’s largest firms by identifying undervalued companies, holding long-term investments, and emphasizing sound business fundamentals. So, any stock market activity made by Buffett is sure to pique investor interest.

Now, Buffett has achieved huge success by firmly sticking to his own beliefs and that means that sometimes not all his choices chime well with the consensus view. That certainly appears to be the case with some of his recent picks. Buffett has been loading up on shares of Sirius XM Holdings (NASDAQ:SIRI) and Pool Corp (NASDAQ:POOL) , a pair of names he evidently has plenty of faith in, but they are currently getting the thumbs down from the analysts at Bank of America.

According to the TipRanks database , the rest of the Street is hardly enamored with them, either. So, let’s take a closer to try and gauge why the investing sage is going against the grain here.

Sirius XM Holdings

The first company on Buffett’s contrarian list, Sirius XM, is a huge player in satellite radio and online streaming services. Originally formed in 2008 through the merger of Sirius Satellite Radio and XM Satellite Radio, Sirius XM has grown to be the biggest name in the audio entertainment space. Another merger made headlines in September when the company combined with Liberty Media’s Sirius XM tracking stock. The move streamlined its capital structure and strategy, while the company kept the Sirius XM brand.

Known for its diverse programming – ranging from music and sports to news and entertainment – Sirius XM serves millions of subscribers across North America through more than 200 channels. The company also has a notable digital presence, enabling users to stream content online and via its mobile app.

However, recent earnings results painted a mixed picture. In Q3, consolidated revenue declined 4.4% year-over-year to $2.17 billion, primarily due to weaker-than-expected advertising revenue from Pandora. Adjusted EBITDA also dropped 7% to $693 million. Consequently, Sirius XM revised its full-year revenue forecast downward to around $8.675 billion, compared to its prior projection of ~$8.75 billion.

Nevertheless, Buffett must be keeping the faith. He has been loading up regularly and is certainly not messing around here. He currently holds a total of 112.5 million shares, worth over $3 billion. With a 32.5% stake, Berkshire is the top shareholder of SIRI stock.

Buffett must be seeing something Bank of America analyst Jessica Reif Ehrlich is missing. She takes a dim view of SIRI’s prospects, writing, “Investments to improve self-pay traction with younger demographics will take time, while more flexible pricing and packaging will weigh on ARPU and revenue growth. Additionally, Pandora continues to lose users challenging the company’s ability to drive advertising growth. Further, the company is the midst of an elevated investment cycle which is weighing on FCF generation. As such, we expect support from capital returns will be subdued as the company is focused on reducing its leverage in coming quarters.”

Bottom line, Ehrlich rates SIRI shares as Underperform (i.e., Sell), while her $23 price objective suggests the shares will drop by ~15% over the next 12 months. (To watch Ehrlich’s track record, click here )

The broader sentiment isn’t exciting either. The consensus remains lukewarm, with the stock earning a Hold (i.e. Neutral) rating based on a mix of 4 Holds, 5 Buys and Sells, each. Wall Street’s average price target stands at $28.71, indicating modest one-year gains of 6.5%. (See SIRI stock forecast )

Pool Corp

Next up is Pool Corporation, or POOLCORP, the world’s biggest wholesale distributor of swimming pool supplies, equipment, and related products. The company serves a wide range of customers, including pool builders, service professionals, and retailers, through an extensive network of over 440 distribution centers across North America, Europe, and Australia.

POOLCORP’s offerings cover everything from chemicals and cleaning tools to heaters, pumps, and construction materials, making it a one-stop shop for all things pool-related. In addition to its core business, the company benefits from a recurring revenue stream through maintenance products.

This is the sort of stock commonly associated with Buffett, including strong returns on capital and a competitive advantage, or “moat.” POOLCORP’s moat is rooted in its substantial scale, reliable revenue stream from maintenance products, and strong client relationships.

So, it’s hardly surprising to see Buffett has been diving in. He opened a new position in POOL stock during Q3, loading up on 404,057 shares. These are currently worth more than $152 million.

That said, Buffett is showing faith at a time of dwindling returns. Revenue and earnings have both been on the backfoot this year, as was the case in the Q3 print. Revenue fell by 2.7% year-over-year to $1.43 billion, while adj. EPS dropped from $3.5 to $3.26. However, it should be noted that both figures beat Street expectations.

Buffett is obviously eyeing a turnaround, but Bank of America analyst Shaun Calnan remains unconvinced. While the analyst made some adjustments following the Q3 results, his thesis remains a bearish one.

“Management raised the 2024 revenue guide to down (5%) vs. previous down (6%) but maintained full year EPS guidance of $11.06-$11.46 due to higher operating expenses,” Calnan noted. “We increase our 2024E/2025E by 4%/1% to reflect the slightly better revenue outlook. We increase our PO to $335 (from $318), now based on a 19x EV/2025E EBITDA (vs. previous 18.5x) given higher sector multiples. We reiterate our Underperform (i.e., Sell) rating, as we still see risks to POOL hitting its long-term growth algorithm (6-9% topline) in 2025.”

That new $335 price objective backing up the aforementioned Underperform rating still factors in a 12-month slide of 11%. (To watch Calnan’s track record, click here )

Elsewhere on the Street, POOL stock garners an additional 4 Holds and 1 Buy for a Hold (i.e. Neutral) consensus rating. Meanwhile, the average price target stands at $379.80, suggesting the shares will stay rangebound for the time being. (See POOL stock forecast )

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy , a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.