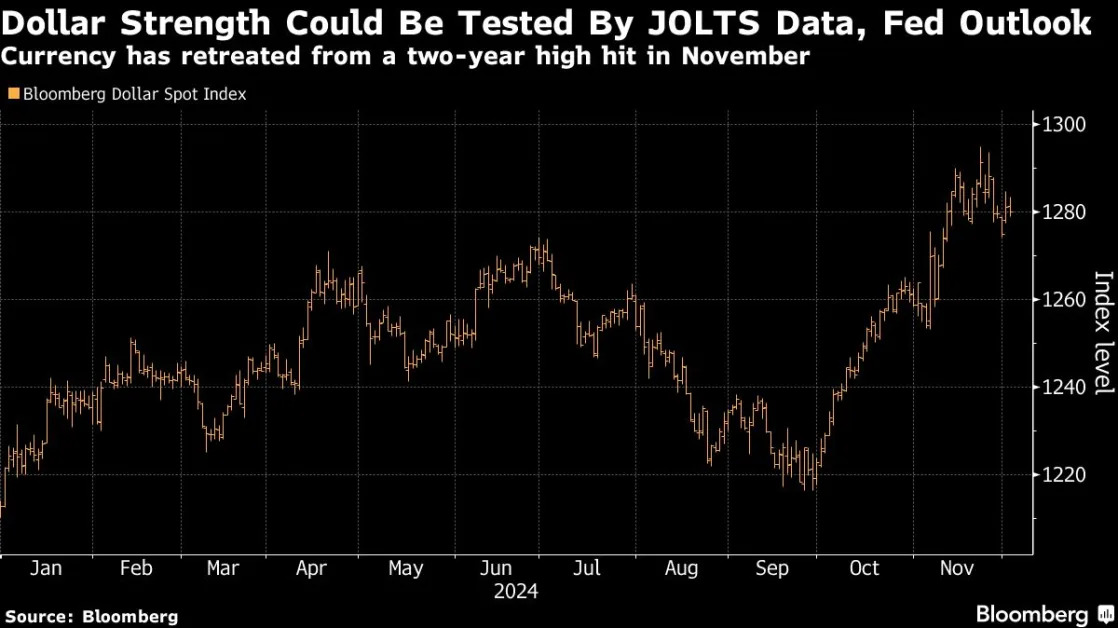

(Bloomberg) -- A gauge of the US dollar slipped as traders ramped up bets on a Federal Reserve interest-rate cut this month ahead of the latest US jobs data.

The Bloomberg Dollar Spot Index dropped as much as 0.2%, with the greenback falling against most Group-of-10 peers. Money markets have lifted bets on the US central bank opting for a quarter—point cut in December after the Fed’s Christopher Waller said he’s inclined to vote for a reduction.

Market participants are refocusing on the near-term outlook for the US economy and policy rates, following President-elect Donald Trump’s tariff threats on so-called BRICS countries on Monday, which spurred the dollar’s biggest one-day gain in around three weeks.

“This week should really be about US data and prospects for Fed easing,” said Chris Turner, global head of markets research at ING Groep NV. “There is room for short-dated US rates and the dollar to fall were the JOLTS data today to surprise on the downside and signal further slack.”

Traders are factoring in around a 70% likelihood that the Fed cuts by 25 basis points this month, up from a 55% chance on Monday. Three Fed officials made clear on Monday they expect rates to be reduced again over the next year, though they weren’t all as explicit as Waller on a reduction in December.

Alongside the outlook for the US labor market, investors are also closely monitoring a deteriorating backdrop in other major economies, for signs the dollar may remain supported by weaker currencies elsewhere. French political uncertainty is building, while the sluggish Chinese outlook is also weighing on sentiment.

These cross-currents make for a tricky backdrop to trade the dollar, with many investors girding for choppiness in the days ahead. December is historically a punishing month for the world’s reserve currency, as the greenback is often a victim of year-end portfolio re-balancing flows and the so-called Santa rally that emboldens traders to sell dollars for riskier assets.

Lauren van Biljon, a fund manager at Allspring Global Investments, thinks long positioning in the dollar could be tested if the Fed cut rates and signals more easing to come.

“The market is currently overweight the dollar in a big way, some was taken off into Thanksgiving but probably a drop in the ocean,” she said. “There may be pressure to close positions into year-end and start 2025 on a cleaner slate.”

(Updates market moves, adds context on December dollar seasonality.)