It was an odd marriage and a costly divorce , but AT&T has found a new love after its expensive Hollywood romance.

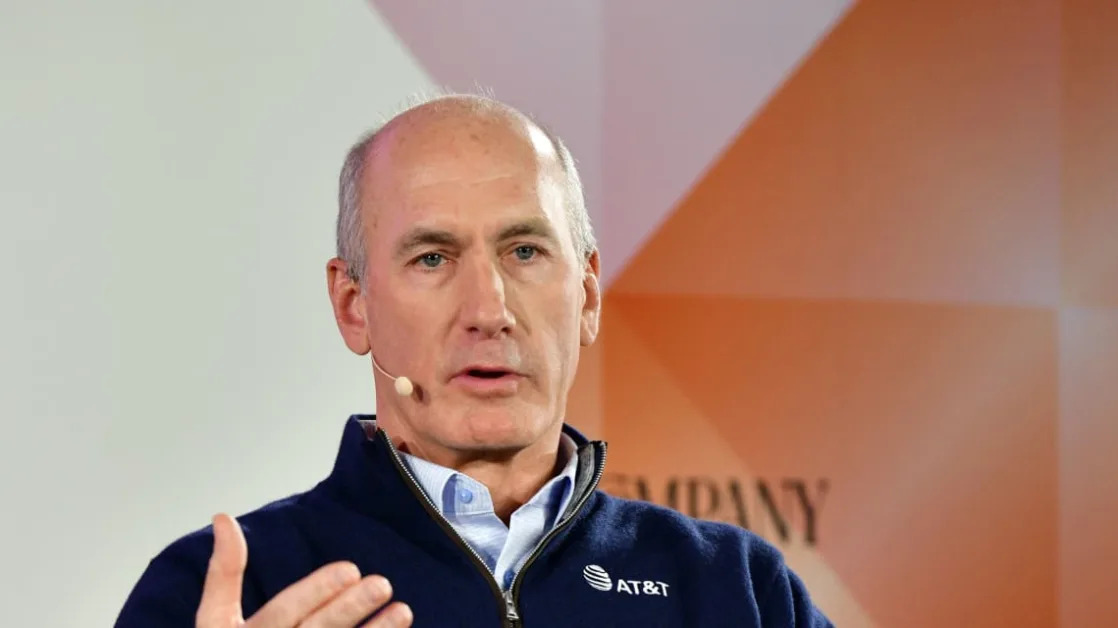

Shares of the telecommunications giant have rebounded—including a 35% gain so far this year—since Chief Executive Officer John Stankey reversed course and spun off its Warner Bros. unit and unloaded satellite company DirecTV. On Tuesday, Stankey and his team will outline new long-term financial goals powered by its wireless and broadband services as it works to wind down its legacy landlines.

The Dallas company, though still a No. 3 player in the chase for the U.S. wireless customers, holds a commanding position in the red-hot battle for fiber-optic broadband subscribers . Its balance sheet, once smothered by debt, is throwing off enough cash to make share buybacks and acquisitions viable options.

The company said Tuesday it expects to return more than $40 billion to shareholders over the next three years through stock buybacks and its existing dividend payouts. The company staked out an additional $10 billion over that span to give it flexibility to make acquisitions, pay down debt or spend on other initiatives.

Such plans were out of the question in 2022 when Stankey slashed the annual dividend and sold the WarnerMedia unit to Discovery Communications. AT&T spent the following two years cutting jobs and booking big write-downs.

Those measures eventually calmed shellshocked investors. Since the April 2022 Warner spinoff, AT&T has delivered a total shareholder return of roughly 50%, which includes stock gains and dividend payments, outpacing the S&P 500 index’s 40% total return. Warner Bros. Discovery shares have slumped in the same period, hurt by competition for streaming-video customers.

“AT&T found itself in a precarious position when it acquired Warner,” with unsustainable demands from network overhauls, streaming-media investments and a dividend too large to support, said Allyn Arden, a credit analyst at S&P Global Ratings. Since then, “they’ve gone back to what they do best, which is telecommunications service.”

What’s left is a simpler AT&T business with a slimmer dividend but more predictable returns. The company’s market value is now about $164 billion, down from a peak of $289 billion in 2019.

AT&T’s painful years are by no means behind it. Its cash-cow cellphone unit remains the third-largest provider behind rivals Verizon Communications and T-Mobile in a wireless market with little room for explosive growth. Recent network failures and data breaches have tarnished its reputation. More layoffs are expected to further thin its ranks in the years ahead.

Those threats aren’t deterring AT&T’s investors. Broadband companies are generally enjoying a Wall Street rebound as investors give the sector a fresh look. And falling interest rates are driving yield-hungry investors toward traditionally dependable telecom stocks backed by tens of millions of monthly cellphone bills.

Stankey took over the telecom giant in 2020. The new CEO worked to unwind many of the big acquisitions he had a hand in striking, including the $49 billion purchase of DirecTV. The company eventually wrote down more than $20 billion of its pay-TV business, which it has gradually sold off to other owners.

The biggest mulligan of all: undoing AT&T’s roughly $80 billion takeover of Time Warner, which had closed in 2018 after a bruising antitrust trial. The split stuck AT&T investors with about half the annual dividend payments they had reaped in years past. In exchange, shareholders kept stakes in both AT&T and the new Warner Bros. Discovery.

AT&T’s debt load still towers above most corporations, with reported net debt of about $126 billion at the end of September, down from a peak of more than $170 billion in 2019. Sales and spinoffs transferred some of its obligations to investors in other companies, including Warner Bros. Discovery.

AT&T executives now highlight their leading position in the U.S. fiber-optic business as the springboard for the company’s recovery. Investors are piling into high-speed fiber lines as an alternative to older cable-internet technology, prompting rivals such as Verizon and Bell Canada to make multibillion-dollar acquisitions .

The operator is instead investing in ventures such as Gigapower, a partnership with investment giant BlackRock, that build lines into new neighborhoods. AT&T said Tuesday that the company and its partners will pass more than 50 million homes and businesses with fiber lines by 2029—up from about 28 million this year—a goal that could widen the gap with runner-up Verizon.

The high cost of building new fiber lines could push executives to look for cost savings in other areas, including labor. Analysts expect the company to significantly shrink the size of its 140,000-member workforce in the years ahead, though executives haven’t detailed how many jobs will be eliminated.

The question remains whether such cuts will harm its network’s reliability. Recent hacks and network failures across the telecom industry have drawn attention to the vulnerability of the country’s communications infrastructure. AT&T’s reputation suffered in February after network maintenance knocked out wireless service for millions of customers, prompting Stankey to apologize to customers.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com